Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693635

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693635

China Electric Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 195 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

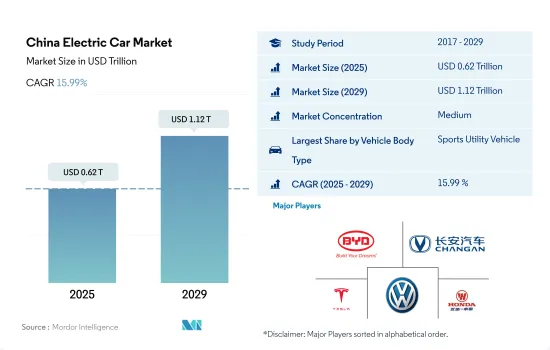

The China Electric Car Market size is estimated at 0.62 trillion USD in 2025, and is expected to reach 1.12 trillion USD by 2029, growing at a CAGR of 15.99% during the forecast period (2025-2029).

The focus on diverse vehicle configurations mirrors China's ambition to lead in electric car innovation, catering to a broad spectrum of consumer preferences

- In China's vibrant automotive landscape, the push toward EVs is reshaping the market dynamics across different vehicle segments, reflecting broader shifts in consumer preferences and policy directives aimed at fostering a more sustainable transportation ecosystem. While the hatchback HEV segment anticipates a slight decline, signaling a market adjustment toward full electrification, the sedan, SUV, and MPV segments are poised for continued growth, propelled by a combination of eco-friendly demand, technological advancements, and strong governmental incentives.

- The sedan HEV market, in particular, has experienced dramatic increases, with projections indicating further expansion, underscored by China's aggressive carbon reduction policies and subsidies that make HEVs more appealing to consumers. Similarly, the SUV HEV sector has shown exponential growth, highlighting a clear preference for vehicles that merge environmental benefits with the practicality and versatility of SUVs. This trend is expected to continue, with sales projected to reach significant numbers by the end of the decade, driven by ongoing advancements in hybrid technology.

- The MPV segment, while smaller, mirrors this upward trajectory, showcasing the diverse needs of Chinese consumers for spacious, versatile, and eco-friendly transportation solutions. Government policies promoting sustainable transportation, alongside developments in charging infrastructure and vehicle technology, are key factors fueling this growth. As China continues to navigate its path toward electrification, the varying trajectories of these vehicle segments reveal a complex and rapidly evolving market.

China Electric Car Market Trends

Government initiatives and strong OEM investments drive rapid drowth in electric vehicle sales in China

- The programs launched by the government to reduce gas emissions caused by vehicle fuels are encouraging consumers to shift to green vehicles. In November 2020, the government of China announced a ban on fossil fuel vehicles by 2035, clearly stating the selling of 100% new energy vehicles under the new energy program. As a result, the demand for electric cars increased. Adopting such regulations enhanced the sales of electric cars and various types of battery packs used in them in China in recent years.

- The government is introducing various schemes and incentives for customers and manufacturers to promote and enhance the demand for electric vehicles in the country. In May 2022, the government announced the reintroduction of the subsidy program to increase the sales of electric vehicles. Moreover, the government will allocate a subsidy of USD 1500 to customers opting for an electric car. Such factors have encouraged customers to invest in electric mobility, which further has increased the sales of electric cars by 2.90% in 2022 over 2021 in China.

- The growing demand for electric vehicles has forced OEMs to plan to increase development and production in the electric vehicle category. In 2021, General Motors announced its plans to raise its spending on electric and autonomous vehicles to USD 20 billion by 2025. The company is expected to launch 20 new electric models by 2023 and aims to sell more than 1 million electric cars a year in China. As a result, these factors are expected to drive the electric vehicle market in China during the 2024-2030 period.

China Electric Car Industry Overview

The China Electric Car Market is moderately consolidated, with the top five companies occupying 53.91%. The major players in this market are BYD Auto Co. Ltd., Chongqing Changan Automobile Company Limited, Tesla Inc., Volkswagen AG and Wuling Motors Holdings Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93023

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Used Car Sales

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Passenger Cars

- 5.1.1.1 Hatchback

- 5.1.1.2 Multi-purpose Vehicle

- 5.1.1.3 Sedan

- 5.1.1.4 Sports Utility Vehicle

- 5.1.1 Passenger Cars

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Auto Co. Ltd.

- 6.4.2 Chery Automobile Co. Ltd.

- 6.4.3 Chongqing Changan Automobile Company Limited

- 6.4.4 Gac Aion New Energy Automobile Co.Ltd

- 6.4.5 Hozon New Energy Automobile Co. Ltd.

- 6.4.6 Li Xiang (Li Auto Inc.)

- 6.4.7 Nio (Anhui) Co. Ltd.

- 6.4.8 Tesla Inc.

- 6.4.9 Volkswagen AG

- 6.4.10 Wuling Motors Holdings Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.