PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850242

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850242

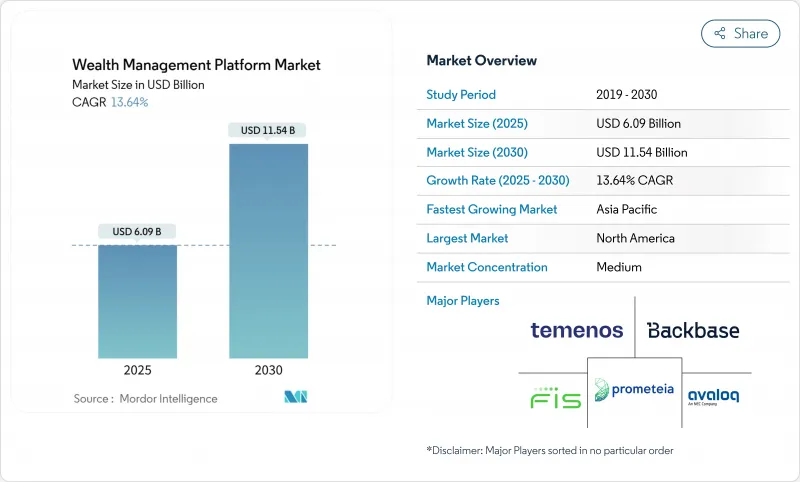

Wealth Management Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The wealth management platform market size is estimated at USD 6.09 billion in 2025 and is forecast to climb to USD 11.54 billion by 2030, advancing at a 13.64% CAGR.

Cloud-native architectures, artificial intelligence (AI) and open-API ecosystems underpin this expansion as institutions modernize legacy stacks to meet real-time analytics and escalating compliance demands. AI copilots, now embedded across advisor desktops, trim administrative workloads and unlock capacity for high-touch client engagement, while secure public-cloud environments enable scalable data processing frameworks that satisfy evolving cybersecurity mandates. Regulatory momentum, including new SEC breach-notification rules and FinCEN's 2026 anti-money-laundering (AML) program for registered investment advisors, intensifies platform demand by turning compliance from discretionary to compulsory investment. Concurrently, embedded-wealth features inside neobanks and super-apps widen distribution channels, and talent headwinds pressure firms to automate routine tasks through machine learning engines.

Global Wealth Management Platform Market Trends and Insights

AI Copilots Slashing Advisor Productivity Costs

Generative AI assistants now automate meeting notes, email drafting and basic portfolio diagnostics that once consumed up to 86% of an advisor's week. Morgan Stanley's GPT-4 powered assistant, rolled out to 15,000 advisors, exemplifies the pivot, freeing staff for consultative conversations and accelerating client-touch cycles. These copilots comb multi-custody data feeds, surface investment ideas in seconds and draft suitability rationales, thereby shortening proposal generation from hours to minutes. Assets are flowing to AI-centric platforms such as PortfolioPilot, which amassed USD 20 billion in two years by offering algorithm-driven trade recommendations at mass-affluent price points. Early adopters report double-digit productivity gains, yet less than half of firms have pushed pilots into enterprise production, underscoring untapped upside. Supervisory authorities now assess AI governance during examinations, making auditable AI pipelines a competitive requirement rather than a differentiator.

Demand for Hyper-Personalized Financial Planning via Behavioral Finance Models

Mass-affluent and digital-native investors expect Netflix-like personalization, prompting platforms to absorb behavioral finance engines that map life-event probabilities, spending habits and risk psychometrics into adaptive portfolio tilts. Hybrid providers such as Kristal.AI attracted over USD 1 billion in assets by blending 80% automated workflows with 20% human guidance-an appealing ratio for clients seeking efficiency with a human safety net. Algorithmic nudges increasingly suggest savings boosts or tax-loss harvesting moments, shifting advisor roles toward coaching. These engines also enable fractional access to private credit, vintage cars or art, democratizing asset classes once gated behind multi-million-dollar tickets. Retirement decumulation models now recalibrate annually to guard against sequence-of-returns risk, drawing on longevity data and forward-looking capital-market assumptions from asset managers such as Amundi.

Cyber-Resilience Obligations Raising Compliance Spend

The SEC's 2024 amendments to Regulation S-P compel firms to notify clients of data breaches within 30 days and to document incident-response playbooks, pushing compliance investment up sharply. FinCEN's forthcoming AML rule extends bank-grade monitoring to registered investment advisors, with non-compliance fines of up to USD 25,000 per day. Family offices, often lightly staffed, must now absorb specialist vendors and cyber-insurance premiums; only one in five currently rate their defences as robust. Vendors embed encryption, key-rotation and audit-trail features directly in platform cores, but these modules add license fees that compress operating margins. Smaller advisors weigh cost-benefit decisions between best-of-breed tools and full outsourcing to managed-security providers.

Other drivers and restraints analyzed in the detailed report include:

- Tokenized Funds Enabling Fractional HNWI Access

- Rise of Embedded Wealth Solutions in Neobanks and Super-Apps

- Talent Drain to Fintech Start-ups

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployments captured 62.5% of wealth management platform market share in 2024, and the sub-segment is projected to rise at a 15.7% CAGR through 2030. This growth aligns with board-level mandates for variable-cost infrastructure, granular elastic compute and geographic redundancy. Wealth firms migrating to Amazon Web Services, Microsoft Azure or Google Cloud gain on-demand provisioning for burst-compute tasks such as Monte-Carlo simulations and risk stress tests. Royal Bank of Canada's wealth unit leverages Avaloq's SaaS core on AWS to cut environment-refresh cycles from weeks to hours while maintaining regulatory logging requirements .

On-premise estates persist among institutions subject to national data-sovereignty statutes or tightly coupled mainframe feeds, but modern encryption and region-pinning have softened regulator objections, accelerating lift-and-shift road-maps. Cloud-native stacks use container orchestration and micro-services to isolate workloads, enabling firms to plug in generative-AI micro-apps without disrupting transaction-processing rails. In practice, public-cloud security certifications such as ISO 27001 and SOC 2 now meet supervisory expectations, tilting procurement decisions toward SaaS contracts and raising competitive hurdles for legacy vendors. The wealth management platform market therefore sees cloud vendors bundling managed-services layers that abstract infrastructure complexity for mid-tier firms.

Banks held 27.9% of revenues in 2024, leveraging broad deposit footprints and internal referral networks to funnel clients onto unified advisory workstations. The wealth management platform market size tied to banks is forecast to expand steadily as universal banking groups seek fee diversification amid net-interest-margin volatility. Cross-selling uptake has gained urgency in the face of the USD 84 trillion intergenerational wealth transfer, compelling retail banks to embed estate-planning modules and AI-driven discovery tools for next-gen heirs.

Family offices and registered investment advisors, however, register the fastest 14.3% CAGR as ultra-wealthy clans formalize governance and reporting. Platforms such as Addepar allow multi-entity consolidation, look-through analytics for partnership structures and drill-down into illiquid holdings, features essential to single-family offices managing art, aircraft or venture funds. The wealth management platform market supports bespoke dashboards for mission-related investments and philanthropic tracking, complementing trustee reporting obligations. While bank platforms emphasise scale and integrated custody, independent RIAs prioritise open-architecture best-of-breed tools, fuelling demand for modular APIs that connect planning software, tax engines and compliance record-keepers.

Wealth Management Platform Market is Segmented by Deployment (On-Premises, Cloud), End User Industry (Banks, Trading Firms, Brokerage Firms and More), Application (Portfolio, Accounting and Trading, Financial Planning and Goal-Based Advice, and More), Enterprise Size (Large Enterprises, Small and Mid-Sized Enterprises (SME)). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 32.7% share in 2024 on the back of mature regulatory regimes, well-capitalised adviser channels and early AI adoption, but growth moderates compared with emerging regions. The SEC's push for cyber-resilience and AML controls funnels budgets to integrated platforms that consolidate trading, planning and audit logs into single data fabrics.

Asia-Pacific posts a 15.1% CAGR, the fastest worldwide. Singapore, Hong Kong and Australia issue progressive tokenisation guidelines, unlocking private-market distribution to affluent investors. Super-apps attach robo-advisers to payments interfaces, converting e-wallet balances into investment flows in a tap. Europe focuses on ESG compliance and cross-border consolidation under MiFID II, while Latin America and Africa leapfrog legacy infrastructure with mobile-first solutions delivering lightweight KYC and dollar-denominated portfolios to unbanked populations.

- Avaloq Group AG

- Fidelity National Information Services (FIS)

- Temenos AG

- Prometeia SpA

- Backbase BV

- Tata Consultancy Services

- Fiserv Inc.

- InvestCloud Inc.

- EdgeVerve Systems (Infosys)

- CREALOGIX AG

- Broadridge Financial Solutions

- SSandC Technologies

- Envestnet Inc.

- SEI Investments

- Orion Advisor Tech

- BlackRock Aladdin

- Addepar Inc.

- SimCorp A/S

- Profile Software

- Charles River Development

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Integration of ESG scoring and sustainability analytics into portfolio planning

- 4.2.2 Shift to fee-based advisory and decumulation planning

- 4.2.3 AI copilots slashing advisor productivity costs

- 4.2.4 Demand for hyper-personalized financial planning via behavioral finance models

- 4.2.5 Tokenized funds enabling fractional HNWI access

- 4.2.6 Rise of embedded wealth solutions in neobanks and super-apps

- 4.3 Market Restraints

- 4.3.1 Talent drain to fintech start-ups

- 4.3.2 Fragmented data standards across custodians

- 4.3.3 Cyber-resilience obligations raising compliance spend

- 4.3.4 Bank/fintech balance-sheet pressure in higher-rate cycle

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Type

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By End-user Industry

- 5.2.1 Banks

- 5.2.2 Trading Firms

- 5.2.3 Brokerage Firms

- 5.2.4 Investment Management Firms

- 5.2.5 Family Offices and RIAs

- 5.3 By Application

- 5.3.1 Portfolio, Accounting and Trading

- 5.3.2 Financial Planning and Goal-Based Advice

- 5.3.3 Compliance and Risk Reporting

- 5.3.4 Client On-boarding and KYC

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Mid-sized Enterprises (SME)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Avaloq Group AG

- 6.4.2 Fidelity National Information Services (FIS)

- 6.4.3 Temenos AG

- 6.4.4 Prometeia SpA

- 6.4.5 Backbase BV

- 6.4.6 Tata Consultancy Services

- 6.4.7 Fiserv Inc.

- 6.4.8 InvestCloud Inc.

- 6.4.9 EdgeVerve Systems (Infosys)

- 6.4.10 CREALOGIX AG

- 6.4.11 Broadridge Financial Solutions

- 6.4.12 SSandC Technologies

- 6.4.13 Envestnet Inc.

- 6.4.14 SEI Investments

- 6.4.15 Orion Advisor Tech

- 6.4.16 BlackRock Aladdin

- 6.4.17 Addepar Inc.

- 6.4.18 SimCorp A/S

- 6.4.19 Profile Software

- 6.4.20 Charles River Development

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment