PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644772

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644772

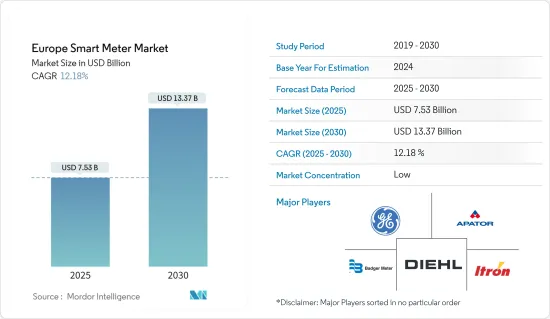

Europe Smart Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe Smart Meter Market size is estimated at USD 7.53 billion in 2025, and is expected to reach USD 13.37 billion by 2030, at a CAGR of 12.18% during the forecast period (2025-2030).

The growing awareness for smart grid projects, increasing urbanization, and supportive government regulations are expected to remain among the major factors driving the studied market's growth in Europe.

Key Highlights

- Smart meters are being adopted in the region for different deployments, such as gas, electricity, and water, owing to their two-way communication feature, which facilitates real-time tracking of utility usage by both consumer and utility supplier and also facilitates reading/start/cutoff of supply remotely by the supplier. Additionally, the deployment of a smart meter also allows the implementation of a Home Energy Management System (HEMS) or Building Energy Management System (BEMS), allowing visualization of the electric power usage in every home or entire building.

- During the past few years, smart metering rollouts have taken place in various European countries, with smart meters replacing traditional regular meters, thus contributing to the grid transition. Moreover, smart meters are utilized not only for automatic readings by the provider but also for empowering the consumer to be aware of their consumption. The swift development of new wireless technologies for IoT communications has a significant impact on the smart metering market in Europe.

- As per the government of the UK, at the end of September 2022, there were about 30.3 million smart and advanced meters in homes and small businesses in Great Britain. Furthermore, about 54 percent of all meters are now smart or advanced meters, with 26.5 million operating in smart mode.

- Furthermore, digitization is also modernizing and accelerating energy efficiency measures, owing to which the deployment of smart grids is surging in the European region, as they are efficient in dynamically optimizing supply and fostering supply of significant amounts of electricity from renewable energy sources such as solar power.

- However, the high cost linked with installing smart meters, growing security concerns, and shortage of capital investment for infrastructure installations is hampering the market's growth over the forecast period.

Europe Smart Meter Market Trends

Increased investments in smart grid projects in expected to drive the market growth

- Electricity demand in the European region is anticipated to increase significantly in the next few decades. For instance, according to IEA, electricity demand in Europe is anticipated to increase by 40 TWh between 2019-2025. Modernization, expansion, digitization, and decentralization of the electricity infrastructure for improved resiliency and planned investment are, thus, expected to change several market dynamics in the region.

- Utilities in the European region are rising, adopting technologies like digital twinning and artificial intelligence and, coupled with surging government support and initiatives, further attracting investments in smart grid projects. For instance, amid the ongoing energy crisis, the German ministry concerning the energy sector has introduced measures to expedite the adoption of federally funded high-saving energy efficiency initiatives. Under the new measures, vendors can start implementing their projects directly after submitting their funding application, whereas previously, they needed to wait for approval.

- The adoption of smart meters, as they are a suitable measure of future-ready technologies, paves the way for the smart grid by facilitating two-way real-time communication between DISCOMs and consumers through GPRS technologies.

- The increasing focus of European countries towards enhancing renewable energy generation capacity is also contributing to the development of smart grid infrastructure in the region as renewable energy generation plants focus more on applying advanced technologies to enhance production and distribution efficiency. By 2023, France's renewable energy sources had a power capacity exceeding 70 gigawatts. Hydropower had the highest amount of energy installed among renewable sources, reaching nearly 26 gigawatts. Around 24 gigawatts of installed capacity is attributed to wind power, with most of it located in onshore power plants.

United Kingdom to Hold a Significant Market Share

- Replacing traditional electricity and gas meters with smart meters forms an important national infrastructure upgrade for the United Kingdom that is expected to help make the region's energy system cheaper, cleaner, and more reliable. According to the government of the United Kingdom, at the end of September 2022, there were around 30.3 million smart and advanced meters in homes and small businesses across Great Britain.

- Further, as of September 2022, a total of 23.8 million gas meters and 28.8 million electricity meters were operated by large energy suppliers in domestic properties across Great Britain. Also, at the end of September 2022, 43 percent of all domestic gas meters and 50 percent of all domestic electricity meters operated by large energy suppliers were smart. Similarly, in non-domestic sites across the region, more electricity meters operate in smart or advanced mode than gas meters (48 percent versus 37 percent).

- Moreover, with a spike in energy prices, many households in the region seek to monitor their gas and electricity usage in real-time and, crucially, how much it costs them, fueling the adoption of smart meters. For instance, per the UK Parliament, household energy bills increased by 54 percent in April 2022 and were expected to increase by 80 percent in October 2022.

- Further, the different regulations implemented to increase the deployment of smart meters in the region further contribute to the market growth. For instance, starting from January 2022, all gas and electricity suppliers in the region had a binding annual installation target to roll out smart and advanced meters to their remaining non-smart customers by the end of 2025.

Europe Smart Meter Industry Overview

The European smart meter market is competitive, with some local and international players active. With the market expected to broaden and yield more opportunities, more players will enter the market soon, fragmenting the competitive landscape during the forecast period. Key players in the market include Elster Group GmbH, Diehl Stiftung & Co. KG, etc.

In February 2023, Netmore, a Swedish IoT operator, started rolling out a LoRaWAN network in France, targeting smart water metering and other large-scale IoT and utility projects. The rollout forms the next step in expanding Netmore's LoRaWAN infrastructure, which, according to the company, is now available in the UK, Sweden, Ireland, the Netherlands, France, and Spain.

In January 2023, the German government announced the adoption of a draft law to restart the digitalization of the energy transition and accelerate the rollout of smart metering. According to the government, the law will likely enter into force in the Spring of 2023, enabling large-scale smart metering rollout to start immediately before becoming mandatory in 2025.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 On The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Investments in Smart Grid Projects

- 5.1.2 Growth in Smart City Deployment

- 5.1.3 Supportive Government Regulations

- 5.2 Market Challenges/Restraints

- 5.2.1 High Costs and Security Concerns

- 5.2.2 Integration Difficulties with Smart Meters

6 MARKET SEGMENTATION

- 6.1 By Type of Meter (Revenue and Unit Shipments)

- 6.1.1 Smart Gas Meter

- 6.1.2 Smart Water Meter

- 6.1.3 Smart Electricity Meter

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 ***By Country (Revenue and Unit Shipments)

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 General Electric Company

- 7.1.2 Apator SA

- 7.1.3 Badger Meter Inc.

- 7.1.4 Diehl Stiftung & Co. KG

- 7.1.5 Elster Group GmbH (Honeywell International Inc)

- 7.1.6 AEM

- 7.1.7 Itron Inc

- 7.1.8 Kamstrup A/S

- 7.1.9 Landis+ GYR Group AG

- 7.1.10 Arad Group

- 7.1.11 Ningbo Sanxing Electric Co. Ltd.

- 7.1.12 Sensus (Xylem Inc.)

- 7.1.13 Zenner International GmbH & Co. KG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET