Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690900

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690900

Uninterruptible Power Supply (UPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 200 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

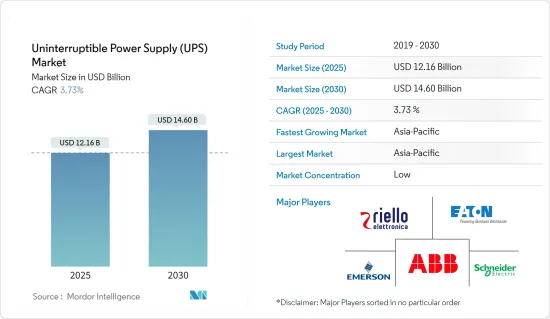

The Uninterruptible Power Supply Market size is estimated at USD 12.16 billion in 2025, and is expected to reach USD 14.60 billion by 2030, at a CAGR of 3.73% during the forecast period (2025-2030).

Key Highlights

- During the medium term, the increasing demand for backup applications in data centers and rising power outages to increase the demand for UPS are expected to drive the growth of the market studied.

- On the other hand, the high capital cost and operation expenditure of UPS systems may hinder the market's growth, which is one of the major restraints for the market.

- Technological advancements in UPS battery systems, such as new lithium-ion (Li-ion) batteries with high operating temperatures, are expected to create immense market opportunities in traditional data centers. UPS systems can be installed as backup systems when the electricity grid fails. They are expected to provide growth opportunities during the forecast period.

- Asia-Pacific dominates the market and is likely to register the highest CAGR during the forecast period. The growth may be driven by the existing policy framework supporting the adoption of 5G networks and increasing investments in data center technologies.

Uninterruptible Power Supply (UPS) Market Trends

Standby UPS System is Expected to Dominate the Market

- A standby UPS system, also called the offline UPS system, provides the essential features of a UPS system. It provides battery backup and surge protection. Standby UPS systems switch to a battery fast enough to prevent power anomalies and ride out short outages, and a standby UPS system protects against most voltage spikes. Still, it does not maintain perfect power during sags and sages.

- The growing demand for consumer electronics worldwide is one of the major drivers for standby UPS systems compared to other UPS systems. Standby UPS systems are the most preferred option for consumer electronics as they are the most economical option for devices with low power consumption.

- For instance, according to the International Data Center (IDC), the global shipment of desktop computers increased to about 88.27 million units in 2021 compared to 79.8 million in 2020. Moreover, the International Data Center predicts that personal computer shipment is expected to increase by 13.1% by 2027, rising from 251.8 million units shipped in 2022 to 285 million units in 2027, growing annually by 3.1%.

- The demand for gaming consoles is expected to increase during the forecast period. Moreover, during the pandemic, there was a surge in demand for home entertainment. According to VGChartz, the cumulative sales of current-generation consoles increased from 13.12 million units to 36.1 million units in November 2023. A standby UPS is necessary for gaming consoles in areas with frequent power fluctuations, as unsafe levels of electricity can damage the system.

- Overall, the demand for standby UPS systems is primarily expected from consumer electronics, as offline UPS systems provide devices with power backup and protection. The demand is expected to increase during the forecast period due to the increasing demand for desktop PCs and gaming consoles.

Asia-Pacific is Expected to Dominate the Market

- * Asia-Pacific witnesses frequent blackouts and unstable power supply, especially in countries like Malaysia, Cambodia, and the Philippines. Major end users of UPS systems in the region include its booming telecom, commercial, industrial, manufacturing, and residential sectors.

- * The region's manufacturing sector is one of the major contributors to its economy, with China being the largest hub of the manufacturing sector. Japan, South Korea, India, and Indonesia are a few major contributors to Asia-Pacific. On the other hand, countries like Malaysia, Vietnam, and Singapore are expected to witness an increased share during the forecast period.

- * The need for UPS systems in industries has been prompted by automation in the manufacturing sector involving computer-based control systems, Programmable Logic Control (PLC) units, and process control applications.

- UPS systems offer backup during electric power failure and protect equipment from power glitches like surges, under voltage, power sags, over-voltage, line noise, frequency variations, and switching transient and harmonic distortions. Therefore, UPS systems have become essential to almost all industries like engineering, telecom, R&D, education, medicine, IT, BPO, aviation, manufacturing, and banking.

- The manufacturing sector encompasses industries like automotive, food processing, steel manufacturing, and semiconductors, all requiring power quality equipment like UPS systems for smooth operations as fluctuating and disruptive power causes monetary losses significantly.

- Power cuts and variable power supply cause significant damage to industries and businesses that rely heavily on good quality electricity for smooth operations. However, maintaining good quality power in developing countries like India and China is difficult for the authorities.

- For instance, according to Invest India, by 2026-27, India's power generation installed capacity will likely be nearly 620 GW, 38% of which will be from coal and 44% from renewable energy. India's aim is to diversify its energy sources and the target is to provide a 24x7 electricity supply by making a large addition of renewable energy generation capacities, which is estimated to be a significant driver for the market. The growing electricity demand, increasing disposable income, and the need for a reliable power supply are expected to support the UPS market in India during the forecast period.

- Therefore, based on the above mentioned factors, Asia-Pacific is expected to become the fastest-growing UPS market during the forecast period.

Uninterruptible Power Supply (UPS) Industry Overview

The uninterruptible power supply (UPS) market is fragmented. Some of the major players (in no particular order) include Riello Elettronica SpA, EATON Corporation PLC, Emerson Electric Co., ABB Ltd, and Schneider Electric SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 72364

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Backup Applications in Data Centers

- 4.5.1.2 Rising Power Outages to Increase the Demand for UPS

- 4.5.2 Restraints

- 4.5.2.1 High Capital Cost and Operation Expenditure of UPS Systems

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Capacity

- 5.1.1 Less than 10 kVA

- 5.1.2 10-100 kVA

- 5.1.3 Above 100 kVA

- 5.2 By Type

- 5.2.1 Standby UPS System

- 5.2.2 Online UPS System

- 5.2.3 Line-interactive UPS System

- 5.3 By Application

- 5.3.1 Data Centers

- 5.3.2 Telecommunications

- 5.3.3 Healthcare (Hospitals, Clinics, etc.)

- 5.3.4 Industrial

- 5.3.5 Other Applications

- 5.4 By Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Spain

- 5.4.2.7 NORDIC

- 5.4.2.8 Turkey

- 5.4.2.9 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Malaysia

- 5.4.3.7 Thailand

- 5.4.3.8 Indonesia

- 5.4.3.9 Vietnam

- 5.4.3.10 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Riello Elettronica SpA

- 6.3.2 EATON Corporation PLC

- 6.3.3 Emerson Electric Co.

- 6.3.4 Delta Electronics Inc.

- 6.3.5 ABB Ltd

- 6.3.6 Schneider Electric SE

- 6.3.7 Hitachi Ltd

- 6.3.8 Mitsubishi Electric Corporation

- 6.3.9 General Electric Company

- 6.3.10 Cyber Power Systems Inc.

- 6.3.11 Aspex Inc.

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Technological Advancements in UPS Battery Systems

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.