PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851588

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851588

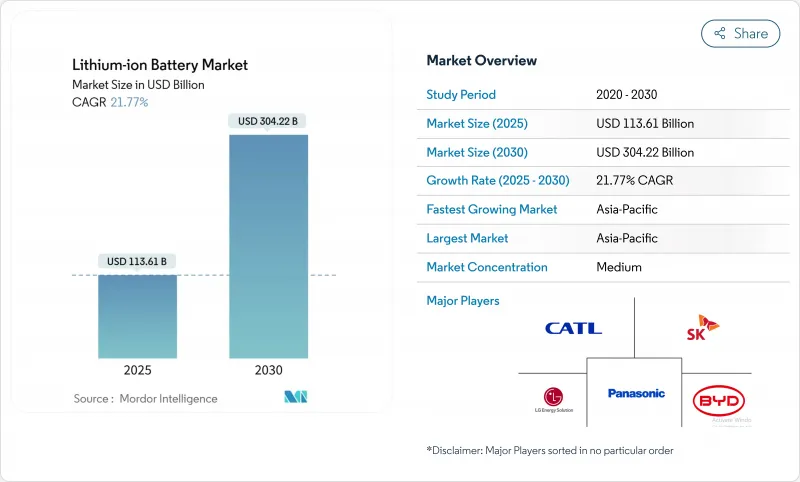

Lithium-ion Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Lithium-ion Battery Market size is estimated at USD 113.61 billion in 2025, and is expected to reach USD 304.22 billion by 2030, at a CAGR of 21.77% during the forecast period (2025-2030).

Momentum comes from steep cost deflation-average pack prices fell to USD 115 per kWh in 2024, their sharpest annual drop since 2017-and from policy mandates that require large-scale electrification across transport and power systems. A 55% market share in Asia-Pacific reflects China's command of cell production and anode materials, while North America and Europe accelerate localisation to hedge supply risk. Product innovation pivots around energy density gains, with silicon-rich anodes moving toward commercial viability. Utilities are adopting multi-hour storage to stabilise renewable generation, and automakers shift entry-level EVs toward cost-oriented LFP chemistry. Together these factors reinforce a virtuous cycle of rising volumes and falling cost that underpins long-term demand.

Global Lithium-ion Battery Market Trends and Insights

Surging Demand for High-Energy-Density Batteries in Long-Range EV Platforms

Manufacturers are pushing beyond 300 Wh kg-1 toward cells that promise 400-mile driving range without enlarging packs. Silicon-dominant anodes raise specific energy by up to 40% relative to graphite. The move coincides with adoption of cell-to-pack architectures that reduce structural weight and lower production cost. Price parity with incumbent chemistries is now expected before 2029, three years sooner than earlier estimates. Automakers view these advances as critical to mainstream EV acceptance in North America and Europe, markets where range anxiety remains a primary hurdle. As a result, procurement contracts increasingly stipulate energy density targets, creating new premium niches in the lithium-ion battery market.

China's Industrial Policy ("Made in China 2025") Accelerating Domestic Li-ion Gigafactory Build-out

China shipped 93.5% of global energy-storage batteries in 2024, reflecting unrivalled scale in cell manufacturing and upstream materials. Vertical integration spans raw-material refining through module assembly, enabling production costs roughly 20% below European peers despite similar commodity inputs. Champion supplier CATL leverages this cost edge to expand in Indonesia, securing nickel supply, and in Hungary, where a multi-GWh plant will serve European OEMs. The policy-driven surge cements China's supplier dominance and forces rival regions to subsidise local projects to preserve strategic autonomy. This structural advantage sustains a pivotal role for Chinese firms in the lithium-ion battery market.

Graphite Anode Supply Tightness Owing to Chinese Environmental Curtailments

China supplies about 90% of global anode material. Temporary shutdowns in Heilongjiang and Inner Mongolia cut output 15% during 2024 environmental inspections. Downstream cell plants in the United States and Europe reported lead-time extensions and spot-price increases, exposing geographic concentration risk. Synthetic graphite projects in South Korea and the United States aim to diversify supply; however, commercial volumes will lag demand for several years. Shortage risk prompts some automakers to evaluate silicon-rich anodes faster than planned, reshaping material roadmaps across the lithium-ion battery market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Roll-out of Utility-Scale Battery Energy Storage Procurements in the United States

- Stationary Data-Centre Back-up Migration from VRLA to Lithium-ion in Nordic Countries

- High-Voltage Electrolyte Additive Cost Inflation Post-Ukraine Conflict

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

NMC accounted for 45% of lithium-ion battery market share in 2024, supported by its high energy density that suits premium EVs. The lithium-ion battery market size for LFP is forecast to rise at 23.4% CAGR through 2030, eroding NMC's lead as cost-sensitive models proliferate. Improved cathode coatings and tighter cell tolerances lift LFP energy density into ranges once reserved for nickel-rich chemistries, lowering total pack cost and mitigating cobalt-price volatility.

Demand trajectories are diverging by application. NMC retains a foothold in performance EVs and aerospace projects requiring maximal range, whereas LCO maintains relevance in flagship consumer electronics. LTO and LMFP serve niche use cases where extreme cycle life or temperature tolerance is paramount. Cross-chemistry hybridisation-such as adding manganese to LFP-highlights how suppliers customise electro-chemistry to address specific performance envelopes inside the lithium-ion battery industry.

Cylindrical cells held 50% of the lithium-ion battery market in 2024, anchored by automotive incumbents exploiting highly automated assembly lines. Pouch cells, however, expand 22.5% CAGR by 2030 as their thin profile enables higher packing efficiency in constrained spaces. Comparative testing shows pouch formats deliver 6-8% higher gravimetric energy at pack level when integrated into skateboard chassis.

Prismatic cells, representing around 40% of shipments, strike a balance between mechanical robustness and volumetric efficiency, making them popular among Chinese bus and truck platforms. The form-factor landscape thus segments by OEM design philosophy: Tesla's 4680 cylindrical cell roadmap prioritises scale and energy density, while BYD's blade-style prismatics champion safety and cost. This coexistence demonstrates how differentiated strategies thrive within the diversified lithium-ion battery market.

The Lithium-Ion Battery Market Report is Segmented by Product Type (Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, and Others), Form Factor (Cylindrical, Prismatic, and Pouch), Power Capacity (0 To 3, 000 MAh, 3, 001 To 10, 000 MAh, and Others), End-Use Industry (Automotive, Consumer Electronics, and Others), and Geography (North America. Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific commanded 55% of the lithium-ion battery market in 2024 and is forecast to post a 31% CAGR to 2030. China alone accounts for roughly 70% of global cell output and 90% of anode materials, leveraging economies of scale and integrated supply chains. Japan and South Korea continue to focus on high-performance chemistries, while India accelerates domestic gigafactory builds under its Production-Linked Incentive programme targeting 104 GWh annual capacity by 2030.

North America benefits from the Inflation Reduction Act, with cell nameplate capacity projected to reach 1,300 GWh yr-1 by 2030, sufficient for 10 million EVs. New plants cluster along the Midwest-to-Southeast corridor where battery-grade nickel, lithium-hydroxide and recycling facilities co-locate. Challenges remain in scaling precursor cathode materials, prompting joint ventures with Asian partners to transfer process know-how.

Europe seeks 30% of global cell production by 2030, led by Poland's 115 GWh LG Energy Solution complex and new projects in Hungary. Strict carbon-footprint regulations push manufacturers toward renewable electricity and robust recycling schemes. Meanwhile, South America monetises lithium brine resources, with Argentina's Sal de Vida targeting 15 kt yr-1 of battery-grade carbonate. The Middle East & Africa leverages critical mineral partnerships, exemplified by a Ugandan lithium-ion pack plant serving regional solar-plus-storage demand.

- Contemporary Amperex Technology Co., Ltd. (CATL)

- BYD Company Limited

- LG Energy Solution Ltd.

- Panasonic Holdings Corp.

- Samsung SDI Co., Ltd.

- SK On Co., Ltd.

- AESC (Envision AESC Group)

- CALB Co., Ltd.

- Gotion High-Tech Co., Ltd.

- EVE Energy Co., Ltd.

- Farasis Energy Inc.

- Sunwoda Electronic Co., Ltd.

- Murata Manufacturing Co., Ltd.

- VARTA AG

- Toshiba Corporation

- Saft Groupe SAS

- Northvolt AB

- Microvast Holdings, Inc.

- A123 Systems LLC

- Hitachi Energy Ltd.

- Lithium Werks BV

- Tesla Inc. (Battery Division)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for High-Energy-Density Batteries in Long-Range EV Platforms

- 4.2.2 China's Industrial Policy ("Made in China 2025") Accelerating Domestic Li-ion Gigafactory Build-out

- 4.2.3 Rapid Roll-out of Utility-Scale Battery Energy Storage Procurements in the United States

- 4.2.4 Stationary Data-centre Back-up Migration from VRLA to Lithium-ion in Nordic Countries

- 4.2.5 Maritime IMO GHG targets Driving Marine-Grade Li-ion Adoption in Europe

- 4.2.6 OEM Shift to LFP Chemistry for Cost-Sensitive Entry-Level EVs in India

- 4.3 Market Restraints

- 4.3.1 Graphite Anode Supply Tightness Owing to Chinese Environmental Curtailments

- 4.3.2 High-Voltage Electrolyte Additive Cost Inflation Post-Ukraine Conflict

- 4.3.3 US-EU Trade Barriers on Critical Minerals Undermining Trans-Atlantic Supply Chains

- 4.3.4 Recycling Infrastructure Lag Delaying Circular Material Flows in Oceania

- 4.4 Supply-Chain Analysis

- 4.5 Recent Trends & Developments

- 4.6 Regulatory Outlook

- 4.7 Technology Outlook

- 4.8 Price Trend Analysis

- 4.9 Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Lithium Cobalt Oxide (LCO)

- 5.1.2 Lithium Iron Phosphate (LFP)

- 5.1.3 Lithium Nickel Manganese Cobalt (NMC)

- 5.1.4 Lithium Nickel Cobalt Aluminium (NCA)

- 5.1.5 Lithium Manganese Oxide (LMO)

- 5.1.6 Lithium Titanate (LTO)

- 5.2 By Form Factor

- 5.2.1 Cylindrical

- 5.2.2 Prismatic

- 5.2.3 Pouch

- 5.3 By Power Capacity

- 5.3.1 0 to 3,000 mAh

- 5.3.2 3,001 to 10,000 mAh

- 5.3.3 10,001 to 60,000 mAh

- 5.3.4 Above 60,000 mAh

- 5.4 By End-use Industry

- 5.4.1 Automotive (EV, HEV, PHEV)

- 5.4.2 Consumer Electronics

- 5.4.3 Industrial and Power Tools

- 5.4.4 Stationary Energy Storage

- 5.4.5 Aerospace and Defense

- 5.4.6 Marine

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Nordic Countries

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Malaysia

- 5.5.3.6 Thailand

- 5.5.3.7 Indonesia

- 5.5.3.8 Vietnam

- 5.5.3.9 Australia

- 5.5.3.10 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Contemporary Amperex Technology Co., Ltd. (CATL)

- 6.4.2 BYD Company Limited

- 6.4.3 LG Energy Solution Ltd.

- 6.4.4 Panasonic Holdings Corp.

- 6.4.5 Samsung SDI Co., Ltd.

- 6.4.6 SK On Co., Ltd.

- 6.4.7 AESC (Envision AESC Group)

- 6.4.8 CALB Co., Ltd.

- 6.4.9 Gotion High-Tech Co., Ltd.

- 6.4.10 EVE Energy Co., Ltd.

- 6.4.11 Farasis Energy Inc.

- 6.4.12 Sunwoda Electronic Co., Ltd.

- 6.4.13 Murata Manufacturing Co., Ltd.

- 6.4.14 VARTA AG

- 6.4.15 Toshiba Corporation

- 6.4.16 Saft Groupe SAS

- 6.4.17 Northvolt AB

- 6.4.18 Microvast Holdings, Inc.

- 6.4.19 A123 Systems LLC

- 6.4.20 Hitachi Energy Ltd.

- 6.4.21 Lithium Werks BV

- 6.4.22 Tesla Inc. (Battery Division)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment