Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644330

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644330

Europe Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

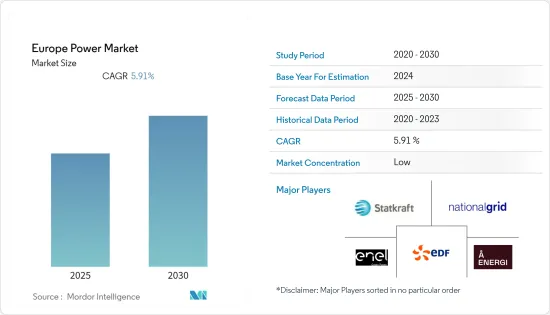

The Europe Power Market is expected to register a CAGR of 5.91% during the forecast period.

Key Highlights

- Over the medium term, the increasing degree of urbanization and power demand is expected to drive the market.

- On the other hand, decreased financial support and the blacklisting of countries like Bulgaria by various financial institutions will likely hinder market growth.

- Nevertheless, the ambitious goals set by the European Union for reducing its carbon emissions are expected to create enormous opportunities in the renewable energy segment for the Europe Power Market.

Europe Power Market Trends

Renewables is Expected to Witness Significant Growth

- The renewable energy segment in Europe mainly consists of wind, solar, biomass, and other renewable sources, excluding hydropower. Renewable power generation accounts for a significant share of total power generation. As of 2022, Europe had 708.58 GW of renewable energy installed capacity. The share of renewable energy grew by almost 8.7% in comparison to 2021.

- According to the European Environment Agency (EEA), in 2022, 22% of the energy consumed in Europe was generated from renewable sources. The European Commission has also set an ambitious target of 40% energy generated from renewable sources by 2030 to pave the way for climate neutrality by 2050.

- Renewable energy in the European region has grown continuously on account of its role in reducing air pollution. Moreover, power plants support renewable energy growth in the region to fill the demand gap generated by the decommissioning of coal.

- Moreover, in response to the Russian invasion of Ukraine, many European Union countries announced plans to accelerate the deployment of renewable energy sources to reduce their dependence on Russian natural gas imports. Germany, the Netherlands, and Portugal have either increased their renewable energy ambitions or moved their initial targets earlier.

- Wind and solar PV power are expected to drive strong growth in renewable energy. Solar and wind are expected to produce more than 50% of the total generation in Germany and the United Kingdom by 2030.

- For instance, in January 2022, the UK government announced more than USD 49 million of public and private funding to advance research and development in floating offshore wind projects. The government planned to invest USD 25.6 million in 11 projects as part of the Floating Offshore Wind Demonstration Program.

Germany is Expected to Witness Significant Growth

- In recent years, the German power market has grown significantly. This is mainly because of Germany's ambitious energy transition project. Greenhouse gas emissions should be cut by at least 80% (compared to 1990 levels) by 2050. Germany will gradually phase out all its nuclear power plants by 2023, revolutionizing its energy infrastructure.

- Moreover, the electricity demand in the country has been on the rise due to the growing population and infrastructure development activities. In 2021, Germany generated 584.5 terawatt-hours of electricity, compared to 573.6 terawatt-hours in 2020, registering a growth rate of 2.2%.

- Additionally, Germany is already at the forefront of renewable energy development. The German government has set a target for renewables to meet 80% of the electricity demand in the country by 2030. Solar power and onshore- and offshore-wind power will be the main pillars of renewable energy production.

- Furthermore, as of January 2023, solar rooftop PVs are expected to become mandatory for rooftop renovations in the country for existing buildings to be certified as climate neutral by 2040 in the North Rhine-Westphalia (NRW) province. Also, other German states are expected to follow similar regulations in a short period, which may directly aid the solar PV rooftop installation market.

- Moreover, the government has also launched various financial incentives to promote rooftop solar energy in the country. For instance, in July 2022, Germany's Bundestag approved new energy regulations that will lead to some increases in solar feed-in tariffs. For PV systems up to 10 kW, the price will be raised from USD 0.0707/kWh to USD 0.08778/kWh. Those who elect not to use any of the electricity themselves will receive the full feed-in bonus of USD 0.049/kWh. The combined remuneration is USD 0.136/kWh.

Europe Power Industry Overview

Europe's power market is fragmented. A few major key players in this market (in no particular order) include Statkraft AS, Enel Green Power SpA, National Grid PLC, Electricite de France SA, and Agder Energi SA., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 71122

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Power Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increase in Adoption of Renewable Energy Sources

- 4.5.2 Restraints

- 4.5.2.1 High Initial Investment Cost and Limited Natural Resources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Power Generation

- 5.1.1 Thermal

- 5.1.2 Hydroelectric

- 5.1.3 Renewables

- 5.1.4 Other Types

- 5.2 Power Transmission & Distribution

- 5.3 Geography

- 5.3.1 Norway

- 5.3.2 Germany

- 5.3.3 Netherlands

- 5.3.4 The United Kingdom

- 5.3.5 Italy

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Statkraft AS

- 6.3.2 Enel Green Power SpA

- 6.3.3 National Grid plc

- 6.3.4 Electricite de France SA

- 6.3.5 Agder Energi SA

- 6.3.6 Iberdrola SA

- 6.3.7 Energi Teknikk AS

- 6.3.8 Rainpower Holding AS

- 6.3.9 SN Power AS

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Decommissioning of Coal and Nuclear Assets and Dominance of Renewables as Primary Energy Source

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.