PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851084

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851084

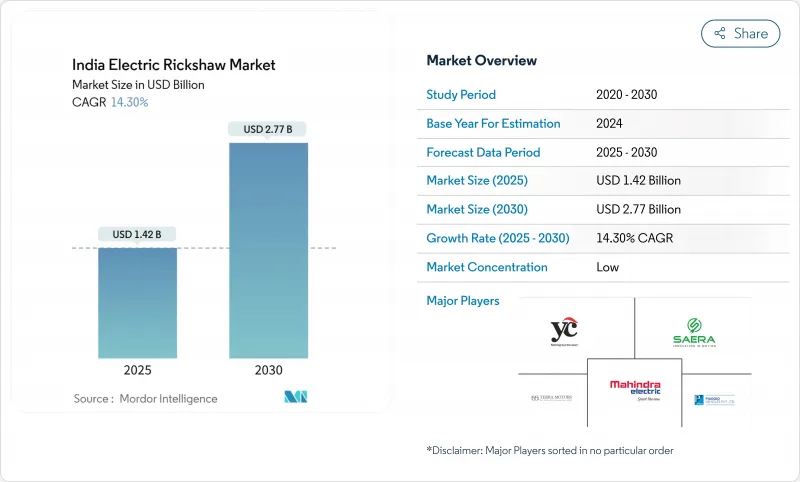

India Electric Rickshaw - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Indian electric rickshaw market size is estimated at USD 1.42 billion in 2025, and is expected to reach USD 2.77 billion by 2030, at a CAGR of 14.30% during the forecast period (2025-2030).

This rapid expansion reflects government incentives, aggressive state-level policies, growing e-commerce demand, and heightened urban air-quality goals. Passenger carrier dominance, strong recycling economics for lead-acid batteries, and the swift pivot of e-commerce logistics toward electric cargo variants are sustaining volume momentum. Parallel advances in battery chemistry, modular finance models, and power-train efficiency are widening the total addressable base beyond Tier-I metros into Tier-II and Tier-III towns. Competitive rivalry intensifies as legacy OEMs, innovative start-ups, and global automakers commit capital and engineering talent to capture the next wave of growth.

India Electric Rickshaw Market Trends and Insights

FAME-II Subsidy Extension and State Incentives Accelerating Tier-II Adoption

Federal continuity between the extended FAME-II program and the Electric Mobility Promotion Scheme 2024 keeps per-vehicle subsidies intact, lowering acquisition cost barriers for drivers outside major metros. State top-ups-ranging from purchase rebates to road-tax waivers in Maharashtra, Karnataka, and Delhi-stack further savings, making electric three-wheelers price-competitive with ICE models at the point of sale. Subsidy density correlates strongly with registrations; assessments reveal a 46.16% sales uplift for each standard-deviation rise in state support intensity. Local financiers report shorter payback periods, encouraging broader credit participation. Combined, these fiscal levers push the Indian electric three-wheeler market deeper into cost-sensitive Tier-II clusters where informal transit demand is surging.

Rising Demand for Last-Mile Shared Mobility in Rapidly Urbanising Towns

India's expanding network of mid-sized cities relies heavily on auto-rickshaws to bridge first- and last-mile gaps in public transit. Electric variants cut running expenses to INR 0.50-0.70/km against INR 3-4/km for petrol or CNG, creating immediate earnings upside for owner-drivers. Shared-mobility aggregators such as Uber and Rapido are onboarding e-rickshaws to meet municipal clean-air mandates and rider price sensitivity. High daily utilization amplifies fuel-cost arbitrage, accelerating payback on the higher upfront purchase. Seamless digital booking elevates asset productivity, further reinforcing operator economics and boosting adoption across the Indian electric three-wheeler market.

Fragmented & Informal Financing Channels Constraining Driver Purchases

The lack of scale credit pipelines keeps effective interest rates high and loan-to-value ratios low, dampening uptake among independent drivers whose livelihood depends on daily fare receipts. Technology-risk perceptions lead many lenders to treat electric variants as non-standard assets, constricting credit lines despite lower running costs. Informal money-lenders bridge the gap but charge punitive rates, eroding total cost of ownership benefits. Development-finance institutions advocate blended-finance pools to de-risk retail lending, yet implementation remains slow outside major cities. Until mainstream banks normalize underwriting for electric three-wheelers, growth will undershoot potential in segments most sensitive to up-front affordability.

Other drivers and restraints analyzed in the detailed report include:

- E-Commerce Logistics Embracing Cargo E-Rickshaws for Intra-City Delivery

- Lead-Acid Battery Recycling Ecosystem Lowering Total Cost of Ownership

- Safety Concerns Over Chassis Integrity on Rural Roads

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

India electric rickshaw market share is currently dominated by the passenger carrier segment, which accounted for 83.92% of unit sales in 2024, cementing its role as the backbone of intra-city shared mobility. Dense urban routes and all-day utilization let drivers exploit penny-per-kilometer energy costs, reinforcing segment resilience. Goods carriers, however, are registering the fastest 29.44% CAGR as online retail pushes demand for nimble, emissions-free last-mile delivery. Amazon India, Flipkart, and quick-commerce players are formalizing procurement pipelines with established OEMs, ensuring predictable volume growth. Segment-specific designs such as refrigerated bodies widen addressable markets in food distribution and pharmaceuticals. Higher payload ratings and telematics integration make cargo e-rickshaws an essential piece of future city-logistics blueprints.

In absolute volume terms, passenger variants will continue to dominate the Indian electric three-wheeler market, yet the value contribution from cargo units will rise steadily through premium specification mixes. Tax breaks for commercial vehicles and dedicated micro-fulfillment hubs in Tier-II cities will push cumulative cargo penetration higher. As urban congestion charges tighten, freight operators will prefer electric three-wheelers over light trucks, cementing the segment's long-term upside.

India electric rickshaw market share by power output was led by the 1-1.5 kW motor segment, which accounted for 54.35% of total demand in 2024. This power band delivers sufficient torque for frequent stop-start city driving while conserving battery life, making it ideal for typical passenger operations. Operators value its balanced offering-affordable upfront cost with practical range-especially in high-usage urban duty cycles.

In contrast, powertrains rated above 1.5 kW are witnessing the fastest growth in the India electric rickshaw market, expanding at a 32.12% CAGR as payload demands and gradient-handling requirements rise. The segment is benefiting from advancements in e-axle technologies, including integrated motor controllers and IP-rated enclosures, which enhance durability during India's heavy monsoon conditions and boost fleet confidence.

The higher-powered bracket supports refrigerated cargo, steep-gradient hill-stations, and premium ride-hailing tiers that demand faster trip times. Component suppliers are localizing magnets and stators, cutting imported content and stabilizing price points. As unit economics improve, the Indian electric three-wheeler market size for the above-1.5 kW class is projected to widen its revenue share, ushering in a new competitiveness layer focused on performance rather than solely cost.

The India Electric Rickshaw Market Report is Segmented by Vehicle Type (Passenger Carriers and More), Power Output ( Up To 1 KW and More), Battery Type (Lead-Acid and More), Battery Capacity (Up To 3 KWh and More), Charging Mode (Plug-In Charging and More), Ownership Model (Individual Owner-Drivers and More), and States (Uttar Pradesh, Delhi, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Terra Motors India Corp.

- Piaggio Vehicles Pvt. Ltd.

- Mahindra Electric Mobility Ltd.

- Kinetic Green Energy & Power Solutions Ltd.

- ATUL Auto Ltd.

- Saera Electric Auto Pvt. Ltd.

- YC Electric Vehicle

- Goenka Electric Motor Vehicles Pvt. Ltd.

- Udaan E-Rickshaw

- Thukral Electric Bikes

- Mini Metro EV LLP

- E-Ashwa Automotive Pvt. Ltd.

- CityLife EV

- Adapt Motors Pvt. Ltd.

- Vani Electric Vehicles Pvt. Ltd. (Jezza Motors)

- Omega Seiki Mobility

- Euler Motors

- Lohia Auto Industries

- Bajaj Auto Ltd. (Electric 3W Division)

- Altigreen Propulsion Labs

- Gayam Motor Works

- Lectrix EV

- Saarthi E-Rickshaw

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 FAME-II Subsidy Extension and State Incentives Accelerating Tier-II Adoption

- 4.2.2 Rising Demand for Last-Mile Shared Mobility in Rapidly Urbanising Towns

- 4.2.3 E-Commerce Logistics Embracing Cargo E-Rickshaws for Intra-City Delivery

- 4.2.4 Lead-Acid Battery Recycling Ecosystem Lowering Total Cost of Ownership

- 4.2.5 Battery-as-a-Service Subscription Models Reducing Up-front Capex

- 4.2.6 Mandatory Phase-Out of ICE Three-Wheelers in Delhi-NCR by 2030

- 4.3 Market Restraints

- 4.3.1 Fragmented & Informal Financing Channels Constraining Driver Purchases

- 4.3.2 Safety Concerns Over Chassis Integrity on Rural Roads

- 4.3.3 Quality Variability in Unorganised Lead-Acid Battery Supply Chain

- 4.3.4 Slow Roll-Out of Swappable Battery Standards Hindering Interoperability

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Carriers

- 5.1.2 Goods Carriers

- 5.2 By Power Output

- 5.2.1 Up to 1 kW

- 5.2.2 1 - 1.5 kW

- 5.2.3 Above 1.5 kW

- 5.3 By Battery Type

- 5.3.1 Lead-Acid

- 5.3.2 Lithium-ion (NMC/NCA)

- 5.3.3 Lithium-ion (LFP)

- 5.3.4 Other Chemistries (Li-Polymer, Ni-MH)

- 5.4 By Battery Capacity

- 5.4.1 Up to 3 kWh

- 5.4.2 3 - 6 kWh

- 5.4.3 Above 6 kWh

- 5.5 By Charging Mode

- 5.5.1 Plug-in Charging

- 5.5.2 Battery Swapping

- 5.6 By Ownership Model

- 5.6.1 Individual Owner-Drivers

- 5.6.2 Fleet Operators

- 5.6.3 Aggregators / MaaS Platforms

- 5.7 By State

- 5.7.1 Uttar Pradesh

- 5.7.2 Delhi

- 5.7.3 Maharashtra

- 5.7.4 Bihar

- 5.7.5 Rajasthan

- 5.7.6 Karnataka

- 5.7.7 Tamil Nadu

- 5.7.8 Punjab

- 5.7.9 Telangana

- 5.7.10 Rest of India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Terra Motors India Corp.

- 6.4.2 Piaggio Vehicles Pvt. Ltd.

- 6.4.3 Mahindra Electric Mobility Ltd.

- 6.4.4 Kinetic Green Energy & Power Solutions Ltd.

- 6.4.5 ATUL Auto Ltd.

- 6.4.6 Saera Electric Auto Pvt. Ltd.

- 6.4.7 YC Electric Vehicle

- 6.4.8 Goenka Electric Motor Vehicles Pvt. Ltd.

- 6.4.9 Udaan E-Rickshaw

- 6.4.10 Thukral Electric Bikes

- 6.4.11 Mini Metro EV LLP

- 6.4.12 E-Ashwa Automotive Pvt. Ltd.

- 6.4.13 CityLife EV

- 6.4.14 Adapt Motors Pvt. Ltd.

- 6.4.15 Vani Electric Vehicles Pvt. Ltd. (Jezza Motors)

- 6.4.16 Omega Seiki Mobility

- 6.4.17 Euler Motors

- 6.4.18 Lohia Auto Industries

- 6.4.19 Bajaj Auto Ltd. (Electric 3W Division)

- 6.4.20 Altigreen Propulsion Labs

- 6.4.21 Gayam Motor Works

- 6.4.22 Lectrix EV

- 6.4.23 Saarthi E-Rickshaw

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment