PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444244

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444244

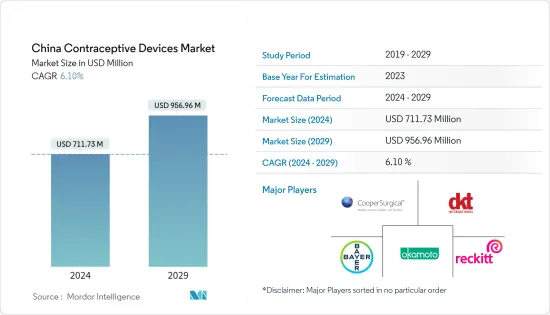

China Contraceptive Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The China Contraceptive Devices Market size is estimated at USD 711.73 million in 2024, and is expected to reach USD 956.96 million by 2029, growing at a CAGR of 6.10% during the forecast period (2024-2029).

The COVID-19 pandemic has had a substantial impact on the Chinese contraceptive devices market. The strict lockdowns and government regulations increased the usage of contraceptive devices. For instance, according to an article published by Nature in August 2021, a significant decrease was observed in the frequency of sexual intercourse in China during the COVID-19 pandemic. However, a significant increase in contraceptive device usage was seen, including condoms, the rhythm method, and the coitus interruptus method, during the pandemic. Thus, the COVID-19 pandemic affected the market's growth favorably in its preliminary phase. However, the market is expected to lose traction post the pandemic.

Factors such as growing cases of sexually transmitted diseases and rising government initiatives with respect to the prevention of these diseases are expected to contribute significantly to the market's growth. According to an article published by PubMed in October 2022, a study conducted in China showed that the overall positive rate of reproductive tract infections among the 4,39,372 women of reproductive age was 5.03%. The most common infection was candidiasis, which accounted for 2.47%, bacterial vaginosis at 1.28%, syphilis at 0.73%, T. vaginalis at 0.49%, C. trachomatis at 0.20%, and N. gonorrhoeae at 0.06%. Thus, there is a rising need for preventive measures for such diseases, which is expected to boost the demand for contraceptive devices in the market.

In addition, new product launches and strategic activities by major players in the market are positively affecting the growth of the studied market. Therefore, owing to such factors, the studied market is anticipated to witness growth over the forecast period. However, the side effects associated with the contraceptive devices are likely to impede the market's growth.

China Contraceptive Devices Market Trends

Intrauterine Devices are Expected to Hold a Significant Share in the Market During the Forecast Period

An intrauterine device, or IUD, is a small device that doctors place inside the uterus as a contraceptive. They are one of the best birth control methods, and more than 99% are effective. There are two types of IUDs that are available, copper IUDs and hormonal IUDs. Cooper IUDs are covered with copper, and the hormonal IUDs release the hormone progestin. Copper IUDs have been in the market for a long time, since 1988, earlier than hormonal IUDs.

According to an article published by the American Academy of Family Physicians (AAFP) in September 2022, CDC advised in 2020 that all hormonal contraceptive methods and intrauterine devices (IUDs) are safe for use and they can be used by people at high risk of HIV infections. This recommendation was based on results from a controlled trial that randomized based on 7,800 women across four countries to one of three contraceptive methods (depot medroxyprogesterone acetate, levonorgestrel implant, or copper IUD).

Therefore, due to such factors and growing research supporting IUDs, the intrauterine devices segment is expected to witness significant growth over the forecast period.

China Contraceptive Devices Industry Overview

The Chinese contraceptive devices market is fragmented in nature due to the presence of several companies. The competitive landscape includes an analysis of a few international and local companies that hold significant market shares, including GUANGZHOU ICLEAR HEALTHCARE LIMITED, Bayer Healthcare, Cooper Surgical Inc., AbbVie Inc. (Allergan PLC), DKT International, Reckitt Benckiser, Okamoto, and Shandong Ming Yuan Latex Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Cases of Sexually Transmitted Diseases

- 4.2.2 Government Initiatives Regarding the Usage of Contraceptive Devices

- 4.3 Market Restraints

- 4.3.1 Side Effects Associated with Contraceptive Devices

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Condoms

- 5.1.2 Diaphragms

- 5.1.3 Intrauterine Devices

- 5.1.4 Other Product Types

- 5.2 By End User

- 5.2.1 Male

- 5.2.2 Female

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 GUANGZHOU ICLEAR HEALTHCARE LIMITED

- 6.1.2 Bayer Healthcare

- 6.1.3 Cooper Surgical Inc.

- 6.1.4 Teva Pharmaceutical Industries Ltd

- 6.1.5 DKT International

- 6.1.6 Reckitt Benckiser

- 6.1.7 Okamoto

- 6.1.8 Shandong Ming Yuan Latex Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS