PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640550

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640550

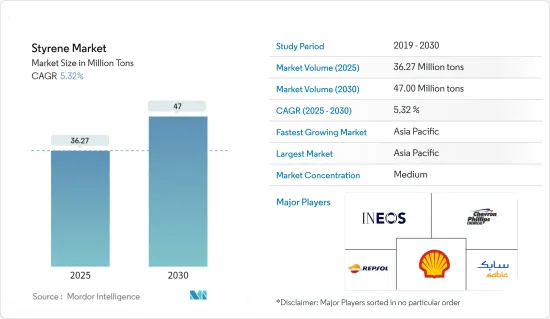

Styrene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Styrene Market size is estimated at 36.27 million tons in 2025, and is expected to reach 47.00 million tons by 2030, at a CAGR of 5.32% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the styrene market. However, the market recovered significantly in 2021, owing to rising consumption of various industries, such as packaging, construction, automotive, and others.

Key Highlights

- Over the short term, the growing demand from the consumer electronics industry is a major factor driving the growth of the market studied.

- However, increasing usage of bio-based plastics in the packaging industry is likely to restrain the growth of the market.

- Nevertheless, ongoing research to develop bio-based polystyrene is likely to create lucrative growth opportunities for the global market soon.

- The Asia-Pacific region dominates the styrene market, with the largest consumption coming from countries such as China, Japan, ASEAN countries, etc.

Styrene Market Trends

Packaging Industry to Drive the Market

- Styrene is commonly used in the packaging industry due to its favorable properties. It is a versatile, lightweight plastic with excellent clarity, impact resistance, and thermal insulation. These characteristics make it suitable for a wide range of packaging applications.

- One of the most common uses of styrene in the packaging industry is in producing polystyrene foam, often referred to as expanded polystyrene (EPS) or Styrofoam. EPS foam is widely used for protective packaging, including cushioning materials, insulation for perishable goods, and lightweight shipping containers.

- Styrene is also used to produce rigid polystyrene, which is commonly employed in food packaging. Clear polystyrene containers, such as clamshells, cups, and trays, are popular in the food service industry due to their transparency, allowing customers to view the contents easily.

- Furthermore, polystyrene is also used in the medical and healthcare industries for various packaging applications; IQVIA shows that the global pharmaceutical market has grown significantly in recent years. The total global pharmaceutical market was valued at USD 1.48 trillion by 2022. This is only a slight increase from 2021 when the market was valued at USD 1.42 trillion.

- In Asia-Pacific, the demand for packaged food is growing, owing to lifestyle changes, the growing disposable income of people, the increasing number of working professionals, and the growing preference for fast food.

- China is the world's largest packaging consumer across the world owing to the factors such as growing per capita income, coupled with rising e-commerce giants in the country. India's packaging industry is the fifth-largest in the world, and it is growing at about 22-25% per year, as per the Plastics Industry Association of India. Packaging and processing food costs can be 40% lower than in Europe because of highly skilled labor and cheap labor costs. The growing population and increasing demand for packaging are expected to drive the market.

- Similarly, in 2022, the Europe food and beverages industry employs 4.6 million people and generates EUR 1.1 trillion (USD 1.159 trillion) in revenue and EUR 230 billion (USD 242.37 billion) in value-added, making it one of the largest manufacturing industries in Europe. Thereby, the growing food and beverages industry in the region is increasing the demand for food packaging, as well as boosting the market studied.

- According to Statistisches Bundesamt, the revenue of the packaging industry in Germany has reached EUR 35.04 billion (USD 37.71 billion) in 2022 and has registered growth when compared to previous years.

- Such factors are likely to support the demand for the studied market from the packaging segment.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific dominated the market and will likely continue its dominance during the forecast period.

- Increasing packaging applications across the region, robust demand for electrical and electronic products, and the rapid growth of automotive and transportation sectors are actively boosting the styrene market.

- According to ZEVI, the Asian electro market reached EUR 3.11 trillion (USD 3.67 trillion) in 2021, a 10% rise. The demand increased by 13% in 2022 and estimated a 7% growth rate for 2023. China's market is the largest in the world, even more significant than the combined markets of all industrialized countries. In 2021, the Chinese market contributed EUR 2.07 trillion (USD 2.45 trillion), or 41.6% of the world market; additionally, the Chinese electronic industry expanded by 14% in 2022, and the sector is expected to grow by 8% in 2023.

- According to the China Association of Automobile Manufacturers (CAAM), China has the largest automotive production base in the world, with a total vehicle production of 27 million units in 2022, registering an increase of 3.4 % compared to 26 million units produced last year.

- China is one of the key packaging industries in the world. The country is expected to witness consistent growth during the forecast period due to the rise of customized packaging and increased demand for packaged consumer goods in the food segment. According to Interpak, in China, in the foodstuff packaging category, total packaging is expected to reach 447 billion units in 2023.

- According to industry publications, in 2021-2022, new factories for polystyrene and ABS plastics were expected to launch with a combined capacity of over 3.5 million tons, including new facilities for companies like Sinopec Gulei, Zhejiang Petrochemical, and Shandong Lihuaya. However, a delay may be observed due to the energy crisis in the country.

- Similarly, according to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at a rate of 22% during the forecast period. Moreover, the Indian packaging market is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7% between 2020 and 2025. Therefore, the plastic injection molding market is expected to grow in the region.

- Considering electronics, according to the Japan Electronics and Information Technology Industries Association (JEITA), the production by the global electronics and IT industry was estimated at USD 3.44 trillion in 2022, registering a growth rate of 1% year on year, compared to USD 3.36 trillion in 2021.

- Thus, the abovementioned factors indicate the rising demand for styrene from various end users in the region.

Styrene Industry Overview

The market studied is partially fragmented among the top players. The key players (not in any particular order) include Shell PLC, Chevron Phillips Chemical Company LLC, SABIC, Repsol, and INEOS, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Consumer Electronics Industry

- 4.1.2 Increasing Demand from Packaging Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Usage of Bio-based Plastics in the Packaging Industry

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Polystyrene

- 5.1.2 Acrylonitrile Butadiene Styrene

- 5.1.3 Styrene Butadiene Rubber

- 5.1.4 Other Product Types (Styrene-Acrylonitrile)

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Construction

- 5.2.3 Consumer Goods

- 5.2.4 Automotive and Transportation

- 5.2.5 Electrical and Electronics

- 5.2.6 Other End-user Industries (Textile)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chevron Phillips Chemical Company

- 6.4.2 Covestro AG

- 6.4.3 Hanwha Group

- 6.4.4 INEOS (INEOS Styrolution)

- 6.4.5 LG Chem

- 6.4.6 LyondellBasell Industries Holdings BV

- 6.4.7 Reliance Industries Ltd

- 6.4.8 Repsol

- 6.4.9 SABIC

- 6.4.10 Shell PLC

- 6.4.11 Versalis SpA (Eni SpA)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Research to Develop Bio-based Polystyrene

- 7.2 Other Opportunities