Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640531

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640531

US Alcoholic Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

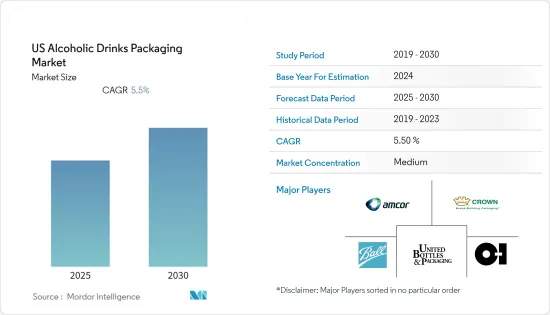

The US Alcoholic Drinks Packaging Market is expected to register a CAGR of 5.5% during the forecast period.

Key Highlights

- The growth of the market depends on serval factors, including the rising consumption of alcohol, the growing demand for metal cans from the craft beer industry, and the increasing use of PET packaging in the alcoholic beverage industry.

- Alcoholic beverage packaging is evolving significantly in terms of design, robustness, and to-go possibilities. Alcohol producers are seeking for innovative ways to represent their brand, reduce carbon emissions, and offer suitable take-out containers.

- Additionally, producers of alcoholic beverages regularly release new products and flavor additions, increasing usage and propelling the market for alcoholic beverage packaging.

- The region's alcoholic beverage packaging market growth is being severely hampered by the growing cost of energy and raw materials, which raises the cost of manufacturing packaging.

- During the outbreak of COVID-19, the market studied faced slow growth due to lockdowns imposed by various countries that have disrupted the supply chain process and the closure of production plants in some countries to curb the effect of the virus.

US Alcoholic Drinks Packaging Market Trends

Plastic to Witness the Growth

- Alcoholic beverages are increasingly embracing plastic packaging solutions. There is an increasing demand for stand-up and spouted pouches for various beverage packaging. However, the quality of beverages is affected by pH, storage temperature, pressure, and the presence of contaminants. Changes in the levels can alter the composition of the beverage. Companies are increasingly employing flexible packaging products with properties such as high barrier resistance (heat, moisture, and bacteria) to eliminate possible oxidation.

- The rapidly adopted tendency of lightweight packaging material, alongside the inclination towards reducing production, shipment, and handling costs, is driving the flexible plastic packaging of beverages.

- Logistics of glass packaging for beverages is expensive and inconvenient due to the large generation of breakage during transportation. Driven cost-effectiveness and ease of logistics offered by plastic packaging have encouraged multiple beverage companies to opt for it. Such likely implementation is expected to impact the studied market positively.

- Spouted stand-up pouches, a product commonly used for beverage packaging, are anticipated to witness an increase in their use for liquid packaging throughout the projection period because they are simple to stand up on store shelves for more effective and efficient display. The market under study is predicted to choose a low-cost option for liquid and beverage packaging, leading to the widespread use of spouted stand-up pouches since they are less expensive than the standard glass and stiff plastic used for beverage packaging.

Glass Bottles Expected to Hold Significant Market Share

- Glass is also often used in alcohol packaging since it is recyclable and may be reused endlessly without losing quality or purity. The water-resistant ability of glass helps avoid contamination of the flavor of alcohol in glass packaging.

- Increased demand for glass, such as liquor bottles, across the region, along with the factor driving the demand for beer bottles, is the shortage of cans, especially after shutdown orders due to the COVID-19 pandemic.

- Glass Bottles also offer great convenience in carrying and storage, making them a preferable choice by consumers. These factors are expected to promote the demand for glass bottle packaging for alcoholic drinks.

- More and more liquor manufacturers are becoming aware of using recycled materials in their packaging and raising the percentage of recycled glass used in their bottles. For instance, Absolut has vowed to minimize packaging waste by launching a limited-edition design made from 41% recycled glass.

- It does not influence the strength, smell, or flavor of the alcohol because it has a 0% rate of chemical interaction. As a result, the glass category is predicted to increase its region's alcohol drinks packaging market share.

US Alcoholic Drinks Packaging Industry Overview

The availability of several players providing packaging solutions for alcoholic beverages has intensified the competition in the market. Therefore, the market is moderately fragmented, with many companies developing expansion strategies.

- May 2022 - Coca-Cola UNITED Partners is partnering with O-I Glass to capture more recycled glass to be created into new glass bottles. Coca-Cola Bottling Company UNITED is committed to building a World Without Waste and has a goal of using 50% recycled material in their bottles by 2030.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 54348

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Purchasing Power of Consumers

- 5.1.2 Increasing Consumption of Alcoholic Drinks

- 5.2 Market Challenges

- 5.2.1 Increasing Environmental and Sustainability Concerns over Packaging

- 5.3 Assessment of the Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Primary Material

- 6.1.1 Glass

- 6.1.2 Metal

- 6.1.3 Plastic

- 6.1.4 Paper

- 6.2 By Alcohol Type

- 6.2.1 Wine

- 6.2.2 Spirits

- 6.2.3 Beer

- 6.2.4 Ready to Drink (RTD)

- 6.2.5 Other Alcohol Types

- 6.3 By Product Type

- 6.3.1 Glass Bottles

- 6.3.2 Metal Cans

- 6.3.3 Plastic Bottles

- 6.3.4 Cartons

- 6.3.5 Pouches

- 6.3.6 Other Product Types

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ball Corporation

- 7.1.2 Crown Holdings Inc.

- 7.1.3 Amcor PLC

- 7.1.4 Owens-Illinois Inc.

- 7.1.5 United Bottles & Packaging

- 7.1.6 Brick Packaging LLC

- 7.1.7 Berry Global Inc.

- 7.1.8 IntraPac International LLC

- 7.1.9 Encore Glass

- 7.1.10 WestRock LLC

- 7.1.11 Ardagh Group SA

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.