PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438421

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438421

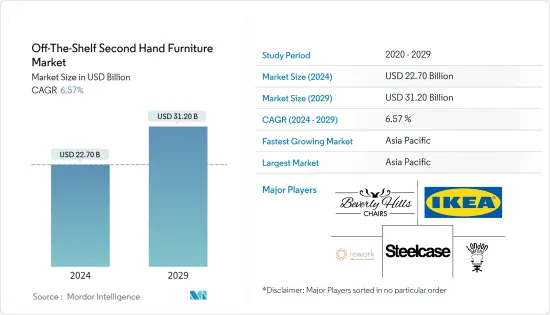

Off-The-Shelf Second Hand Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Off-The-Shelf Second Hand Furniture Market size is estimated at USD 22.70 billion in 2024, and is expected to reach USD 31.20 billion by 2029, growing at a CAGR of 6.57% during the forecast period (2024-2029).

The market is increasing due to the rising availability of second-hand furniture products across online and offline channels. Consumers are adopting various furniture designs which can meet their needs. The adoption of second-hand furniture is getting influenced by the availability of products at an attractive price range which is expected to affect the significant demand for second-hand furniture in upcoming years.

The COVID-19 crisis has altered how people shop by adapting to new technologies. Shopping for furniture is now a decision to buy virtually. On average, second-hand furniture is more than 50% cheaper, allowing consumers access to the products at comparatively less cost. Low cost being the primary factor, is estimated to expand the market.

The rising millennial population has been paving the way for rising sales through online channels. This will positively impact the supply of second-hand furniture through online media. The market's growth is owing to the cost-saving benefits of second-hand furniture and the increasing desire of consumers to save money across the globe.

Second Hand Furniture Market Trends

Offline Distribution Channel is Dominating the Market

The Off-the-Shelf Second Hand Furniture Market is segmented into the distribution channel, which is further segmented into online and offline, out of which the offline segment, with a larger market share in 2021, is anticipated to have the largest share during the forecast period. However, with the rise of an increasing number of smartphone users and increasing penetration of internet users, the market share for the online segment is expected to grow at a higher rate over the forecast period.

Asia-Pacific is Expected to Witness the Highest Growth

The Asia Pacific is expected to account for a larger share in terms of revenue during the forecast period. The increasing size of the online marketplace for second-hand goods is anticipated to drive the growth of the Asia Pacific regional market.

Additionally, ease of accessibility, availability of a large variant of products coupled with comparatively low cost of second-hand furniture is anticipated to drive the growth market in the region during the forecast period. Countries such as China, Japan, and India have the most prominent market in the region.

Second Hand Furniture Industry Overview

The report covers major international players operating in the Off-the-Shelf Second Hand Furniture Market. The Indian mattress market is domestically dominated by players such as IKEA, Beverly Hills Chairs, Steelcase, London Aerons, and others. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Technological Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Kitchen Furniture

- 5.1.2 Dining Furniture

- 5.1.3 Living Room Furniture

- 5.1.4 Bathroom Furniture

- 5.1.5 Indoor Furniture

- 5.1.6 Outdoor Furniture

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Online

- 5.3.2 Offline

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IKEA

- 6.1.2 Beveraly Hills Chairs

- 6.1.3 Steelcase

- 6.1.4 London Aerons

- 6.1.5 Rework Chicago

- 6.1.6 eBay Inc.

- 6.1.7 Craiglist

- 6.1.8 Etsy

- 6.1.9 Amazon

- 6.1.10 Yelp*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX