Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644936

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644936

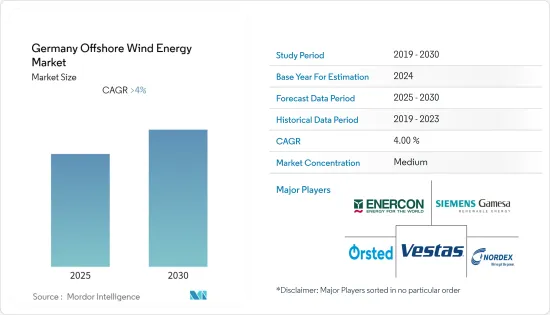

Germany Offshore Wind Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Germany Offshore Wind Energy Market is expected to register a CAGR of greater than 4% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the medium term, the growing demand for clean energy sources is expected to stimulate market growth. Furthermore, supportive government programs and advancements in renewable energy technologies are also expected to drive the growth of the market studied.

- On the other hand, the increasing adoption of alternate clean power sources, such as solar, and the availability of fossil fuels is expected to restrain Germany Offshore Wind Energy Market during the forecast period.

- Nevertheless, the ambitious plans to expand wind energy to 40 GW by 2035 and 70 GW by 2045 are likely to create lucrative growth opportunities for the Germany Offshore Wind Energy Market in the forecast period.

Germany Offshore Wind Energy Market Trends

Upcoming Projects and Investments Driving the Market Demand

- Germany has vast reserves of high-quality, cost-competitive wind energy resources. Therefore, Germany held the first-largest installed wind power capacity in the European region, with a total installed capacity of 63.76 GW in 2021. This installed capacity is enough to power approximately 3.4 million homes in the country.

- With the increasing need for an affordable, reliable, clean, and diverse electricity supply, the government and utilities across the nation are increasingly considering wind power as a solution. Moreover, with the country's unparalleled wind resources, ample opportunities exist to maximize wind energy development's economic and environmental benefits.

- In May 2021, RWE and BASF planned to invest USD 4.9 billion in offshore wind power projects. As part of the project, RWE intends to build a 2 GW offshore wind park by 2030. The project aims to supply energy to BASF's Ludwigshafen chemical complex.

- In November 2021, Google signed up for 50 MW of wind power to be delivered from an offshore wind farm built by Danish energy giant Orsted in the German North Sea. The 12-year corporate power purchase agreement (CPPA) will contribute to Google's commitment to operating all data centers with carbon-free energy by 2030.

- In August 2022, Singaporean conglomerate Keppel Corporation announced plans to spend USD314.7 million along with a unit for a 50.01 percent stake in a particular purpose vehicle (SPV) that owns 50 percent of Borkum Riffgrund 2, an offshore wind farm in Germany.

- Therefore, the increasing investments and upcoming projects in offshore wind energy projects are likely to drive the growth of the Germany Offshore Wind Energy Market during the forecast period.

Greater Than or Equal to 5 MW to Witness Significant Growth

- As energy demand is rising, major countries and companies are turning toward the adoption of renewable energy sources, especially wind energy, as they can provide clean energy. The adoption of offshore wind energy with advanced technologies attracted many countries and companies for high investments.

- Installation of wind farms in the offshore area is becoming a lucrative market because of the higher wind speed compared to onshore wind speed. Thus, offshore wind power generation capacity is expected to witness significant growth during the forecast period.

- Offshore wind energy capacity has significantly increased during this period, rising from just 35 megawatts in 2009 to 7,747 megawatts in 2021. Germany's onshore wind energy capacity reached 56,013 megawatts in 2021.

- In November 2021, BASF and Orsted concluded a 25-year fixed-price corporate power purchase agreement (CPPA), under which BASF will offtake the output of 186 MW from Orsted's planned Borkum Riffgrund 3 Offshore Wind Farm in the German North Sea.

- In November 2021, RWE announced plans to invest EUR 50 billion (USD 57 billion) by 2030. The investment aims to double its green energy to 50 gigawatts (GW). This is expected to create significant opportunities for Germany offshore wind energy market.

- In September 2022, RWE Renewables Offshore HoldCo Four GmbH, a unit of energy major RWE AG, secured a contract in the competitive auction to develop a 980-MW offshore wind farm in the N-7.2 zone in the German North Sea.

- Therefore, based on the above-mentioned factors, the Greater Than or Equal to 5 MW segment is expected to witness significant growth, increasing the German offshore wind energy market demand during the forecast period.

Germany Offshore Wind Energy Industry Overview

The Germany Offshore Wind Energy Market is moderately fragmented in nature. Some of the major players in the market (not in particular order) include Nordex SE, Enercon GmbH, Vestas Wind Systems A/S, Orsted A/S, and Siemens Gamesa Renewable Energy, S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93217

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Offshore Wind Energy Installed Capacity and Forecast in GW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

6 Foundation Type

- 6.1 Fixed Foundation

- 6.2 Floating Foundation

7 Capacity

- 7.1 Less Than 5 MW

- 7.2 Greater Than or Equal to 5 MW

8 COMPETITIVE LANDSCAPE

- 8.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 8.2 Strategies Adopted by Leading Players

- 8.3 Company Profiles

- 8.3.1 Nordex SE

- 8.3.2 Enercon GmbH

- 8.3.3 General Electric Company

- 8.3.4 Vestas Wind Systems A/S

- 8.3.5 Orsted A/S

- 8.3.6 Siemens Gamesa Renewable Energy, S.A.

- 8.3.7 RWE AG

- 8.3.8 Suzlon Energy Limited

- 8.3.9 PNE AG

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.