PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906903

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906903

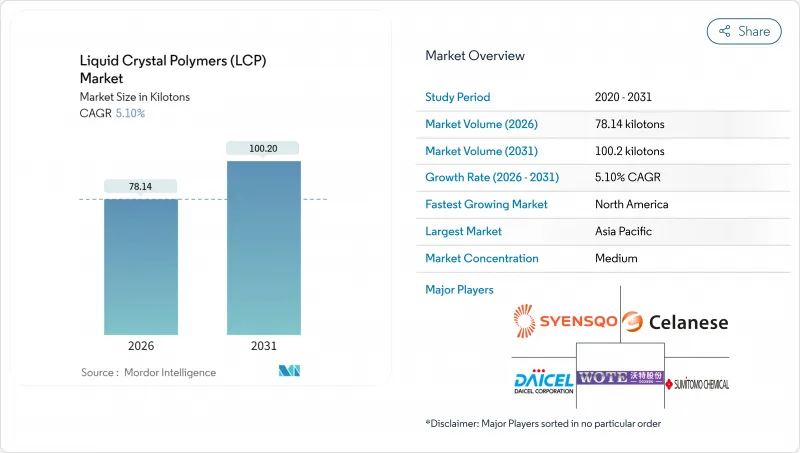

Liquid Crystal Polymers (LCP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Liquid Crystal Polymers Market is expected to grow from 74.35 kilotons in 2025 to 78.14 kilotons in 2026 and is forecast to reach 100.2 kilotons by 2031 at 5.10% CAGR over 2026-2031.

This upward curve rests on three interconnected pillars: the steady roll-out of 5G network hardware, the accelerating shift toward battery-electric vehicles, and the industry-wide drive to miniaturize high-frequency electronic assemblies. Each of these end-uses requires polymers that maintain dimensional accuracy under thermal stress, exhibit negligible electrical loss at millimeter-wave frequencies, and retain mechanical integrity over long service lives. Volume rather than price determines adoption, because design engineers primarily choose LCP grades for their low dielectric constants, low dissipation factors, and excellent moisture resistance. Against that backdrop, the liquid crystal polymer market has become a critical input for next-generation antenna modules, high-voltage inverter packages, and flexible high-density interconnects. Firms able to secure reliable feedstocks of specialty diacids and diols position themselves to capture outsized volumes as downstream demand rises.

Global Liquid Crystal Polymers (LCP) Market Trends and Insights

Miniaturization of SMT Components & 5G RF Modules

Wideband antenna studies show that LCP substrates sustain dielectric constants below 3.5 and loss tangents under 0.004 at mmWave frequencies, enabling compact array elements for 28 GHz base stations without signal degradation. The material exhibits machine-direction shrinkage as low as 0.05%, maintaining impedance control in fine-line circuits used for Multiple-Input and Multiple-Output (MIMO) beam-forming. Polyplastics lifted polymerization capacity to 25,000 tons in 2025 to satisfy handset and infrastructure demand as China adds 700,000 new 5G base stations and United States operators retrofit legacy sites. Despite tight dielectric tolerances, cost-effective processing on conventional injection equipment keeps the liquid crystal polymer market attractive for high-volume radio modules. The resulting ecosystem strengthens design flexibility for original equipment manufacturers (OEMs) targeting 6G-ready performance envelopes.

Lightweight Substitution for Metals in EV Power-electronics

Thermotropic grades match the 0.1-2.0 X 10-5/°C coefficient of thermal expansion of copper busbars, eliminating shear stress that degrades solder joints in 800 V inverters. Energy-conversion research confirms that LCP cooling plates achieve a 36% weight saving while maintaining +-2°C temperature uniformity across battery modules at 200 A charge rates. Celanese introduced ultra-high-flow variants for miniature board-to-board connectors that survive 3,000 thermal cycles between -40°C and 150°C without warpage. Automakers' carbon-credit strategies reward component light-weighting, expanding the liquid crystal polymer market beyond under-hood sensors into traction voltage assemblies. Supply agreements now bundle design support and recyclate take-back options to satisfy OEM circularity targets.

High Price Premium vs. High-temperature Nylons and PPS

Polyphenylene sulfide delivers 250°C continuous service at 35-50% lower raw-material cost, steering commodity connectors away from LCP in consumer electronics. Automotive Tier 1 suppliers negotiate dual-tooling strategies so that non-critical housings default to high-temperature nylons when dielectric performance is non-essential. Injection setups for LCP require +-2°C barrel control and mold temperatures above 300°C, raising energy consumption and cycle-time costs, discouraging adoption in emerging economies. Recent bio-based variants narrow the premium by 8-10%, yet price parity remains distant for high-volume parts. This cost gap continues to slow the broader penetration of the liquid crystal polymer market into commodity electronics.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Demand for High-frequency Flexible Circuits

- LCP Films for Wearable/implantable Medical Sensors

- Weld-line Weakness and Anisotropic Shrinkage in Complex Molds

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermotropic grades accounted for 92.58% of 2025 volume, underscoring their entrenched supply chains and compatibility with conventional melt-processing equipment. These materials flow at 280-340°C yet retain their crystalline order, yielding inherent flame retardancy and eliminating the need for halogen additives in ultrathin connectors. Consistent isotropic dielectric values below 3.2 make thermotropic LCPs the preferred choice for antenna substrates in 5G smartphones across the Asia-Pacific region. Sustainability gained momentum in 2025 when Celanese introduced a 60% bio-content variant that did not compromise its UL 94 V-0 ratings. Lyotropic LCP, though only 7.42% by volume, benefits from a 7.12% CAGR as aerospace composites demand solution-spun fibers with tensile strengths above 3.2 GPa. Manufacturers invest in solvent recovery units to reduce operating costs, but CAPEX hurdles limit lyotropic capacity to a handful of integrated producers. As additive manufacturers qualify lyotropic filaments for 3D-printed radomes, the liquid crystal polymer market size in this sub-segment is expected to expand, particularly in defense platforms.

The Liquid Crystal Polymer Report is Segmented by Product Type (Thermotropic LCP and Lyotropic LCP), End-User Industry (Aerospace, Automotive, Electrical and Electronics, Industrial and Machinery, and Other End-User Industries), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons) and Value (USD).

Geography Analysis

The Asia-Pacific region retained its leadership position, accounting for 72.45% of the 2025 value, bolstered by dedicated electronics ecosystems that compress lead times from polymerization to finished modules. Government subsidies in China for 5G base-station roll-outs ensure stable offtake, while Japan's automotive tier suppliers continue to specify LCP in radar connectors to meet zero-defect mandates. Production clusters around Ningbo benefit from port proximity, cutting logistics costs for exporters serving European handset makers.

North America posted the fastest 5.98% CAGR to 2031 as wireless carriers upgraded mid-band spectrum with massive MIMO arrays that require low-loss substrates. Sumitomo Chemical's 2025 acquisition of Syensqo's neat-resin assets included pilot lines in Texas, reinforcing domestic supply security for defense electronics. Aerospace primes leverage these local sources to qualify LCP replacements for aluminum EMI shields in avionics, aligning with stimulus-backed on-shoring agendas.

Europe maintained mid-single-digit growth, driven by fuel-cell stack developers that value LCP's chemical resilience in hydrogen environments. Automotive OEMs incorporate LCP header plates in 800 V inverter designs to meet 2027 CO2 fleet targets under EU (European Union) Regulation 2019/631. Deployment of gigafactories in Hungary and Sweden signals incremental capacity for high-voltage battery enclosures, widening regional demand for the liquid crystal polymer market.

- Avient Corporation

- Celanese Corporation

- HUAMI NEW MATERIAL

- Kingfa Sci.&Tech. Co.,Ltd.

- Kuraray Co., Ltd.

- Ningbo Jujia New Material Technology Co., Ltd

- Daicel Corporation

- RTP Company

- SABIC

- Shenzhen WOTE Advanced Materials Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Syensqo

- Toray Industries, Inc.

- UENO FINE CHEMICALS INDUSTRY,LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Miniaturization of SMT Components & 5G RF Modules

- 4.2.2 Lightweight Substitution for Metals in EV Power-electronics

- 4.2.3 Surge in Demand for High-frequency Flexible Circuits

- 4.2.4 LCP Films for Wearable/implantable Medical Sensors

- 4.2.5 Use of LCP Membranes in PEM Fuel-cells and Hydrogen Electrolysers

- 4.3 Market Restraints

- 4.3.1 High Price Premium vs. High-temperature Nylons and PPS

- 4.3.2 Weld-line Weakness and Anisotropic Shrinkage in Complex Molds

- 4.3.3 Concentrated Upstream Supply of Specialty Diacids/diols

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 End-use Sector Trends

- 4.7.1 Aerospace (Aerospace Component Production Revenue)

- 4.7.2 Automotive (Automobile Production)

- 4.7.3 Building and Construction (New Construction Floor Area)

- 4.7.4 Electrical and Electronics (Electrical and Electronics Production Revenue)

- 4.7.5 Packaging(Plastic Packaging Volume)

5 Market Size & Growth Forecasts (Value and Volume)

- 5.1 By Product Type

- 5.1.1 Thermotropic LCP

- 5.1.2 Lyotropic LCP

- 5.2 By End-User Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Electrical and Electronics

- 5.2.4 Industrial and Machinery

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Argentina

- 5.3.2.3 Rest of South America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 Asia-Pacific

- 5.3.4.1 China

- 5.3.4.2 India

- 5.3.4.3 Japan

- 5.3.4.4 South Korea

- 5.3.4.5 Australia

- 5.3.4.6 Malaysia

- 5.3.4.7 Rest of Asia-Pacific

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Avient Corporation

- 6.4.2 Celanese Corporation

- 6.4.3 HUAMI NEW MATERIAL

- 6.4.4 Kingfa Sci.&Tech. Co.,Ltd.

- 6.4.5 Kuraray Co., Ltd.

- 6.4.6 Ningbo Jujia New Material Technology Co., Ltd

- 6.4.7 Daicel Corporation

- 6.4.8 RTP Company

- 6.4.9 SABIC

- 6.4.10 Shenzhen WOTE Advanced Materials Co., Ltd.

- 6.4.11 Sumitomo Chemical Co., Ltd.

- 6.4.12 Syensqo

- 6.4.13 Toray Industries, Inc.

- 6.4.14 UENO FINE CHEMICALS INDUSTRY,LTD.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

8 Key Strategic Questions for CEOs