PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639412

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639412

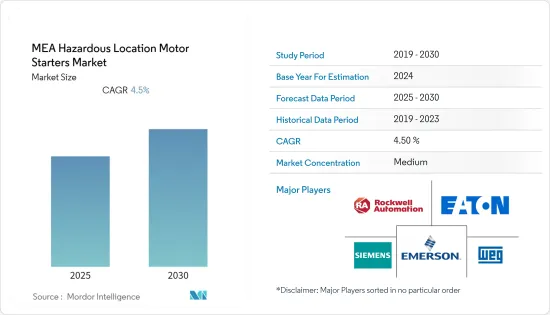

MEA Hazardous Location Motor Starters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The MEA Hazardous Location Motor Starters Market is expected to register a CAGR of 4.5% during the forecast period.

Hazardous location motors are intended to enhance workplace safety by containing explosions within the motor. Different motors are used to meet the needs of various settings and applications. Class I motors are used for settings affecting gases, vapors, or liquids. Class II motors are intended for areas containing dust, flammable lint, or fibers, such as textiles and sawdust.

Growing demand for instruments for protection against thermal overload drives the market, as instantaneous over-current is usually the result of fault conditions. Bimetallic overload relays and time overcurrent relays are the motor protection relay used in high voltage areas and provide various features, such as short circuit protection, locked rotor protection, and many more.

Regional mergers and acquisitions have led to enormous drilling and exploration activities in hazardous locations, further boosting the region's demand for motors and motor starters. For instance, in December last year, ADNOC Drilling Co., a subsidiary of Abu Dhabi's national oil company ADNOC, signed a deal to acquire two offshore drilling rigs for a combined cost of USD 200 million. The acquisition is part of the company's fleet expansion and growth strategy. This rig purchase adds to the company's earlier deals for nine rigs signed last year and four rigs acquired in 2021. The company wants to operate a total fleet of 122 owned rigs by 2024.

In addition, in May last year, ADNOC announced three oil discoveries, including one at Bu Hasa, Abu Dhabi's most extensive onshore field, with a crude oil production capacity of 650,000 barrels per day (bpd).

According to the US Energy Information Administration 2021, Saudi Arabia holds 15% of the world's proven crude oil reserves. It is the world's largest crude oil exporter. It has about 12 million barrels per day of crude oil production capacity, including capacity from the Neutral Zone, which it shares with Kuwait. After the United States, Saudi Arabia is OPEC's largest crude oil producer and the world's second-largest producer of total petroleum liquids.

The region constantly discovers fresh oil and gas wells while existing and underutilized ones renew. For instance, the government-owned Abu Dhabi National Oil Co. recently announced a significant rig fleet evolution program that desired to add dozens of rigs by 2025. In January last year's report by Arab Petroleum Investments Corporation, energy investments in the Middle East and Africa are anticipated to increase by 9% over the next five years to more than USD 879 billion as energy exporters raise spending amid higher oil revenue.

The COVID-19 pandemic posed several challenges to the market, like supply chain disruptions and increased raw material prices. The market is expected to grow during the forecast period with the growth of many industries across the region, such as oil and gas.

MEA Hazardous Location Motor Starters Market Trends

Coal Preparation Plants Hold Significant Market Share

- Coal mines are rich in methane, and an explosion occurs in the confined cavern when exposed to open fire. Methane explosion is severe, as it often consists of an initial explosion leading to the burning of a coal dust cloud, which produces a more violent dust explosion.

- Growing dependency on coal production is triggering the growth of several coal plants in the region, driving the market. All machinery and electrical equipment inside the enclosed coal storage area or structure are approved for use in hazardous locations to eliminate potential ignition sources and provide appropriate equipment. These are supplied with spark- or explosion-proof motors, which are assigned a temperature code (T code).

- According to the General Authority for Statistics (Saudi Arabia), coal mining revenue was recorded at 0.44 million in 2022 and is projected to amount to USD 0.55 million in 2023. A dust ignition-proof motor is developed to exclude hazardous materials and prevent dust explosions. ABB delivers a wide range of dust ignition-proof motors, which helps prevent any explosion transmission of dust in the coal preparation.

- The United Arab Emirates plans to evolve as the first Gulf country to develop electricity from coal and maintain net-zero carbon emissions by 2050. Further, Dubai is constructing a USD 3.4 billion Hassyan coal plant, which will increase capacity from 600 MW to 2,400 MW by this year. According to ACWA's statement, Jera Co. of Japan will supply coal as part of a long-term agreement with Acwa Power of Saudi Arabia to build the plant.

- Such expansion in coal mining plants in the region may further create significant demand for hazardous location motor starters.

Saudi Arabia to Experience Significant Market Growth

- Oil refineries are dominating the hazardous location motor starters market. Increasing dependency on oil products is triggering the growth of several oil refining plants. The region has witnessed a massive demand from the petroleum industry. The oil refineries are typically large, sprawling industrial complexes with extensive piping running all over, carrying streams of fluids between extensive chemical processing units for instant distillation columns.

- Countries in the Middle East furnish and export a significant amount of crude oil globally. The area commands considerable demand for industrial sensors used for various applications. For instance, according to Baker Hughes, the number of oil and gas rigs in the Middle East recently stood at 275, including offshore and land, the second-highest in the world.

- In addition, regular electric motors are prone to explosions containing flammable elements such as oil and gas fumes or liquids. The implications could vary from modest production interruptions to serious injury and death.

- Further, in January last year, Honeywell, an international technology player, announced the new oil and gas exhibit facility in the Kingdom of Saudi Arabia. The facility was created as part of a joint venture (JV) partnership between Elster Instromet Saudi Arabia and Gas Arabian Services to provide a cutting-edge infrastructure for the manufacturing and assembly of natural gas and liquid fuel solutions. Such regional oil and gas investments will significantly drive the Motor Starter market.

- The increased number of populations across the country may further drive the growth of oil refineries, thereby creating significant demand for hazardous location motor starters in the market. For instance, according to OPEC, Saudi Arabia has a population of around 35.5 million, more than seven million of whom live in Riyadh. Saudi Arabia possesses about 17% of the world's proven petroleum reserves. The country has exported 1,344 (1,000 b/d) of petroleum products recently.

- As a result, the region is rapidly using various types of hazardous site motors, which are engineered such that their motor case temperatures do not exceed permissible temperatures for settings with flammable gases, vapors, or liquids.

MEA Hazardous Location Motor Starters Industry Overview

The Middle East and African hazardous location motor starters market are moderately consolidated, with many market players cornering a minimal market share. The development of regional markets and increasing shares of local players in foreign direct investments are the major factors promoting the fragmented nature of the market.

- February 2022- ABB launched NMK 630L4A 5000 KW 11000V ABB high voltage induction motor 1492 RPM 50HZ. ABB's engineered motors for low-voltage variable speed drive range of up to 2240 kW. Modular slip-ring motors, a type of NMK available for heavy load inertia applications slip-ring motors, are an ideal solution for applications that require high starting torque and low starting current. They are especially suitable for rich load inertia applications like mill drives or weak network conditions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness: Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyer

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Safety Measures

- 5.1.2 Increasing Demand for Energy Efficient Motors

- 5.2 Market Restraints

- 5.2.1 Regulations and Compliance

- 5.2.2 High Installation Cost for Material and Labor Compared to Non-explosion Proof Motors

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Low Voltage Motor Starter

- 6.1.2 Full Voltage Motor Starter

- 6.1.3 Manual Motor Starter

- 6.1.4 Magnetic Motor Starter

- 6.1.5 Other Types

- 6.2 By Class

- 6.2.1 Class I

- 6.2.2 Class II

- 6.2.3 Class III

- 6.3 By Division

- 6.3.1 Division 1

- 6.3.2 Division 2

- 6.4 By Zone

- 6.4.1 Zone 0

- 6.4.2 Zone 1

- 6.4.3 Zone 21

- 6.4.4 Zone 2

- 6.4.5 Zone 22

- 6.5 By Applications

- 6.5.1 Paint Storage Areas

- 6.5.2 Coal Preparation Plants

- 6.5.3 Sewage Treatment Plants

- 6.5.4 Oil Refineries

- 6.5.5 Chemical Storage and Handling Facilities

- 6.5.6 Grain Elevators

- 6.5.7 Petrochemical Facilities/Oil Rigs

- 6.5.8 Other Applications

- 6.6 By Country

- 6.6.1 United Arab Emirates

- 6.6.2 Saudi Arabia

- 6.6.3 South Africa

- 6.6.4 Qatar

- 6.6.5 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Eaton

- 7.1.2 Emerson Industrial Automation

- 7.1.3 WEG Industries

- 7.1.4 Rockwell Automation

- 7.1.5 Siemens

- 7.1.6 Heatrex

- 7.1.7 Schneider Electric

- 7.1.8 R. Stahl Inc.

- 7.1.9 ABB Group

- 7.1.10 GE Industrial Solutions

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET