PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640413

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640413

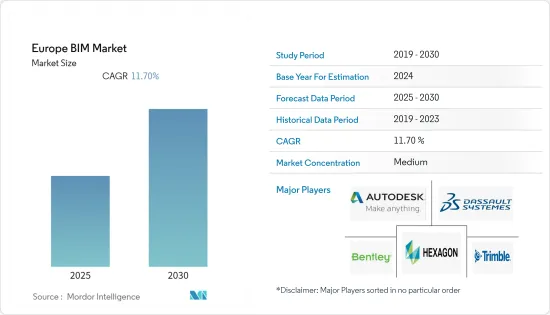

Europe BIM - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe BIM Market is expected to register a CAGR of 11.7% during the forecast period.

Key Highlights

- The usage of BIM has become more common in the AEC industry due to the numerous benefits connected with this technology. Because of the fragmented delivery methods, building problems, and various parties involved in the process, the contemporary AEC business is complicated, allowing for the widespread use of BIM. This is mostly due to a growth in the number of government laws pertaining to BIM adoption in the AEC industry, as well as the growing need for automated models in the construction arena to improve operational efficiencies.

- BIM-supporting technology and methods are continually emerging in the building sector. The concept of BIM integration with AR/VR, where users may view and interact with a virtual world, has grown in popularity. The growing popularity of BIM integration with AR/VR is good for market growth since it enhances communication among stakeholders and provides better visualization for designers, engineers, and other stakeholders, allowing for a one-to-one, completely immersive experience.

- The COVID-19 pandemic had had little influence on the expansion of the building information modeling business since the COVID-19 lockdown allowed for widespread adoption of BIM, allowing projects to proceed in a virtual and digital environment even when participants were unable to meet in person. The epidemic has compelled people to seek out safer and more efficient methods to construct offices and houses.

- Policies and regulations implemented by governments for the deployment of BIM solutions in the construction of public and private infrastructure across different countries in this region foster the growth of the BIM market. In Europe, in most countries, the use of BIM for commercial projects has been made mandatory.

Europe Building Information Modelling Market Trends

IoT is Becoming More Popular in the Construction Industry

- Modeling and ordering procedures can become more straightforward with IoT in construction, and the appropriate material can be supplied straight to the building site, eliminating the time required for ordering. Prefabrication can benefit from IoT technologies. Using prefabricated building components instead of traditional building methods can result in faster and more cost-effective solutions, as well as reduced construction waste.

- Using prefab for major commercial building projects, on the other hand, might be challenging to coordinate with the entire construction lifecycle. As a result, the Internet of Things (IoT) can assist in resolving this issue. Companies like Trimble, ES Track, Pillar Technologies, and others are developing and deploying IoT technologies in the construction industry, so the future seems bright. They are pushing construction company owners to check out the technology and discover for themselves how beneficial it is.

- This technology may be used to track down people on the job and keep them out of harm's way. It may be used to produce a real-time map of the construction site so that everyone is aware of who is there and what is being done. Some danger zones and managers' only zones can be highlighted on the map in a genuinely grave scenario, and others can be prevented from visiting such regions if it is not essential. IoT Devices might collect all of this information on the site and utilize it for the projects.

Increasing Cloud-based BIM Software

- As a result of the pandemic, more people are working from home. Designers and structural engineers may plot future projects using digital collaboration tools and cloud-based software from remote places. The cloud-based software market is predicted to develop as a result of this. Engineers and builders may also remotely manage client contracts, project management, sales, and other activities using BIM software.

- According to numerous builders and owners, now is a great moment to upskill employees and provide fundamental foundation knowledge with digital tools to improve productivity. During the crisis, software companies also assist builders and contractors in getting the most out of these solutions.

- Autodesk Inc. provided free access to its 31 million 360 Docs, 81 million 360 Design, Fusion 360, Fusion Team, and other products. In this complicated context of the COVID epidemic, the organization wanted to give project managers, workers, team members, and owners flexibility-this aided project managers in retaining high-productivity onsite work. As a result of the epidemic, demand for building information modeling software is likely to skyrocket.

Europe Building Information Modelling Industry Overview

The European building information modeling market is highly competitive owing to the presence of many small and large vendors providing solutions in the domestic and international markets. The market appears to be a highly fragmented stage with new players in the market. Major players in the market are adopting strategies like product and service innovation and mergers and acquisitions. Some of the major players in the market are Autodesk Inc., Bentley Systems Inc., Dassault Systemes SA, and Hexagon AB, among others.

- July 2021: AVEVA, an industrial software company, partnered with RIB Software, a digital construction company, to expand its Project Execution portfolio for the process and plant industries. The connection will deliver additional features from the RIB MTWO platform to the AVEVA Unified Project Execution solution, such as improved estimating and project cost management, as well as more robust dashboards and KPI monitoring.

- June 2021: SPIDA Software, a producer of specialized software for the design, analysis, and administration of utility pole systems, was bought by Bentley Systems. SPIDA's integration with Bentley's OpenUtilities engineering software and grid digital twin cloud services will aid in the transition to new renewable energy sources.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Government Initiatives

- 5.1.2 Technological Upgradation in the Construction Sector

- 5.2 Market Restraints

- 5.2.1 High Cost of Product

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment Type

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Application

- 6.3.1 Commercial

- 6.3.2 Residential

- 6.3.3 Industrial

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

- 6.4.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Autodesk Inc.

- 7.1.2 Dassault Systmes SE

- 7.1.3 Hexagon AB

- 7.1.4 Bentley Systems Inc.

- 7.1.5 Trimble Inc.

- 7.1.6 Aveva Group PLC

- 7.1.7 Bimeye Inc.

- 7.1.8 Topcon Positioning Systems Inc.

- 7.1.9 Asite Solutions Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET