PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686654

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686654

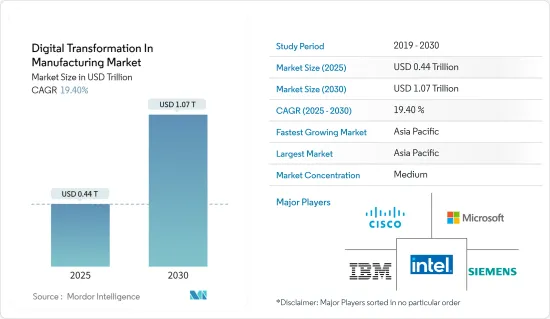

Digital Transformation In Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Digital Transformation In Manufacturing Market size is estimated at USD 0.44 trillion in 2025, and is expected to reach USD 1.07 trillion by 2030, at a CAGR of 19.4% during the forecast period (2025-2030).

Key Highlights

- The digitalization of the manufacturing sector impacts every aspect of operations and the supply chain. It begins with the design of the equipment and continues with the product design, production process development, and, finally, the monitoring and improvement of the end-user experience. Through cross-border collaboration, digital transformation is revolutionizing how manufacturers communicate and maintain product and engineering design specifications on the cloud.

- In addition, the widespread use of Internet of Things (IoT) devices is transforming industrial processes and increasing productivity. IoT devices enable real-time monitoring, gathering, and analyzing data on various industrial processes. It enables preventative maintenance, reduces energy use, and boosts overall productivity.

- With the help of these tools, stakeholders, systems, and machines can communicate and work together more easily, streamlining processes and decreasing downtime. By integrating IoT devices, manufacturers can improve quality control, manage inventories in real-time, and improve supply chain visibility.

- However, there are significant up-front expenses related to digital transformation. Implementing new technologies, including IoT gadgets and automation systems, frequently necessitates large expenditures in hardware, training, software, and infrastructure, which can be financially challenging for certain businesses, impeding market expansion.

- The COVID-19 outbreak expedited the manufacturing industry's digital transition. As supply chains and worker availability were disrupted, businesses sought technological solutions to reduce risks and improve operational effectiveness. Automation, remote monitoring, and data analytics were essential for streamlining manufacturing procedures, controlling inventory, and guaranteeing worker safety. Along with enhancing resilience and agility to facilitate real-time data analysis, remote collaboration, and predictive maintenance, manufacturers implemented cloud-based platforms, IoT gadgets, and artificial intelligence in the face of upcoming challenges. This rapid digitization also cleared the way for smarter, more integrated factories to boost efficiency and creativity in the post-pandemic period.

Digital Transformation in Manufacturing Market Trends

Internet-of-Things (IoT) to Hold Major Market Share

- The Internet of Things is a key driver of digital transformation that connects physical devices and sensors to the Internet, creating smart and connected systems. This connection enables real-time data collection and analysis, improving operational efficiency, better decision-making, new business models, and increased automation across various industries.

- Manufacturing businesses are concentrating on IoT as the critical enabler to augment digital transformation and unlock operational efficiencies. It facilitates the collection and analysis of real-time data, enabling organizations to make informed decisions and optimize manufacturing and related processes.

- The Internet of Things impacts organizations' digital transformation by creating new investment opportunities, improving customer experience, increasing productivity, lowering operational costs and efficiency, and empowering business models. It became essential for industries, including healthcare, government and education, security, communication, and others, owing to numerous benefits that could act as a competitive factor in the coming years.

- The market is expanding positively as IoT technology is increasingly used in manufacturing. The Internet of Things (IoT) is driving the next industrial revolution of intelligent connectivity as the traditional manufacturing sector transforms digitally. It is transforming how businesses handle the increasingly complex systems and machines they use to increase productivity and minimize downtime. According to Ericsson, ioT connections are anticipated to increase from USD 13.20 billion in 2022 to USD 34.70 billion by 2028 at a CAGR of over 18%.

- Overall, manufacturers are optimizing processes, improving productivity, and reducing costs by leveraging IoT technologies. It is to gain a competitive edge in the rapidly involving manufacturing industry across the globe and driving digital transformation in the manufacturing sectors. The market's growth is likely to continue with the development of the manufacturing industry and the adoption of IoT over the forecast period.

Asia-Pacific to Register Fastest Growth

- China's manufacturing sector saw a digital revolution in recent years. The Chinese government actively supports digital technologies in traditional manufacturing processes to increase production, efficiency, and innovation.

- China invested significantly in innovative technologies like robotics, IoT, Big Data Analytics, AI, and cloud computing technologies for smart manufacturing. With the help of these technologies, industrial processes can become optimized, and preventative maintenance is made possible. It significantly boosts productivity and lowers costs, boosting the market's growth opportunities.

- Japan is a significant provider of robotics and automation, and digital transformation is further driving their adoption. Advanced robots are used in various manufacturing processes for packaging, assembly, and material handling tasks. Automation helps improve efficiency, reduce errors, and enhance workplace safety.

- Moreover, Japan became a global leader in digital twin technologies creation and application in recent years. Digital twins are virtual representations of actual things, systems, or procedures that can be used for analysis, simulation, and optimization. They can enhance product design, lower costs, and boost manufacturing effectiveness. This technique is used in many industries in Japan, including manufacturing.

- The Indian government introduced "Make in India" and "Digital India" to encourage the manufacturing sector's digital transformation. These initiatives seek to make doing business easier, promote infrastructure and technology investments, and offer legislative support and incentives to hasten the use of digital technologies in manufacturing. Also, IIoT adoption is accelerating in the Indian manufacturing sector. IIoT offers real-time data collection, remote monitoring, and predictive maintenance by integrating machines, sensors, and devices. It aids producers in streamlining operations, decreasing downtime, and enhancing overall equipment performance.

- In the Asia-Pacific region, robotics and automation technologies are rapidly being widely adopted in the manufacturing industry. Advanced robots are increasingly used in assembly lines, material handling, and other repetitive operations to increase efficiency, productivity, and product quality. Automation enables industries to respond rapidly to shifting market demands while lowering labor costs and improving precision.

Digital Transformation in Manufacturing Industry Overview

The competition in digital transformation is considerable due to the availability of many solution providers and technological improvements in the industry. Notably, firms often adjust their pricing methods to maintain market share and retain new and existing consumers, placing pricing pressure on other companies and boosting market competitiveness. Furthermore, firms are continually pursuing techniques such as acquisitions and the production of new goods at competitive prices, increasing competition among organizations. Some significant players in the market are Cisco Systems Inc., Microsoft Corporation, Intel Corporation, IBM Corporation, and Siemens AG.

- In March 2023, Mitsubishi Electric launched a free mobile application for iOS and Android platforms. It is for searching and comparing its factory automation products to make it easier to identify relevant products to aid digital manufacturers quickly.

- In February 2023, Oracle declared plans to open a third public cloud region, especially in Saudi Arabia, to fulfill the rapidly growing demand for its cloud services. Located in Riyadh, the new cloud region will be part of a planned USD 1.5 billion investment by Oracle to expand its overall cloud infrastructure capabilities in the Kingdom. Oracle Cloud delivers pioneering innovation in key technologies like Machine Learning, AI, and IoT. It will help fuel economic growth and digital transformation, an integral part of Saudi Vision 2030.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Inclination of Manufacturers Toward Cost-efficient Processes

- 5.1.2 Proliferation of IoT

- 5.2 Market Restraints

- 5.2.1 Lack of Technical Expertise

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Robotics

- 6.1.2 IoT

- 6.1.3 3D Printing and Additive Manufacturing

- 6.1.4 Cybersecurity

- 6.1.5 Other Technologies

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United kingdom

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Microsoft Corporation

- 7.1.3 Intel Corporation

- 7.1.4 IBM Corporation

- 7.1.5 Siemens AG

- 7.1.6 SAP SE

- 7.1.7 Nortonlifelock Inc.

- 7.1.8 Oracle Corporation

- 7.1.9 Schneider Electric SE

- 7.1.10 Mitsubishi Electric Corporation

- 7.1.11 General Electric Company

- 7.1.12 ABB Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET