PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850332

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850332

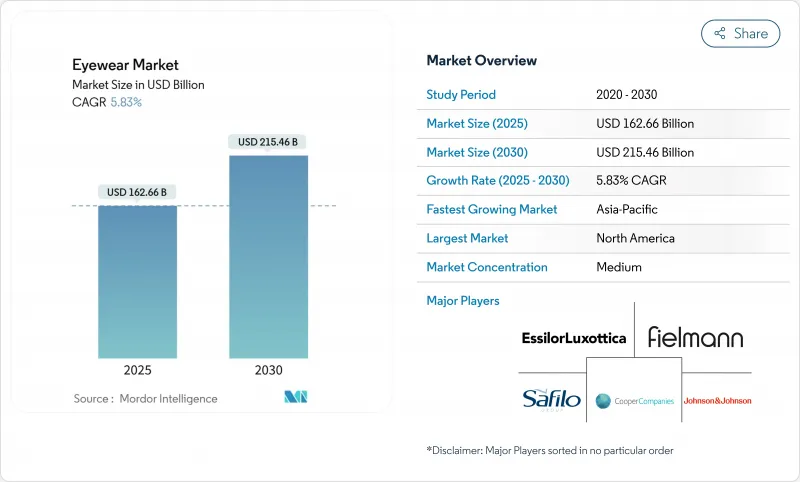

Eyewear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global eyewear market, valued at USD 162.26 billion in 2025, is expected to reach USD 215.46 billion by 2030, registering a CAGR of 5.83%.

The market growth stems from increased health consciousness, smart glasses adoption, and the dual perception of eyewear as a medical necessity and fashion statement. Technological advancements are reshaping the industry. Augmented-reality (AR) frames combine digital and physical environments, expanding beyond traditional vision correction. Artificial intelligence (AI) enhances the fitting process, enabling accurate eyewear selection. These technological integrations generate additional revenue streams beyond conventional lens and frame sales. Luxury collaborations, stringent UV-protection rules, and a widening online channel support steady demand.Meanwhile, counterfeit risks and raw-material cost swings challenge margin preservation, urging firms to invest in authentication tools, diversified supply chains, and premium positioning to protect pricing power.

Global Eyewear Market Trends and Insights

Rising demand for luxury and premium sunglasses

The luxury sunglasses market continues to grow as consumers view these products as status symbols beyond their functional purpose. Generation Z consumers particularly consider luxury sunglasses an accessible entry point into premium fashion. The increasing disposable income, changing fashion preferences, and growing awareness of eye protection drive consumer demand for high-end sunglasses. Consumers demonstrate increased willingness to purchase premium-priced sunglasses that combine innovative designs, established brand names, and high-quality materials. The integration of advanced lens technologies, sustainable materials, and customization options further enhances the appeal of luxury sunglasses. Collaborations between established fashion houses and eyewear manufacturers enhance market growth by creating exclusivity and strengthening brand value. For instance, in February 2025, Maison Margiela and Gentle Monster launched their third collaboration, following successful collections in 2023 and 2024. The collection features eight sunglasses designs and 12 optical frames, with previous releases experiencing rapid sell-out rates.

Increasing prevalence of vision problems

The global increase in refractive errors such as myopia, hyperopia, and astigmatism drives the demand for prescription sunglasses that combine vision correction with UV protection. The World Health Organization reports that at least 2.2 billion people worldwide have near or distance vision impairment, highlighting the significant market potential for vision correction solutions . According to the British Journal of Ophthalmology (BJO) in 2023, myopia (nearsightedness) affects one-third of children and adolescents globally, indicating a substantial need for early vision correction interventions . Advancements in photochromic lens technology enhance the prescription sunglasses market through improved functionality. In April 2024, Indizen Optical Technologies of America (IOT America) launched Neochromes FT-28 flat-top polycarbonate photochromic lenses, strengthening the bifocal lens segment with enhanced light-adaptive capabilities and durability. The rising screen time leads to increased digital eye strain, driving the adoption of blue light filtering lenses. Additionally, aging populations in developed markets create sustained demand for specialized vision correction products.

Proliferation of counterfeit products

The rise in counterfeit sunglasses sales through e-commerce platforms poses a significant challenge. The problem stems from anonymous vendor accounts and attractive, low prices. These factors lead consumers to unintentionally purchase counterfeit products, which harms legitimate manufacturers and retailers. Counterfeit sunglasses present serious health and safety risks, as their substandard materials and insufficient UV protection can cause permanent eye damage. These products not only harm consumers physically but also erode consumer trust in legitimate brands. The use of low-quality materials, improper manufacturing processes, and a lack of quality control in counterfeit sunglasses production creates significant safety concerns. According to U.S. Customs and Border Protection (CBP) Intellectual Property Rights Seizure Statistics in 2024, counterfeit sunglass seizures increased to 7.7 million units from 1.4 million in FY 2023, indicating a growing problem in the market . Also, in June 2025, Customs officers at O'Hare Airport seized a shipment of counterfeit luxury items valued at USD 638,000. Upon inspecting a shipment labeled "fashion sunglasses," they found 61 pairs adorned with counterfeit trademarks from renowned designers like Louis Vuitton, Versace, and Chanel.

Other drivers and restraints analyzed in the detailed report include:

- Technological advancements and smart eyewear

- Growing awareness of UV protection and eye health

- Vision correction surgeries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Spectacles held a 67.35% share of the eyewear market in 2024, driven by increasing vision correction requirements. The segment's growth continues due to extended screen time usage, aging demographics, and rising myopia rates worldwide. Digital device proliferation across work and leisure activities has intensified eye strain issues, while demographic shifts toward older populations have increased the need for reading glasses and bifocals. Contact lens sales growth stems from consumer preferences for active lifestyles, technological improvements in lens materials, and scheduled replacement cycles that create consistent revenue streams.

The sunglasses segment is projected to grow at a 6.24% CAGR through 2030. Driven by heightened awareness of UV protection and the growing emphasis on eye health, the sunglasses segment is swiftly rising in the global eyewear market. Fashion trends, coupled with celebrity endorsements, have elevated sunglasses to a prominent style statement, spurring demand across diverse age groups. Moreover, technological advancements, including polarized and smart sunglasses, are captivating tech-savvy consumers, propelling the market's growth.

In 2024, mass-market frames dominated the market, capturing 68.55% of the revenue. This success stemmed from production economies of scale and pricing strategies that resonated with a broad spectrum of income levels. Retailers, leveraging standardized designs and robust global supply networks, ensured eyewear became a staple for many. The mass-market segment, with its high-volume manufacturing and efficient distribution, boasts a vast retail footprint, allowing for a diverse product range at wallet-friendly prices. This segment's strength is evident in both urban and rural landscapes, where price sensitivity often drives purchasing decisions.

On the other hand, the premium segment is on an upward trajectory, projected to expand at a 6.54% CAGR through 2030. This growth is fueled by aspirational buying and shifting fashion trends. Younger consumers, in particular, are pivotal, treating limited-edition drops and designer collaborations as must-have collectibles. Even in the face of economic headwinds, this enthusiasm has buoyed the premium segment's expansion. To command their higher price tags, premium eyewear brands emphasize unique designs, top-tier materials, and exclusive collaborations, appealing to discerning consumers who prioritize distinctiveness and quality. Moreover, the surge of social media and influencer endorsements has cemented luxury eyewear's status as a coveted lifestyle emblem.

The Eyewear Market is Segmented by Product Type (Spectacles, Sunglasses, Contact Lenses, Other Product Types), Category (Mass, Premium), End User (Men, Women, Unisex), Distribution Channel (Offline, Online) and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounts for 33.53% of the eyewear market revenue in 2024, supported by high consumer purchasing power, comprehensive insurance coverage, and consumer readiness to adopt smart eyewear frames. The region's market dominance is further strengthened by advanced retail infrastructure, increasing awareness of eye health, and a growing aging population requiring vision correction.

The Asia-Pacific region is projected to grow at an 8.04% CAGR through 2030, emerging as the fastest-growing market. This growth stems from increasing myopia cases, growing middle-class income levels, and widespread mobile commerce adoption. China remains a key market, particularly in functional eyewear, supported by government-led rural vision screening programs. The region's growth is further amplified by rapid digitalization, increasing screen time among young populations, and expanding e-commerce penetration.

Europe maintains stable growth through established craftsmanship and strong luxury brand presence. Italian and French manufacturers continue to influence global trends and maintain premium price points. The region's focus on sustainable materials and bioplastic innovations helps maintain competitiveness against lower-priced imports. European manufacturers are investing in research and development to create innovative lens technologies and frame designs. South America and the Middle East and Africa markets show growth potential, driven by increasing urbanization, improving healthcare facilities, and rising consumer spending. These regions are experiencing rapid development in optical retail chains and growing awareness of vision care needs among their populations.

- EssilorLuxottica SA

- Safilo Group SpA

- Fielmann AG

- Johnson & Johnson AG

- The Cooper Companies Inc.

- Alcon Inc.

- Bausch + Lomb Corp.

- Carl Zeiss AG

- De Rigo Vision SpA

- Charmant Group

- Hoya Corporation

- Warby Parker Inc.

- Lenskart Solutions Pvt. Ltd.

- Marchon Eyewear (VSP Global)

- Maui Jim Inc.

- Zenni Optical Inc.

- Marcolin SpA

- Inspecs Group PLC

- Hangzhou Lingban Technology Co., Ltd

- Kering S.A

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Luxury and Premium Sunglasses

- 4.2.2 Increasing Prevalence of Vision Problems

- 4.2.3 Technological Advancements and Smart Eyewear

- 4.2.4 Growing Awareness of UV Protection and Eye Health

- 4.2.5 Influence of Celebrity Endorsements and Social Media

- 4.2.6 Expansion of E-commerce and Online Try-On Services

- 4.3 Market Restraints

- 4.3.1 Proliferation of Counterfeit Products

- 4.3.2 Vision Correction Surgeries

- 4.3.3 Fluctuating Raw Material Prices

- 4.3.4 High Costs of Research, Design, and Technology

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Spectacles

- 5.1.2 Sunglasses

- 5.1.3 Contact Lenses

- 5.1.4 Other Product Types

- 5.2 By Category

- 5.2.1 Mass

- 5.2.2 Premium

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.3.3 Unisex

- 5.4 By Distribution Channel

- 5.4.1 Offline Stores

- 5.4.2 Online Stores

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 EssilorLuxottica SA

- 6.4.2 Safilo Group SpA

- 6.4.3 Fielmann AG

- 6.4.4 Johnson & Johnson AG

- 6.4.5 The Cooper Companies Inc.

- 6.4.6 Alcon Inc.

- 6.4.7 Bausch + Lomb Corp.

- 6.4.8 Carl Zeiss AG

- 6.4.9 De Rigo Vision SpA

- 6.4.10 Charmant Group

- 6.4.11 Hoya Corporation

- 6.4.12 Warby Parker Inc.

- 6.4.13 Lenskart Solutions Pvt. Ltd.

- 6.4.14 Marchon Eyewear (VSP Global)

- 6.4.15 Maui Jim Inc.

- 6.4.16 Zenni Optical Inc.

- 6.4.17 Marcolin SpA

- 6.4.18 Inspecs Group PLC

- 6.4.19 Hangzhou Lingban Technology Co., Ltd

- 6.4.20 Kering S.A

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK