Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644922

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644922

South America DC Distribution Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

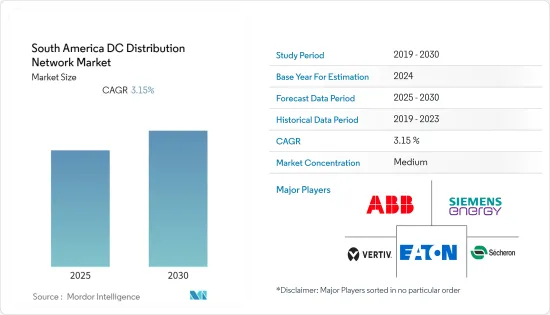

The South America DC Distribution Network Market is expected to register a CAGR of 3.15% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as growth in the region's renewable energy sector, its compatibility with battery storage devices, and advantages over AC distribution, like power sharing between systems with different frequencies, are expected to drive the market over the forecast period.

- On the other hand, high initial costs and complexity compared to generic distribution networks are expected to hinder the market's growth.

- Nevertheless, the DC distribution network is considered an essential factor regarding the future aspects of smart grids. Also, solar power is estimated to supply one-third of the world's energy demand by 2060, thereby proliferating DC distribution in the future, as solar energy generates a direct current.

- Brazil is expected to dominate the market due to increasing HVDC transmission projects during the forecast period.

South America DC Distribution Network Market Trends

EV Fast Charging Systems to Witness Significant Growth

- The countries in South America are rapidly growing in terms of electric vehicle usage. With incentives and a growing charging station network, the region wants to stimulate electric car demand and cut transport emissions.

- The government is converting the fleet of public transport buses to electric which is expected to drive the country market in coming years. For instance, in January 2021, BYD announced that it had bagged a cumulative order to supply 1,002-unit pure-electric buses to Bogota, Colombia. These buses were scheduled to be delivered from 2021 to the first half of 2022 and will be put into operation on 34 bus routes across five city regions.

- Vehicle tax in the country is based on the overall valuation of the car, varying anywhere from 1.5% - 3.5%. However, this has been relaxed to only 1% for Electric Vehicles. In addition to tax rebates, the government is also lowering electricity tariffs that would make charging EVs even more affordable. Also, major automobile companies like Renault, BMW, Hyundai, and KIA are actively introducing their electric portfolio in Colombia.

- As of November 2021, Mexico was the South American country with the most charging stations for electric vehicles, with 290 recharging points registered across the territory. It was followed by Brazil and Chile, with 273 and 244 stations, respectively.

- Moreover, in March 2022, Shell exclaimed to install the first EV chargers in the service station network. The company is working on its e-mobility strategy for the Latin-American region and plans to deploy its first EV chargers in Argentina. The company is currently assessing the initiative through a partnership with Audi and Volkswagen and has recently acquired a number of chargers to install in its Argentinian service stations.

- Owing to the above points and the region's recent developments, EV fast-charging systems are expected to witness significant growth during the forecast period.

Brazil is Expected to Dominate the Market

- Brazil has the largest electricity market in South America. Hydroelectricity provides more than 70% of Brazil's generation. Its total power generation installed capacity is comparable to that of Italy and the United Kingdom, although with a much more extensive transmission network.

- Brazil generates the third-highest amount of electricity in the Americas. The region is followed by Chile and the rest of the central and Southern American regions. Hydroelectricity is the major form of electricity, and the remaining electricity gets generated by fossil fuel and biomass.

- Electricity generation in Brazil amounted to over 656 terawatt-hours in 2021, an increase of some 5.6% compared to the previous year. Hydropower is the most important electricity generation source in Brazil, accounting for more than half of the country's output in 2021.

- Moreover, in December 2021, Iberdrola, through its subsidiary Neoenergia, was selected by the Agencia Nacional de Energia Eletrica (ANEEL) to build a 500 kV substation in the state of Minas Gerais. The award was granted by the Agencia Nacional de Energia Eletrica (ANEEL), Brazil's electricity system regulator, in an international tender with the aim of attracting investment to upgrade and expand the country's transmission networks. This, in turn, culminates in the growth of DC distribution network supplies across the country.

- Owing to the above points and the recent developments, Brazil is expected to dominate the market during the forecast period.

South America DC Distribution Network Industry Overview

The South American DC distribution network market is moderately consolidated. The key companies in the market (in no particular order) include ABB Ltd, Siemens AG, Vertiv Group Corp., Eaton Corporation PLC, and Secheron SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93173

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-User

- 5.1.1 Remote Cell Towers

- 5.1.2 Commercial Buildings

- 5.1.3 Data Centers

- 5.1.4 Military Applications

- 5.1.5 EV Fast Charging Systems

- 5.1.6 Other End Users

- 5.2 Geography

- 5.2.1 Brazil

- 5.2.2 Argentina

- 5.2.3 Colombia

- 5.2.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd

- 6.3.2 Siemens Energy AG

- 6.3.3 Vertiv Group Corp.

- 6.3.4 Eaton Corporation PLC

- 6.3.5 Robert Bosch GmbH

- 6.3.6 Schneider Electric SE

- 6.3.7 Alpha Technologies Inc.

- 6.3.8 Nextek Power Systems Inc.

- 6.3.9 Secheron SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.