PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693575

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693575

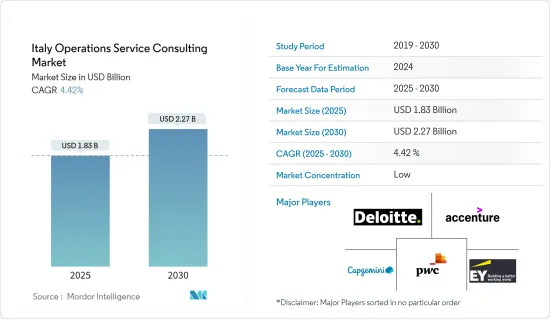

Italy Operations Service Consulting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Italy Operations Service Consulting Market size is estimated at USD 1.83 billion in 2025, and is expected to reach USD 2.27 billion by 2030, at a CAGR of 4.42% during the forecast period (2025-2030).

Operations management sometimes referred to as operations consulting, provides advice and implementation services to improve a company's internal operations and performance across the value chain.

Key Highlights

- Due to continued technological breakthroughs and the digitization of society, Italy is undergoing a rapid growth period. To embrace change, discover opportunities, develop new strategies, articulate a plan, and implement plans to achieve their goals, businesses need strategic partners in the form of operations consulting firms.

- By end-user, the market is divided into financial services, manufacturing, energy and utilities, the public sector, retail, and other end users. With a share of 26.91%, the financial industry controlled most of the market in 2021. Due to bank mergers, acquisitions, asset transfers, liquidations, and conversions that accounted for 60% of all banking assets in the nation throughout the 1990s, the number of banks in Italy has drastically declined. There are about a thousand banks in Italy. The government is promoting consolidation through several programs to make the Italian banking sector more competitive abroad.

- The market is greatly impacted by increased digitization since it makes it possible for new businesses to emerge with unique business models and strategies. The ongoing appearance of new freelancing websites, virtual networks, and specialty teams has increased the options available to clients. Greater firms compete with smaller ones. Independent contractors and loosely established expert networks put a strain on smaller enterprises. Due to the influx of overseas talent, even independent contractors are under pressure to enter the market.

- Over the forecast period, the public sector in Italy is anticipated to adopt operations consulting services at a healthy rate. Public sector organizations are keeping citizens, communities, workers, and businesses at the center of progress by utilizing the disruptive potential of digital technologies, which opens up opportunities for market vendors in the nation.

- Organizations around Italy took all required precautions to safeguard the safety of communities and workers due to the COVID-19 outbreak. Many organizations finished their digital transformation and have chosen to operate entirely remotely or in a hybrid model that combines digital and in-office work. In addition, the emergence of COVID-19 has made supply chains more vulnerable. For the majority of IT firms, the ecosystem is fragile and comprises important operations consulting service providers. Mandates encouraging remote work have also prompted service providers to guarantee that mission-critical corporate clients have access to the tools and technology required to allow the speed, security, quality, and overall effectiveness of services offered.

Italy Operations Service Consulting Market Trends

Financial Service Sector to Hold Significant Share

- Due to the quick technological advancements affecting financial institutions, financial services companies will increasingly need to innovate, reduce operational risk, cut costs, increase customer loyalty, improve business performance, reduce operational risk, reduce costs, and create compelling value propositions for their clients.

- Improvements in technology and consumer behavior continue to propel the development of the payments sector in Italy. Financial services companies are quickly introducing operations consulting services to stay up with the changing payment landscape and seize the possibilities. This has ramifications for retail payments services, cash management, and payments technology.

- Global market vendors are customers for financial transformations, restructurings, turnarounds, and transactions in Italy because of the country's growing digitalization of financial services. For instance, the international consulting company FTI Consulting extended its corporate finance and restructuring service offerings in Italy in June 2022. Several market vendors operating in Italy are engaging in merger and collaboration operations to offer better services to their clients who want financial services.

- Furthermore, the COVID-19 pandemic has driven the banking sector in Italy to undergo significant digital transformation. For instance, the usage of digital channels has increased, along with changing customer preferences toward a one-stop shop with a single platform for obtaining all necessary financial services. Examples include digital payments, online insurance, online payments for online shopping, etc.

- Regional consulting companies like Parva Consulting, which provides consulting services in the financial sector, are attracting much interest from the banking, asset management, and insurance industries with their creative services. To improve customer experience and sales effectiveness in banking, the organization analyses distribution networks and redesigns operational procedures to free up commercial quality time.

- As per research by Acuris Global, JPMorgan was Italy's top financial advisory company for merger and acquisition (M&A) agreements in 2021. With a total deal value close to USD 97 billion, the company became the top advisor to M&A deals in the nation. Goldman Sachs & Co. is placed second in the leaderboard with a deal value of USD 91 billion.

Surged Investment Trends in Emerging Technologies

- The Italian government is working hard to build up its start-up model and draw the rest of Europe's attention to it. Despite the unfavorable recent economic climate, the atmosphere is evolving to support entrepreneurs. Italy used to be known for having high taxes. Hence, many Italians would regularly leave the nation to start their enterprises in places with more freedom and flexibility. The government has been focusing on ending this cycle by increasing its support for innovation and technology and granting greater power to advance research and tech transfer.

- To boost the regional start-up ecosystem, the Italian government introduced a EUR 1 billion (USD 1.04 billion) investment program and established a new venture arm named CDP Venture Capital. This manages seven different funds, including an accelerator fund, a VC fund-of-funds, and "Series A/B matching" funds. It also launched two acceleration programs to provide SMEs and entrepreneurs mentorship, networking, and support services.

- The new National Transition Plan 4.0 serves as the foundation for the Italian Recovery Fund. About EUR 24 billion (USD 24.6 billion) is being invested in a structural change that strengthens all deduction rates and significantly increases usage. It aims to increase private investment and provide businesses with stability and predictability.

- One of the world's biggest and most comprehensive artificial intelligence doctorates, the National Doctorate in "Artificial Intelligence" was launched in Italy in 2021. Italian academics are participating in all key worldwide AI research networks, including the most prestigious EU networks, such as CLAIRE and ELLIS. It is also one of the founding members of the Global Partnership on Artificial Intelligence (GPAI).

- According to the Ministry of Economics Development, the number of business services start-ups in Italy for 1Q 2021 was 9,377. There were 2,138 new start-ups in the manufacturing activities, energy, and mining sector. Business services had the highest number of start-ups, in contrast to transportation and logistics, which had the lowest.

Italy Operations Service Consulting Industry Overview

The Italian operations service consulting market is highly competitive and consists of many global and regional players. These players account for a considerable market share and focus on expanding their global client base. They focus on research and development activities, strategic alliances, and other organic and inorganic growth strategies to stay stronger in the market.

- October 2022: Ernst & Young unveiled the worldwide official launch of EY Nexus for financial services, a three-year, USD 10 billion investment in technology, strategy, and people. With the launch of EY Nexus, the company has expanded the amount of its technological ecosystem by introducing a business transformation platform intended to deploy new products and solutions quickly for financial services.

- September 2022: Accenture announced its plan to acquire Stellantis, a world-class manufacturing, training, and consulting business. By way of this takeover, Accenture could include the World Class Manufacturing (WCM) approach into its solutions for customers, assisting them in improving the effectiveness, sustainability, and resilience of their production and supply chain networks.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Investment in Emerging Technologies

- 5.1.2 Adoption of BI and Advanced Data Management Strategies

- 5.2 Market Restraints

- 5.2.1 Shift in the Consulting Marketplace

- 5.3 Case Studies VIS-A-VIS Operations Consultancy

6 MARKET SEGMENTATION

- 6.1 By End-user

- 6.1.1 Financial Services

- 6.1.2 Manufacturing

- 6.1.3 Energy and Utilities

- 6.1.4 Public Sector

- 6.1.5 Retail

- 6.1.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Deloitte Touche Tohmatsu Limited

- 7.1.2 Accenture PLC

- 7.1.3 PricewaterhouseCoopers LLP

- 7.1.4 Ernst & Young ITALY Limited

- 7.1.5 Capgemini SE

- 7.1.6 KPMG International

- 7.1.7 Boston Consulting Group Inc.

- 7.1.8 A. T. Kearney Inc. (Kearney)

- 7.1.9 Mckinsey & Company Inc.

- 7.1.10 Bain & Company Inc.

- 7.1.11 Roland Berger GmbH

- 7.1.12 Simon-Kucher & Partners

- 7.1.13 OC&C Strategy Consultants

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET