PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1326457

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1326457

HVAC Equipment Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028)

The HVAC Equipment Market size is estimated at USD 141.36 billion in 2023, and is expected to reach USD 195.96 billion by 2028, growing at a CAGR of 6.75% during the forecast period (2023-2028).

HVAC equipment can be applied in a wide range of locations, and building types, such as shopping centers, industrial facilities, warehouses, etc., ensuring that a building has proper climate control with heating and cooling, along with the necessary air pressure and air quality to make the occupants in the building comfortable and safe.

Key Highlights

- The rapid rise in industrialization and urbanization worldwide is one of the primary factors driving the market's growth. The significant increase in the construction of different commercial and residential buildings worldwide is creating considerable demand for HVAC equipment as a space heating and cooling system, ventilation control, humidity control, and air filtration. For instance, as per the IEA, the global building construction sector's value increased by 5% compared to the previous year, reaching over USD 6.3 trillion.

- Rising energy costs directly impact building owners' and tenants' profit/loss statements. The invasion of Ukraine affected energy markets worldwide, particularly in Europe, which remains the primary market for Russian oil and gas due to the lack of these energy sources in European countries. However, due to Russia's invasion of Ukraine, the European Union decided to cut Russian oil imports by two-thirds, resulting in a surge in energy prices. Consequently, the demand for energy-efficient HVAC systems has recently increased significantly.

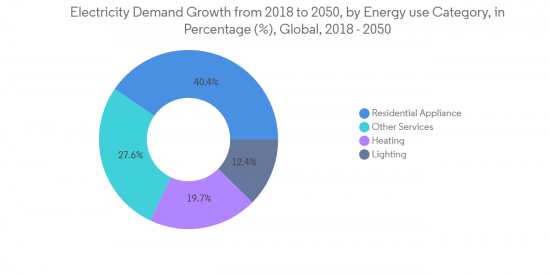

- Heating, ventilating, and air-conditioning in a commercial building usually consume more energy than any other activity in the building. According to the US Department of Energy's studies of commercial buildings, HVAC equipment usually account for over 40% of a building's energy usage. Owing to the huge amount of energy, HVAC systems use improvements in equipment efficiency translate to significant reductions in building operating costs.

- The high initial cost of HVAC equipment can be challenging for its demand because the high cost may deter some customers from purchasing or upgrading their systems. This is especially true for homeowners or small business owners who may have limited budgets and may not be able to afford the upfront costs of a new system. Secondly, the high cost of HVAC equipment can result in long payback periods for customers. This means that the cost savings resulting from the new system's improved energy efficiency may not offset the initial investment for several years.

- With the outbreak of COVID-19, more consumers are expressing concerns about the environmental impact of the services and products they buy. They are willing to pay more for more eco-friendly and health-friendly options than others. Smart HVAC systems are expected to have significant demand.

HVAC Equipment Market Trends

Supportive Government Regulations, Including Incentives for Saving Energy Through Tax Credit Programs, Drive the Market's Growth

- Many governments worldwide are offering tax incentives to encourage the installation of efficient HVAC (heating, ventilation, and air conditioning) equipment. This is part of a larger effort to reduce carbon emissions and mitigate the impact of climate change. By bolstering current supplies while accelerating the sustainable energy transition, the energy provisions of the Inflation Reduction Act will strengthen energy security and meaningfully reduce emissions, representing an important step toward a better future.

- These unprecedented incentives present consumers with a compelling opportunity to replace any aging, lower-efficiency HVAC systems with advanced, high-efficiency technology at a fraction of the cost.

- For instance, in December 2022, the federal tax incentives in the United States for greater HVAC efficiency were on again. Enhanced tax credits have been provided for homeowners who install certain HVAC equipment and home builders whose projects meet specific energy-efficiency standards, and tax deductions for the owners of commercial buildings that are upgraded to achieve defined energy savings are part of the Inflation Reduction Act, passed in the US House of Representatives. Through the Inflation Reduction Act, a tax credit of up to USD 2,000 is available to homeowners, followed by USD 2500-5000 for home builders with qualified heat pumps installed. The 25C credit is available to homeowners with eligible HVAC equipment, while home builders can take advantage of enhanced 45L credits. The Inflation Reduction Act broadened the availability of 179D tax deductions, which commercial building owners generally use outfitted to increase energy efficiency. All these tax rebates require specific categories to show minimum energy cost savings.

- In July 2022, two bills pending in the US Senate were designed to speed the electrification of HVAC systems, minimize the number of fossil fuels (such as natural gas and oil) used in buildings, and cut carbon emissions. Both offered financial incentives for producing certain electric-powered HVAC equipment, particularly heat pumps, geothermal and air sources, and heat-pump water heaters.

- The Tax-and-Climate bill passed by Congress is the largest investment in energy efficiency in US history, with more than USD 21 billion allocated for rebates and federal tax deductions for household energy-saving upgrades over the next 10 years.

- All these rebates were expected to be distributed beginning in January 2023 and continue through September 2031 through state and tribal governments that establish their qualifying programs.

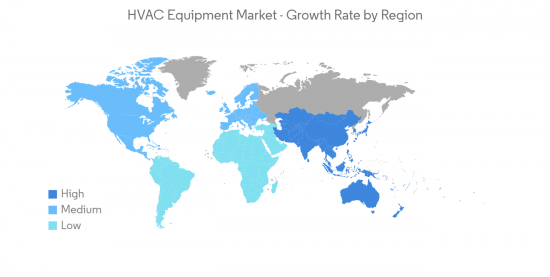

Asia-Pacific Expected to Register Fastest Growth

- The Asia-Pacific HVAC systems market is predicted to rise steadily due to commercial and residential construction activity in India and China and rising consumer expenditure on luxury products. Low ownership rates and increased disposable income in Asia are likely to boost the market's growth. Due to rising demand from India and China, the residential sector accounted for a significant portion of the Asia-Pacific air conditioning systems market. Increased competition from Chinese producers offering products at lower prices than globally recognized names is projected to sustain sales growth. A large installed base in established regions like Western Europe and the United States is expected to create development prospects in the comparatively untapped Asia-Pacific market.

- The largest air conditioning firm introduced a new line of split-room air conditioners designed and built in India for discerning Indian consumers. This new U Series line features future-ready technologies that enable clients to control the quality of air conditioning across their facilities.

- In February 2023, Godrej Appliances, a division of Godrej & Boyce, the Godrej Group's flagship firm, launched India's first leakproof split air conditioner with anti-leak technology and has filed a patent for it. The all-new anti-leak technology found in Godrej Leak Proof Split ACs strives to solve the issues mentioned above. This AC also includes several other valuable technologies and features, such as 5-in-1 Convertible Cooling Technology, which can be adjusted based on the number of people in the room to save energy, i-sense technology to match the set temperature for maximum comfort, powerful cooling even at 52°C with lower derating, inverter technology for power savings, and eco-friendly R32 refrigerant, which has zero ozone depletion and low global warming potential.

- In February 2023, Daikin Japan, one of the world's major air conditioning manufacturers, plans to supply heat pumps and cooling systems to public buildings, including social housing, around the city, which will be remotely monitored and certified. The signing of this UK-first agreement will assist between 800-1000 houses in Greater Manchester over the next two years via retrofitting efforts, low-carbon heating systems such as air-source heat pumps, and broader digital interventions.

- In the Asia-Pacific market, the energy and power sectors will be essential end users of heating equipment. Rising power plant capacity will be a primary driver of market expansion. According to the International Energy Agency's Global Energy Investment Forecast, between 2014 and 2035, over USD 9.5 trillion will be spent on constructing new power plants and rehabilitating existing ones worldwide. Over one-third of this will likely be used for fossil-fuel-based thermal power plants. Increasing generation capacity is planned to be achieved primarily through fossil-fuelled thermal power plants, which are the primary source of electricity generation in these countries.

HVAC Equipment Industry Overview

The HVAC equipment market is fragmented with the presence of major players like Trane Technologies PLC, Aermec SpA (Giordano Riello International Group SpA), Daikin Industries Ltd, Clivet SpA (Midea Group), Emicon Innovation and Comfort SRL. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In November 2022, Daikin introduced the Emuraindoor climate management system, designed to purify the air and heat and cool interior areas. Emura is a slim and unobtrusive shape designed to fit in various indoor areas, from living rooms to offices, and strives to provide effective temperature control.

- In September 2022, Trane Technologies, one of the global climate innovators, announced innovations that expanded its electrified heating and cooling portfolio and upgraded two well-known rooftop units to improve energy efficiency, building connectivity, and control. Trane introduced the new ThermafitAir-to-Water Modular Heat Pump Model AXM, which offers flexible, all-electric heating and cooling. It also added updates to its Voyager 3 and IntelliPak2 Rooftop Units to improve indoor comfort and air quality in warehouses and large facilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Outbreak on the Industry

- 4.5 The Impact of Regulations on the Market

- 4.6 Distribution Channel Analysis

- 4.7 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Supportive Government Regulations, Including Incentives for Saving Energy Through Tax Credit Programs

- 5.1.2 Increasing Demand for Energy-efficient Devices

- 5.1.3 Increased Construction and Retrofit Activity to Aid Demand

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of Energy Efficient Systems

- 5.2.2 Dependence on Macro-economic Conditions

- 5.2.3 Growing Competition to Limit Margins

- 5.3 Market Opportunities

- 5.3.1 Emergence of IoT and Product Innovations to Aid Replacements

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Air Conditioning Equipment

- 6.1.2 Heating Equipment

- 6.1.3 Heat Pumps

- 6.1.4 Humidifiers/Dehumidifiers

- 6.2 By End-user Industry

- 6.2.1 Residential

- 6.2.2 Industrial and Commercial

- 6.3 By Geography***

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 Africa

- 6.3.5.4 Rest of Middle East

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Trane Technologies PLC

- 7.1.2 Aermec SpA (Giordano Riello International Group SpA)

- 7.1.3 Daikin Industries Ltd

- 7.1.4 Clivet SpA (Midea Group)

- 7.1.5 Emicon Innovation and Comfort SRL

- 7.1.6 G.I. Industrial Holding SpA

- 7.1.7 Mitsubishi Electric Hydronics & IT Cooling Systems

- 7.1.8 Rhoss SpA (NIBE Group)

- 7.1.9 MTA SpA

- 7.1.10 Hitema International

- 7.1.11 Swegon Group AB

- 7.1.12 Systemair AB

- 7.1.13 Lennox International Inc.

- 7.1.14 Carrier Corporation

- 7.1.15 Rheem Manufacturing Company Inc.

- 7.1.16 Midea Group

- 7.1.17 Gree Electric Appliances

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET