PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1524108

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1524108

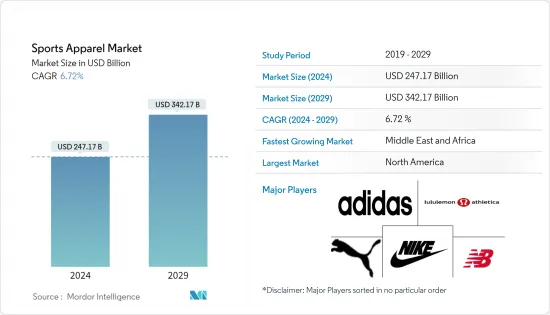

Sports Apparel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Sports Apparel Market size is estimated at USD 247.17 billion in 2024, and is expected to reach USD 342.17 billion by 2029, growing at a CAGR of 6.72% during the forecast period (2024-2029).

Rising health and self-consciousness, a desire to live an active lifestyle, and a desire to appear fit motivate consumers to incorporate sports and fitness activities into their daily routines. The availability of sports apparel with enhanced properties, such as moisture management, temperature control, and other performance-boosting characteristics that prevent discomfort and potential injury, has captured the interest of consumers, who have been observed to be willing to pay more for such additional benefits. Furthermore, the rising participation of the female population in professional and domestic sports and fitness activities is expected to drive the market over the forecast period. For instance, according to the Bureau of Labor Statistics of the United States, 19.1% of women participated in sports, exercise, and recreational activities every day in 2022, an increase from 17.2% in 2018. Besides this, a long-standing fashion trend, sustainability, has entered the athleisure industry. Consumers continue to find and invest in new items made of sustainable, durable, and high-quality materials. Moreover, the growing crossover between sports and fashion, which has resulted in an increased presence of fashionable sports apparel, is expected to fuel the market growth further.

Sports Apparel Market Trends

Increased Sports Participation and Popularity of Athleisure

The rising participation in sports and recreation activities across all demographics has fueled sports apparel sales globally. Consumers increasingly seek designer sports apparel with sports design elements aligned with the athleisure trend. This trend is further supported by celebrities advertising for global sports brands on social media. Furthermore, initiatives by governments of numerous countries to increase sports participation have recently driven athleisure demand. Governments increase their investments to encourage physical activity participation, and partners strengthen relationships between the community and sports organizations. For instance, in March 2022, the Australian government announced its plans to invest AUD 10.7 million in major sporting events, such as the ICC T20 Men's World Cup 2022 and the FIFA Women's Football World Cup 2023, among other events. This is aimed to increase community engagement, gender equality, and physical activity participation to maximize social, economic, and sporting outcomes.

North America Dominates the Market

The United States is one of the most prominent regional markets for sports apparel owing to its highly evolved retail structure, increased sports participation, aggressive advertising, and celebrity brand endorsements. The passionate fanbases of sports such as basketball and baseball greatly influence the demand for sports apparel in the market. Additionally, the global recognition of these athletes plays a significant role in driving the demand for sports apparel. Basketball players, in particular, are influential figures whose personal brands drive merchandise sales featuring their names and jersey numbers. Moreover, the emergence of athleisure wear has become a notable phenomenon, erasing the boundaries between sportswear and casual attire. Therefore, many firms attempt to bridge the gap between fashion and innovative functional designs through their new collections. For instance, in June 2022, Canadian Tire Corporation (CTC) launched Forward With Design (FWD). According to the company, Forward With Design highlights in-house brand-building capabilities and delivers a customer-centric collection that combines style with functionality, mindfully designed to transition with Canadians throughout their daily activities.

Sports Apparel Industry Overview

The sports apparel market is fragmented and comprises several prominent international and regional players. Some of the major players in the market are Adidas AG, Nike Inc., Puma SE, New Balance, and Lululemon Athletica. Companies are increasingly investing in research and development (R&D) activities and expanding their distribution channels to maintain a leading position in the market. They also adopt competitive strategies by developing new products to appeal to a mass audience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Drivers

- 4.1.1 Increase in Sports Participation

- 4.1.2 Trend of Athleisure

- 4.2 Market Restraints

- 4.2.1 Availability of Fake and Counterfeit Products

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Sport

- 5.1.1 Soccer

- 5.1.2 Basketball

- 5.1.3 Baseball

- 5.1.4 Golf

- 5.1.5 Other Sports

- 5.2 End -User

- 5.2.1 Men

- 5.2.2 Women

- 5.2.3 Children

- 5.3 Distribution Channel

- 5.3.1 Specialty Stores

- 5.3.2 Supermarket/Hypermarket

- 5.3.3 Online Retail Stores

- 5.3.4 Warehouse Clubs

- 5.3.5 Other Distribution Channels

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Netherlands

- 5.4.2.6 Spain

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Adidas AG

- 6.3.2 Nike, Inc.

- 6.3.3 Puma SE

- 6.3.4 Under Armour Inc.

- 6.3.5 Lululemon Athletica Inc.

- 6.3.6 Columbia Sportswear Company

- 6.3.7 New Balance Athletics Inc.

- 6.3.8 Li Ning Company Limited

- 6.3.9 VF Corporation

- 6.3.10 Fila Holdings Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS