PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833690

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833690

Motor Starter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

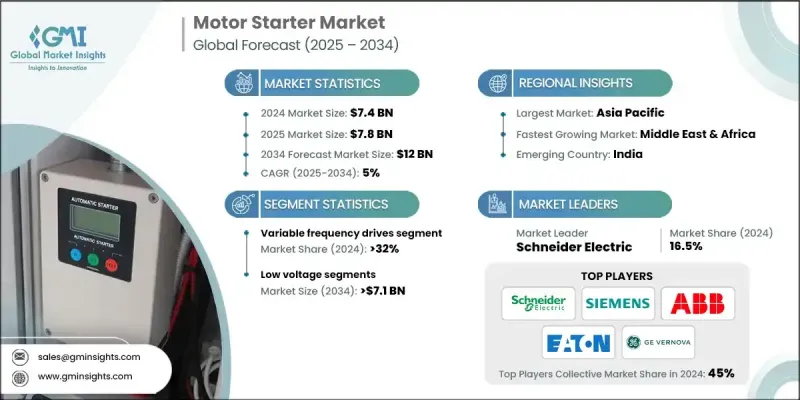

The global motor starter market was estimated at USD 7.4 billion in 2024 and is expected to grow from USD 7.8 billion in 2025 to USD 12 billion by 2034, at a CAGR of 5%, as per the latest report published by Global Market Insights Inc.

With a strong focus on energy savings and reducing operational costs, industries are investing in advanced motor starters, especially soft starters and intelligent starters that help reduce power surges, manage load, and enhance motor efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 Billion |

| Forecast Value | $12 Billion |

| CAGR | 5% |

Variable Frequency Drives to Gain Traction

The variable frequency drives (VFD) segment held a significant share in 2024, owing to its superior energy efficiency, precise motor control, and reduced mechanical stress on equipment. VFDs not only regulate motor speed but also help extend motor life and lower energy consumption, making them a preferred choice across industries such as HVAC, oil & gas, and water treatment.

Rising Adoption of Low Voltage

The low voltage held a sizeable share in 2024, driven by its widespread use in commercial buildings, small-scale manufacturing, and infrastructure applications. These starters are ideal for controlling motors in systems with voltage ratings typically below 1,000V, including pumps, compressors, and conveyors.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific motor starter market held a sustainable share in 2024, fueled by booming industrialization, rising investments in infrastructure, and growing energy demand across countries like China, India, and Southeast Asia. This region accounts for a significant share of global motor installations, particularly in manufacturing, construction, and utilities.

Major players in the motor starter market are CHINT Group, Emerson Electric, LOVATO ELECTRIC, Kalp Controls, GE Vernova, Rockwell Automation, Mitsubishi Electric, C&S Electric, Siemens, Phoenix Contact, Fuji Electric, LS ELECTRIC, WEG, c3controls, Havells India, ABB, CORDYNE, Lauritz Knudsen Electrical & Automation, Danfoss, Schneider Electric, CG Power & Industrial Solutions, Eaton, Omron Corporation, SKN-BENTEX.

To expand their presence, leading players in the motor starter market are focusing on product innovation, digital integration, and strategic partnerships. Many are developing smart starters with built-in connectivity, allowing remote monitoring, diagnostics, and seamless integration with industrial control systems. Others are expanding their global footprint by establishing manufacturing hubs and R&D centers in high-growth regions like the Asia Pacific and Latin America. In addition, companies are strengthening their service networks, offering end-to-end support that includes commissioning, maintenance, and training to enhance customer loyalty. Tailored pricing strategies, vertical-specific product lines, and aggressive marketing in emerging markets are also being deployed to capture untapped demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Product trends

- 2.1.3 Protection system trends

- 2.1.4 Control system trends

- 2.1.5 Voltage trends

- 2.1.6 Current trends

- 2.1.7 Application trends

- 2.1.8 End use trends

- 2.1.9 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.7 Cost structure analysis of motor starters

- 3.8 Price trend analysis, (USD/Unit)

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Emerging opportunities & trends

- 3.10 Investment analysis & future outlook for the motor starter

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Strategic dashboard

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

- 4.7 Competitive pricing strategy benchmarking

- 4.8 Distribution channel strategy comparison

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 Soft starters

- 5.3 Variable frequency drives (VFDs)

- 5.4 Across-the-line starters

- 5.5 Reversing starters

- 5.6 Hybrid motor starters

- 5.7 Others

Chapter 6 Market Size and Forecast, By Protection System, 2021 - 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 Electronic overload relays

- 6.3 Solid-state overload protection

- 6.4 Thermal-magnetic protection

Chapter 7 Market Size and Forecast, By Control System, 2021 - 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 PLC

- 7.3 Fieldbus

Chapter 8 Market Size and Forecast, By Voltage, 2021 - 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Size and Forecast, By Current, 2021 - 2034 (Units & USD Million)

- 9.1 Key trends

- 9.2 > 9 A - 27 A

- 9.3 > 27 A - 90 A

- 9.4 > 90 A - 270 A

- 9.5 > 270 A - 810 A

- 9.6 > 810 A

Chapter 10 Market Size and Forecast, By Application, 2021 - 2034 (Units & USD Million)

- 10.1 Key trends

- 10.2 Distributed architecture

- 10.3 Control cabinet

- 10.4 Hybrid configuration

Chapter 11 Market Size and Forecast, By End Use, 2021 - 2034 (Units & USD Million)

- 11.1 Key trends

- 11.2 Residential

- 11.3 Commercial

- 11.4 Industrial

Chapter 12 Market Size and Forecast, By Region, 2021 - 2034 (Units & USD Million)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.2.3 Mexico

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 France

- 12.3.3 Russia

- 12.3.4 UK

- 12.3.5 Italy

- 12.3.6 Spain

- 12.3.7 Netherlands

- 12.3.8 Austria

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 South Korea

- 12.4.4 India

- 12.4.5 Australia

- 12.4.6 New Zealand

- 12.4.7 Indonesia

- 12.5 Middle East & Africa

- 12.5.1 Saudi Arabia

- 12.5.2 UAE

- 12.5.3 Qatar

- 12.5.4 Egypt

- 12.5.5 South Africa

- 12.5.6 Nigeria

- 12.6 Latin America

- 12.6.1 Brazil

- 12.6.2 Argentina

Chapter 13 Company Profiles

- 13.1 ABB

- 13.2 C&S Electric

- 13.3 c3controls

- 13.4 CG Power & Industrial Solutions

- 13.5 CHINT Group

- 13.6 CORDYNE

- 13.7 Danfoss

- 13.8 Eaton

- 13.9 Emerson Electric

- 13.10 Fuji Electric

- 13.11 GE Vernova

- 13.12 Havells India

- 13.13 Kalp Controls

- 13.14 Lauritz Knudsen Electrical & Automation

- 13.15 LOVATO ELECTRIC

- 13.16 LS ELECTRIC

- 13.17 Mitsubishi Electric

- 13.18 Omron Corporation

- 13.19 Phoenix Contact

- 13.20 Rockwell Automation

- 13.21 Schneider Electric

- 13.22 Siemens

- 13.23 SKN-BENTEX

- 13.24 WEG