PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640591

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640591

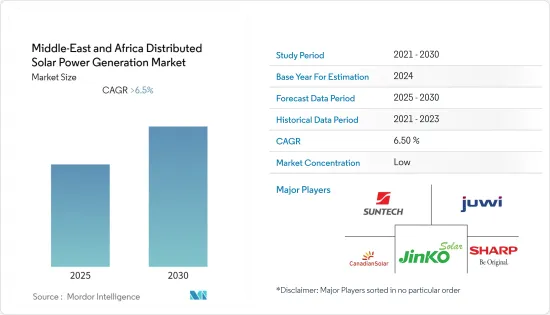

Middle-East and Africa Distributed Solar Power Generation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Middle-East and Africa Distributed Solar Power Generation Market is expected to register a CAGR of greater than 6.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Currently. The market has reached pre-pandemic levels.

Key Highlights

- Over the long term, increasing demand for clean electricity and the impetus to shift from conventional power generation sources, such as diesel and gas gen-sets, in the face of rising fossil fuel prices to power off-grid electricity requirements with sources such as distributed solar is expected to help the distributed solar power generation market grow.

- On the other hand, the higher costs of distributed solar energy due to complete dependence on solar PV hardware imports are expected to restrain costs during the forecast period.

- Nevertheless, the innovation of new technologies, the upcoming solar power projects, and the use of hybrid power solutions in this region can create immense opportunities for distributed solar power generation market in the near future.

- Saudi Arabia is expected to witness significant demand due to various government initiatives to promote renewable energy projects, particularly solar energy-based projects, in the country during the forecast period.

MEA Distributed Solar Power Generation Market Trends

Increasing Demand for Clean Electricity to Drive the Market

- Clean energy, which includes renewables, such as solar and wind power, and alternative fuels, including waste-to-energy and nuclear, accounts for only a small proportion of electricity generation in the region.

- As of 2021, the total installed renewable energy capacity in the Middle East and Africa regions stood at 24.05 GW and 55.71 GW, respectively. Installed renewable energy capacity in both markets has been growing steadily over the past few years, with the installed renewable capacity in the Middle East growing by nearly 40% since 2017 and installed renewable capacity in Africa growing by nearly 30% since 2017. In both regions, a significant share of the total installed capacity came from solar energy. This demonstrated the growing demand for clean energy in the region, which is expected to drive the market during the forecast period.

- Rooftop solar offers the benefits of modern electricity services to households with no access to electricity, reducing electricity costs on islands and in other remote locations dependent on oil-fired generation and enabling residents and small businesses to generate electricity.

- Various governments are taking various initiatives to promote the solar market in the region; for instance, In 2020, Saudi Arabia's Electricity & Cogeneration Regulatory Authority published new rules for distributed-generation solar installations, which is anticipated to encourage electricity consumers to install PV systems under the country's net billing regime. The new framework will apply to PV systems ranging in size from 1 kW-2 MW and to all energy consumers.

- Moreover, Saudi Arabia's target to install 58.7 GW of renewable energy by 2030 may offer some of the most exciting opportunities for regional and international investors and energy firms. The United Arab Emirates is expected to remain a focal point of the clean energy transition, having set a target of 50% of its energy to be produced by carbon-free sources by 2050.

- Therefore, based on the above factors, clean electricity is expected to drive the Distributed Solar Power Generation Market in the Middle East and Africa region over the forecast period.

Saudi Arabia to Witness Significant Demand

- Saudi Arabia's energy demand has been rising, with consumption increasing by 60% in the last ten years. The demand for electricity in 2021 is about 65 GW, which is expected to increase to 120 GW in 2030.

- According to the International Renewable Energy Agency (IRENA), Saudi Arabia's total renewable installed capacity stood at 12 MW in 2012, which rose to 443 MW at the end of 2021. Solar PV has been the most significant share in total solar energy capacity, with 389 MW in the country, accounting for more than 86% of the total renewable energy as of 2021.

- Saudi Arabia has become one of the Middle East and North Africa (MENA) region's leaders in the race to use renewable energy. In 2021, the Saudi Green Initiative reinforced the country's commitment to increase the share of renewable energy to 50% of its primary energy mix while producing the other 50% from natural gas by 2030.

- Moreover, under Vision 2030, more than 40 GW of solar photovoltaic (PV) capacity and 2.7 GW of concentrated solar power (CSP) capacity are expected to be developed in the country by 2030. The Renewable Energy Project Development Office (REPDO) within the Ministry of Energy, established in 2017, is responsible for delivering on the goals of the National Renewable Energy Program (NREP) in line with Vision 2030.

- Therefore, based on the projects mentioned above, Saudi Arabia is expected to witness significant demand for distributed solar power generation in the Middle-East and Africa region over the forecast period.

MEA Distributed Solar Power Generation Industry Overview

The market for distributed solar power generation in Middle-East and Africa is partially fragmented, with the presence of numerous players. Some of the major players in the market (not in particular order) include Wuxi Suntech Power Co. Ltd., Canadian Solar Inc., Juwi Solar Inc., JinkoSolar Holding Co. Ltd, and Sharp Solar Energy Solutions Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in MW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 Saudi Arabia

- 5.1.2 United Arab Emirates

- 5.1.3 South Africa

- 5.1.4 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Wuxi Suntech Power Co. Ltd

- 6.3.2 First Solar Inc.

- 6.3.3 Juwi Solar Inc.

- 6.3.4 JA Solar Holdings Co. Ltd

- 6.3.5 Trina Solar Limited

- 6.3.6 JinkoSolar Holding Co. Ltd

- 6.3.7 Sharp Solar Energy Solutions Group

- 6.3.8 Canadian Solar Inc.

- 6.3.9 Sonnedix Power Holdings Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS