Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689694

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689694

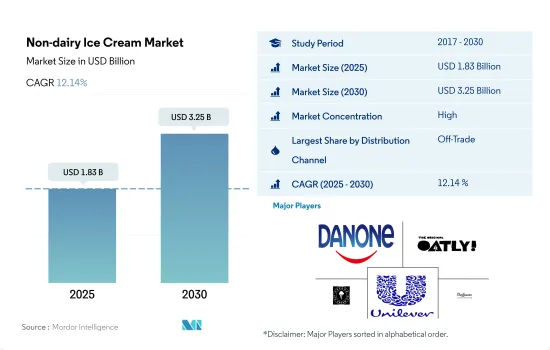

Non-dairy Ice Cream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 224 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Non-dairy Ice Cream Market size is estimated at 1.83 billion USD in 2025, and is expected to reach 3.25 billion USD by 2030, growing at a CAGR of 12.14% during the forecast period (2025-2030).

Significant sales through supermarkets and online stores are boosting the segment sales through off-trade channel

- There was a huge demand for consumers to purchase more plant-based ice cream through retail groceries (off-trade) in 2020, with an increase of 15.68%. The non-dairy ice cream showed an overall growth rate of 50.51% in 2023 compared to 2020. This illustrates a sustained increase over recent years and demonstrates the incredible opportunities available for brands in every part of the store and across online platforms.

- However, the region does not have a considerable market for the on-trade channel and is at an underdeveloped stage in the region. Consumers eat plant-based dairy in a definite amount, and they prefer to eat at home and are less likely to eat from a restaurant or foodservice outlet. Numerous industries are being impacted by the shift in consumer preference toward conscious and healthy lifestyle habits as consumers attempt to find better alternatives for conventional products. The spread of vegan culture and the influence of social media are the key factors. Ubud, Indonesia, had the highest percentage of vegan-friendly restaurants as of April 2021, with approximately 38% of all restaurants based in the city offering vegan cuisine, followed by Edinburgh, Scotland (UK), with around 33%.

- The online channel is expected to be the fastest-growing distribution channel in the off-trade segment. It is projected to register a CAGR of 18.25% during the forecast period. Convenience is the primary motivation for 61.1% of shoppers who have transitioned to shopping for more groceries online. This growth is due to the increasing number of smartphone users, which is expected to be 6.92 billion in 2023, i.e., 86.29% of the world's population.

Surging non-dairy ice cream consumption in North America and Europe is fueling the market

- The non-dairy ice cream market experienced a growth rate of 17.7% in 2022 compared to 2021. Consumers' inclination toward health consciousness and increasing preference toward vegan-based products is driving the global non-dairy ice cream market.

- North America dominates the non-dairy ice cream market. In 2022, the region accounted for 55.3% of the share, and the sales value of non-dairy ice cream is anticipated to grow by 33.5% in 2025. The surge in the popularity of plant-based ice cream can be attributed to burgeoning consumer interest in dairy-free desserts and the significant improvement in vegan ice cream offerings in terms of accessibility, texture, and flavor.

- Europe is the second leading region for the sales of non-dairy ice cream. In Europe, the number of vegans is growing, and more than half of the population wants to reduce meat consumption, considering themselves flexitarian. As of 2021, 2.6 million consumers in the region were vegans, representing 3.2% of the population. Nearly 75 million European consumers purchased vegan food in the same year. As a result, the total sales value of non-dairy ice cream in Europe increased from USD 378.1 million in 2021 to USD 479.02 million in 2022.

- As the number of ice cream parlors increases globally, the demand for non-dairy ice cream is anticipated to grow during the forecast period. Baskin-Robbins, Dairy Queen, Haagen-Dazs, and Wall's are some major non-dairy ice cream outlets operating worldwide. Baskin-Robbins is the world's largest chain of vegan ice cream specialty shops. As of 2022, it had more than 7,500 stores located in around 50 countries, while Dairy Queen had more than 6,000 outlets located in the United States, Canada, and 18 other countries.

Global Non-dairy Ice Cream Market Trends

The increasing awareness of health consequences, rise in lactose intolerance, growing adoption of plant-based diets, and busy lifestyles of consumers are driving the demand for plant-based ice cream and non-dairy alternatives

- A plant-based diet, such as veganism and vegetarianism, is becoming a growing trend globally. In 2022, around 3% of responding German consumers between 18 and 64 followed a vegan diet. In Brazil, China, Mexico, and the United States, between 2% and 6% of respondents were vegan.

- Non-dairy ice creams are gaining popularity among American and European consumers because of the rise in the population who are flexitarian, lactose-intolerant, or strict vegan. In 2022, the non-dairy ice cream segment of the United States witnessed a growth of 11.98% compared to 2021. The growth is attributed to the rising awareness about the consequences of obesity, which is leading to an increased preference for and consumption of non-fat or less-fat food products. The region observed growth in its obesity by 11.98% in 2020. In Canada, obesity rates in Canadian adults are higher in men than women (28.0% versus 24.7%, respectively). Globally, consumers are becoming increasingly aware of their nutritional choices. Owing to their busy lifestyles, their purchasing decision is dependent on the nutritional value of the product, which is driving the demand for plant-based ice cream worldwide. Consumers, especially those allergic to milk, are keen to consume plant-based milk products. For example, cow milk allergy is one of the common food allergies in young children. Many Japanese consumers are also lactose-intolerant and do not consume milk or milk products. As of 2022, in Australia, around 1 in 50 babies and young children showed signs of an allergy to cow's milk. Thus, the demand for plant-based dairy products increased gradually. The per capita consumption of non-dairy ice cream grew by 13.27% globally during 2023-2024.

Non-dairy Ice Cream Industry Overview

The Non-dairy Ice Cream Market is fairly consolidated, with the top five companies occupying 80.10%. The major players in this market are Danone SA, Oatly Group AB, Oregon Ice Cream Company, Unilever PLC and Van Leeuwen Ice Cream (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 67366

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Per Capita Consumption

- 4.2 Raw Material/commodity Production

- 4.2.1 Dairy Alternative - Raw Material Production

- 4.3 Regulatory Framework

- 4.3.1 Australia

- 4.3.2 Canada

- 4.3.3 Germany

- 4.3.4 Mexico

- 4.3.5 United Kingdom

- 4.3.6 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Distribution Channel

- 5.1.1 Off-Trade

- 5.1.1.1 Convenience Stores

- 5.1.1.2 Online Retail

- 5.1.1.3 Specialist Retailers

- 5.1.1.4 Supermarkets and Hypermarkets

- 5.1.1.5 Others (Warehouse clubs, gas stations, etc.)

- 5.1.1 Off-Trade

- 5.2 Region

- 5.2.1 Asia-Pacific

- 5.2.1.1 By Distribution Channel

- 5.2.1.2 Australia

- 5.2.2 Europe

- 5.2.2.1 By Distribution Channel

- 5.2.2.2 Belgium

- 5.2.2.3 France

- 5.2.2.4 Germany

- 5.2.2.5 Italy

- 5.2.2.6 Netherlands

- 5.2.2.7 Spain

- 5.2.2.8 United Kingdom

- 5.2.2.9 Rest of Europe

- 5.2.3 Middle East

- 5.2.3.1 By Distribution Channel

- 5.2.3.2 Saudi Arabia

- 5.2.3.3 United Arab Emirates

- 5.2.4 North America

- 5.2.4.1 By Distribution Channel

- 5.2.4.2 Canada

- 5.2.4.3 Mexico

- 5.2.4.4 United States

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Danone SA

- 6.4.2 Nadamoo

- 6.4.3 Oatly Group AB

- 6.4.4 Oregon Ice Cream Company

- 6.4.5 The Brooklyn Creamery

- 6.4.6 Tofutti Brands Inc.

- 6.4.7 Unilever PLC

- 6.4.8 Van Leeuwen Ice Cream

- 6.4.9 WildGood

7 KEY STRATEGIC QUESTIONS FOR DAIRY AND DAIRY ALTERNATIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.