Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1443952

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1443952

UK Energy Storage Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 142 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

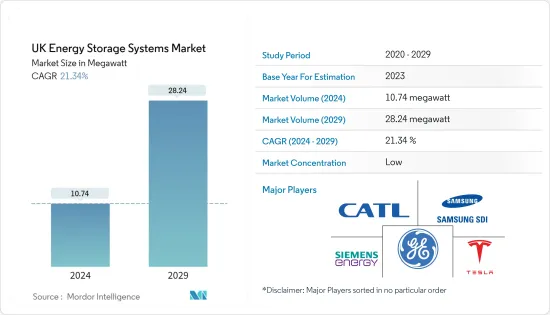

The UK Energy Storage Systems Market size is estimated at 10.74 megawatt in 2024, and is expected to reach 28.24 megawatt by 2029, growing at a CAGR of 21.34% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, the growing renewable energy sector, supportive government policies and schemes for energy storage systems (ESS), and improving energy storage economics are also expected to drive the growth of the market studied.

- On the other hand, the closing of FiT and other supporting schemes in the country has slowed down rooftop solar PV installations since March 2019 may negatively impact the market's growth and is one of the major restraints for the market.

- Nevertheless, The increasing adoption of ESS by the commercial and industrial sectors, are expected to provide growth opportunities in the forecast period.

UK Energy Storage Market Trends

Battery Energy Storage Systems Expected to Witness Significant Demand

- Batteries are considered a critical technology in the transition to a sustainable energy system. The battery energy storage systems are used to regulate voltage and frequency, reduce peak demand charges, integrate renewable sources, and provide a backup power supply. Batteries play a crucial part in energy storage systems and are responsible for around 60% of the total cost of the system.

- In the recent past, lithium-ion batteries have witnessed a massive demand in the battery energy storage market in the United Kingdom owing to their declining prices. Additionally, lithium-ion batteries are expected to hold the largest share in the battery energy storage market, as they require less maintenance, are lightweight, have a reliable cycle life, have a high energy density in terms of volume, and have a high charge/discharge efficiency.

- The United Kingdom added around 800 MWh new utility energy storage capacity this year. Furthermore, the country's energy storage pipeline increased substantially by 34.5GW. Around 2.4GW/2.6 GWh of battery energy storage sites have been connected in total by the end of 2022.

- Thus, flexible technologies, like batteries, are likely to become part of the United Kingdom's smarter electricity grid, supporting the integration of more low-carbon power, heat, and transport technologies, and it is likely to save the UK energy system up to USD 60 billion by 2050.

- In November 2022, the largest battery storage system on the European continent went live in East Yorkshire, United Kingdom. This particular facility can store 196 megawatt hours (MWh) of electricity per cycle, which is enough to power around 300,000 homes for two hours. Thus, such upcoming projects are likely to increase the demand for batteries in the United Kingdom during the forecast period.

- By the end of December 2022, the United Kingdom registered around 14.4 GW of installed solar capacity, and the new capacity added was around 613 MW in the same year.

- Therefore, the upcoming energy storage projects in the country and the need to integrate renewable sources with the national grid are expected to drive the demand for battery energy storage systems over the forecast period.

Growth in the Renewable Energy Sector to Drive the Demand for Energy Storage Systems

- As renewable resources such as solar and wind generate power intermittently and at various levels, storing this energy to be used during high demand is of vital importance.

- Due to this, modern energy-storing systems (ESS) are becoming an indispensable part of renewable energy projects. The rapid growth in the renewable energy sector is expected to be one of the strongest drivers for the growth of the ESS market in the United Kingdom.

- Renewable energy capacity developed significantly this year, accounting for nearly 52.42 GW of cumulative renewable power. Renewables produced more than 42% of the primary electricity required by the country last year.

- Favorable government policies, the declining price of solar modules and wind turbines, and agreements to reduce the increasing carbon footprint are a few prominent factors supporting the capacity growth in the country.

- In November 2022, the UK government announced to provide a funding of EUR 32.9 million to energy storage projects. Such projects includes the developemnt of new energy storage technologies, such as thermal batteries and liquid flow batteries as part of Longer Duration Energy Storage (LODES) competetion.

- In May 2022, ABB and Ecotricity partnered to build a 10 MW battery energy storage project in Ecotricity's existing 6.9 MW wind farm in Gloucestershire in 2023. The project will consist of a 10 MW/20 MWh lithium-ion energy storage system. The lithium-ion batteries will come from Kore Power, and ABB's Storage OS energy management system will be in charge of the BESS.

- Therefore, with government assistance, energy security concerns, and declining costs, the renewable power sector is expected to register significant growth over the forecast period, thus driving the demand for energy storage systems.

UK Energy Storage Industry Overview

The UK energy storage systems market is fragmented. Some of the key players operating in the market (in no particular order) include Tesla Inc., Contemporary Amperex Technology Co. Ltd, Samsung SDI Co. Ltd, Siemens Energy SA, and General Electric Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 49480

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Energy Storage Installed Capacity and Forecast, in MW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Batteries

- 5.1.2 Pumped-storage Hydroelectricity (PSH)

- 5.1.3 Other Types

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial (C&I)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Tesla Inc.

- 6.3.2 Contemporary Amperex Technology Co. Ltd

- 6.3.3 Siemens Energy AG

- 6.3.4 Wartsila Oyj Abp

- 6.3.5 Electricite de France SA (EDF)

- 6.3.6 General Electric Company

- 6.3.7 LG Energy Solution Ltd

- 6.3.8 ABB Ltd

- 6.3.9 NGK Insulators Ltd

- 6.3.10 Samsung SDI Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.