PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440264

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440264

Latin America E-commerce Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

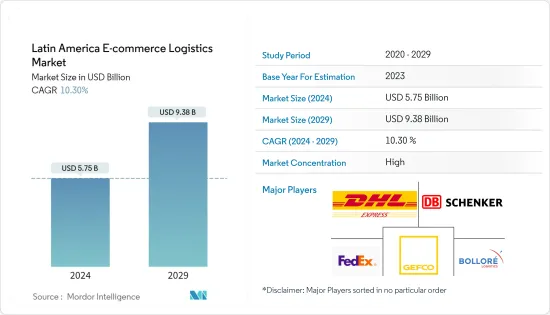

The Latin America E-commerce Logistics Market size is estimated at USD 5.75 billion in 2024, and is expected to reach USD 9.38 billion by 2029, growing at a CAGR of 10.30% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic encouraged growth in the digital world in 2020, with e-commerce being one of the biggest beneficiaries. The exponential growth of internet shopping throughout Latin America, with some countries reporting significant increases in online purchases, is one of the primary drivers of the market.

- The Latin American e-commerce market is one of the global leaders in e-commerce growth. It is expected to grow by 19% over the forecast period, surpassing the global average of 14% (as reported in 2021). Massive provides immense scope for growth of the e-commerce logistics market growth.

- Demand for home delivery boosted the growth of e-commerce segments, such as food and beverage, that had already been gaining popularity in recent years. The digitalization of shopping seems to have transcended the coronavirus onset, becoming an increasingly regular habit in people's everyday lives.

- Significant factors contributing to the market growth include increasing e-commerce businesses, the surge in e-commerce sales, and technological advancement across Latin America. The explosion of the mobile internet also played an important role, as people could now search for any product.

- Countries such as Brazil, Argentina, and Chile rely heavily on roads to transport agricultural products and fertilizers over long distances. Hence, reliance on logistics and transportation networks ensures its competitiveness, and continued growth is expected to boost the development of the e-commerce logistics market in Latin America.

Latin America E-commerce Logistics Market Trends

E-commerce Boom Spearheading Last-mile Delivery Demand

With a population of 386 million, there is an abundance of potential opportunities for e-commerce success in the region. While many would not expect growth in e-commerce during economic unrest, this surge mostly came from the rise in internet and smartphone usage, which provided access to goods from abroad that were previously out of reach.

E-commerce's rapid growth in Latin America faces a stubborn bottleneck offline with same-day deliveries. Reaching a customer's doorstep faster has drawn investors toward warehouses and fulfillment centers in dense city centers. However, moving goods in and out of mega metropolises like Mexico City or Sao Paulo is sluggish at best.

Van and small truck drivers drive on poor roads amid terrible traffic jams to make deliveries from large warehouses in the sprawling suburbs, often arriving late. While e-commerce companies have shaved delivery times from 7-10 days to 2-3 over the past few years, the target is to reach same-day deliveries.

Mercado Libre has played a leading role in developing the sector in Latin America. Although the third-party sales giant maintains a growing influence, many competitors are rising to catch up with its e-commerce hegemony.

The online marketplace created in Argentina remains at the top of the Latin America-born e-commerce companies list. Branching out to digital payments, Mercado Libre's Mercado Pago, its online payments service, processed a staggering USD 50 billion inside and outside the marketplace business model.

Digitization and Inclination Toward Online Transactions

To circumvent the logistical nightmare of a cash-based society, e-commerce providers targeting the region have found ways to manage this reality. About 40% of online consumers prefer utilizing PayPal, and 38% use cash-on-delivery.

Moreover, the declining costs of internet services and data and the growing use of credit cards and digital payment systems have reduced the challenges to adopting online shopping. As a result, the sector has captured a 8-10% share of total retail sales in Latin America.

Brazil and Mexico hold enormous potential for e-commerce in Latin America. There are currently 77.4 million e-commerce users in Brazil, with an additional 38.8 million estimated to be shopping online by the end of 2023. By comparison, there are 103.31 million internet users in Mexico, accounting for just under half of the population, leaving room for substantial growth.

Latin America E-commerce Logistics Industry Overview

The Latin American e-commerce logistics market is relatively fragmented, with a mixture of domestic and international companies, including DHL, DB Schenker, and Kerry Logistics.

Growing e-commerce activities have led to a high frequency of large-scale deliveries across provinces, giving birth to logistics services specifically for e-commerce activities in the region. Since the e-commerce business environment has become more dynamic and competitive, companies tend to demand better logistics services that are flexible and cost-effective. Value-added services, such as door delivery, real-time tracking, and others, have given a competitive advantage to logistics players who want to build long-lasting customer relationships.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases Explained

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Technological Trends and Automation

- 4.3 Government Regulations and Initiatives

- 4.4 Supply Chain/Value Chain Analysis

- 4.5 Impact of COVID-19 on the Market

- 4.6 Insights into the E-commerce Market

- 4.7 Spotlight - Key Hubs for E-commerce Logistics

- 4.8 Insights into Reverse/Return Logistics

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise In Population

- 5.1.2 Rapid growth in Urbanization

- 5.2 Market Restraints/Challenges

- 5.2.1 Integration Complexities

- 5.2.2 Technical reliability issues can hinder entry into the region

- 5.3 Market Opportunities

- 5.3.1 Technological Innovation

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Buyers/Consumers

- 5.4.2 Bargaining Power of Suppliers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing and Inventory Management

- 6.1.3 Value-added Services (Labeling, Packaging, etc.)

- 6.2 By Business

- 6.2.1 B2B (Business-to-Business)

- 6.2.2 B2C (Business-to-Customrs)

- 6.3 By Destination

- 6.3.1 Domestic

- 6.3.2 International/Cross-border

- 6.4 By Product

- 6.4.1 Fashion and Apparel

- 6.4.2 Consumer Electronics and Home Appliances

- 6.4.3 Beauty and Personal Care Products

- 6.4.4 Other Products (Toys, Food Products, Furniture, etc.)

- 6.5 By Country

- 6.5.1 Brazil

- 6.5.2 Mexico

- 6.5.3 Argentina

- 6.5.4 Colombia

- 6.5.5 Chile

- 6.5.6 Peru

- 6.5.7 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 DHL Express

- 7.2.2 FedEx Corporation

- 7.2.3 Bollore Logistics

- 7.2.4 DB Schenker

- 7.2.5 Gefco Logistics

- 7.2.6 CH Robinson Worldwide Inc.

- 7.2.7 CEVA Logistics

- 7.2.8 Kuehne Nagel

- 7.2.9 Nippon Express

- 7.2.10 Kerry Logistics

- 7.2.11 Loggi

- 7.2.12 B2W Digital

- 7.3 Other Companies*

8 FUTURE OF THE MARKET

9 APPENDIX

- 9.1 Macroeconomic Indicators (GDP Distribution by Activity, Contribution of Transport/Courier Sector to Economy)

- 9.2 Key Statistics Related to Retail and E-commerce Sectors (such as Sales/Revenue, Consumer Preferences, etc.)