Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644542

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644542

Italy E-commerce - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

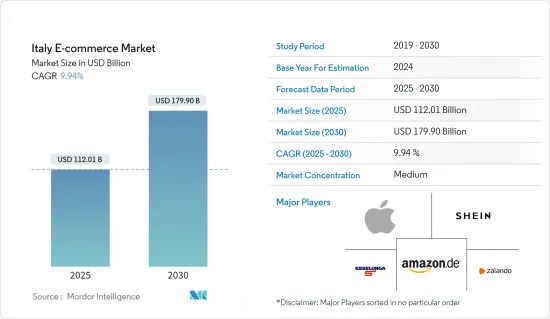

The Italy E-commerce Market size is estimated at USD 112.01 billion in 2025, and is expected to reach USD 179.90 billion by 2030, at a CAGR of 9.94% during the forecast period (2025-2030).

Technological advances have made business communication faster, easier, less expensive, and more efficient. It has enabled the company to move from the domestic to the global market. Furthermore, the growing popularity of cybercafes has played an essential role in attracting internet users to e-commerce.

Key Highlights

- International B2C retailing platforms heavily influence the Italian e-commerce market. Subito, Aliexpress, Zalando, Autoscout24, Groupon, Yoox, and Pixmania are some of the most popular e-commerce websites in Italy. ePrice and Saldiprivati are owned by Banzai Srl, Italy's largest e-commerce company.

- E-business is the most common model in e-commerce, which entails digitalizing corporate processes in collaboration with clients and suppliers. Furthermore, in recent years, web portals for B2B e-commerce (similar to e-commerce B2C models) and B2B marketplaces have grown in popularity. Automotive, pharmaceutical, consumer goods, and electronics are the most active sectors implementing B2-B solutions.

- The COVID-19 pandemic has forced many small businesses to rethink their decades-old business models or face permanent closure. New and existing technologies are being pushed to the forefront of every business toolkit. Forward-thinking companies are addressing talent issues arising from these new digital business skillsets.

- The COVID-19 pandemic is undergoing rapid digital transformation, and many Italian companies prioritize digitalization. Furthermore, the requirement for private and state-owned businesses to submit electronic invoices to the Italian Public Administration (PA) has pushed for digitalization.

Italy E-commerce Market Trends

Technological advancements

- The number of Italian online shoppers is growing by 2020; online sales in Italy account for 8% of total retail sales. As Internet access infrastructure improves and broadband connection availability expands, mobile devices are increasingly used for sales, accounting for roughly 40% of all digital sales. Furthermore, the country has 61 million people, with 19 million shopping online.

- Italy's economy is prosperous, with one of the world's largest GDPs. Italy's government revenues increased to 64.87 billion EUR in September 2021, up from 46.50 billion EUR in August 2021. Luxury goods sales are also significant in this country, as Armani, Gucci, and Prada are all located there. Previously, the fashion industry dominated the country. However, Electronics & Media is now the largest segment in the Italian e-market, accounting for 29 % of e-commerce revenue in Italy.

- At the beginning of 2021, mobile phones were almost as popular as laptops or desktop computers for accessing the internet, while tablets accounted for only 2% of total web traffic. Making video calls and using services like Facetime to stay in touch with friends and loved ones appeared to be the most popular activity among Italian smartphone internet users. Chat and messenger apps were among the country's most popular types of apps, with a 94.4 % reach as of the third quarter of 2020.

- Every day, 2 million new users on average sign up for social media, which impacts e-commerce because consumers are now more likely to purchase through social media. In particular, many brands and marketplaces have integrated their e-commerce platforms with social media so customers can easily connect to their online stores. Roughly 41 million people use social media in Italy, accounting for 68 %.

- COVID-19 outbreaks around the world drove consumers to unprecedented levels of online activity. By May 2020, e-Commerce transactions had reached $82.5 billion, a 77 % increase from the previous year. Using traditional year-over-year increases would have taken four to six years to get that figure. Consumers have moved online to make purchases they would typically make in stores, such as food and household items, clothing, and entertainment. Many customers say they will continue to shop online until a COVID-19 vaccine becomes available.

Italy E-commerce Industry Overview

- Amazon is the dominant player in the Italian E-commerce market. In 2021, the store's revenue was $5.3 billion. It is followed by shein.com, which has a revenue of US$1.1 billion, and Esselunga, which has a revenue of US$846 million. The top three stores account for 30% of online payments in Italy; it is one of the fastest-growing stores in the Italian market. In 2021, the store made approximately US$1.6 million in sales. Its revenue growth amounted to 595 % in the previous year.

- May 2022 - Alibaba, the Chinese E-commerce giant, is expanding its Lazada marketplace to Europe. Lazada will concentrate on local merchants rather than cross-border sales like AliExpress. Cainiao, Alibaba's logistics company, has only recently arrived in Belgium. Alibaba is currently present in the European market through its marketplace AliExpress. However, AliExpress's leading source of revenue is cross-border sales from China. Instead, Lazada concentrates on local European sellers.

- May 2022- Olsam, a British E-commerce aggregator, acquired MarketFleet, a competitor in the United States. It is the company's second acquisition of an aggregator, following the purchase of Flywheel Commerce in November of last year. With this move, the company hopes to consolidate the market. Furthermore, Olsam acquires Amazon sellers and leverages its own platform's data, technology, and operational expertise to drive revenue and profit growth. It received another aggregator, Flywheel Commerce, with the capital raised last year. According to the company, it is now present in 15 countries across three continents.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90630

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Key market trends and share of E-commerce of total Retail sector

- 4.4 Impact of COVID-19 on the E-commerce sales

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of the market during the COVID-19 Pandemic

- 5.1.2 Penetration of Internet and Smartphone Usage

- 5.2 Market Challenges

- 5.2.1 The Heightened Demand for Data Security

- 5.2.2 Low Internet Penetration

- 5.3 Analysis of key demographic trends and patterns related to E-commerce industry in Italy (Coverage to include Population, Internet Penetration, E-commerce Penetration, Age & Income etc.)

- 5.4 Analysis of the key modes of transaction in the E-commerce industry in Italy (coverage to include prevalent modes of payment such as cash, card, bank transfer, wallets, etc.)

- 5.5 Analysis of cross-border E-commerce industry in Italy (Current market value of cross-border & key trends)

- 5.6 Current positioning of country Italy in the E-commerce industry in Europe

6 Market Segmentation

- 6.1 By B2C E-commerce

- 6.1.1 Market size (GMV) for the period of 2017-2027

- 6.1.2 Market Segmentation - by Application

- 6.1.2.1 Beauty & Personal Care

- 6.1.2.2 Consumer Electronics

- 6.1.2.3 Fashion & Apparel

- 6.1.2.4 Food & Beverage

- 6.1.2.5 Furniture & Home

- 6.1.2.6 Others (Toys, DIY, Media, etc.)

- 6.2 By B2B E-commerce

- 6.2.1 Market size for the period of 2017-2027

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 eBay

- 7.1.2 Amazon

- 7.1.3 Mediaworld

- 7.1.4 E-shop

- 7.1.5 Unieuro

- 7.1.6 AliExpress

- 7.1.7 MarksandSpencer

- 7.1.8 Zalando

- 7.1.9 ePrice

- 7.1.10 Esselunga

- 7.1.11 Decathlon

8 Investment Analysis

9 Future Outlook of the Market

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.