Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644950

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644950

Cooling Tower - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

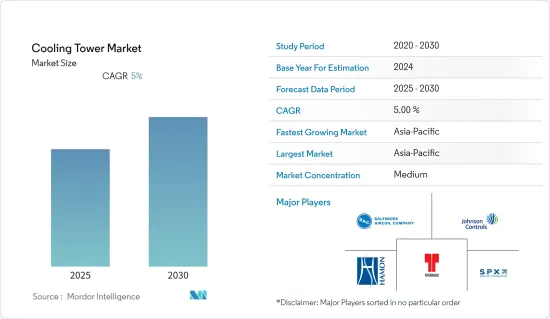

The Cooling Tower Market is expected to register a CAGR of 5% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing technological advancements in HVAC systems and construction activities are expected to increase the demand for a cooling tower market.

- On the other hand, the difficulty in operations, high operations, and maintenance costs are expected to hinder market growth.

- Nevertheless, the reignited interest in nuclear energy, where cooling towers are an essential part of the power plant, is expected to create huge opportunities for the cooling tower market.

- Asia-Pacific is expected to dominate the market during the forecasted period due to the region's increasing infrastructure development and HVAC product requirements, especially in countries like India and China.

Cooling Tower Market Trends

Power Generation Expected to Witness Growth

- A cooling tower is a device that dissipates the heat generated from various activities or processes in power plants, generally a stream of water. These towers either release heat by evaporating water using another coolant liquid in counter-flow or cross-flow fluid movement, or it relies entirely on air to bring the temperature down of the fluids utilized.

- These towers are critical in power generation facilities deployed in thermal and nuclear power plants. For instance, in thermal power plants, steam is condensed in the condenser using raw water or cooling water after expanding in the steam turbine to reuse that water (steam) in the cycle. The cooling water is heated by absorbing heat from the condenser's steam. This cooling water must cool before it can be reused in the condenser. As a result, this cooling water is cooled in the cooling tower either spontaneously or with the assistance of fans.

- Furthermore, the electricity generation from coal has increased significantly in recent years. In 2021 the electricity generated from coal was recorded at around 8.8% compared to 2020. In 2021 10244 TWh of electricity was generated from coal compared to 9439.3 TWh. A similar trend will be followed over the medium term during the forecasted period.

- Moreover, In September 2022, China approved 15 gigawatts of a new coal-fired thermal power plant in Shanghai, China. According to the Chinese department of energy, provincial governments across China approved plans to add 8.63 gigawatts (GW) of new coal power plants in the first quarter of 2022.

- Additionally, due to the Russia-Ukraine war, many countries suffered a gas supply shortage which significantly affected their power generation facilities and made countries like Japan and France reignite their interests in nuclear energy to meet the increasing electricity demands.

- Thus the power generation segment is expected to grow significantly during the forecasted period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is expected to witness significant growth during the forecasted period due to the increasing infrastructure development activities, increasing power generation through fossil fuels, increasing usage of HVAC products in the region, and increasing data centers. These increasing industries are expected to create significant demand for cooling towers in the region.

- The rapid pace of development of infrastructure around the region is increasing the demand for these structures. Construction activity in developing economies is driving demand for heating, ventilation, cooling, and refrigeration equipment, projected to drive the market. Thus, expanding transportation infrastructures such as airports, bridges, and port expansion is likely to drive market growth.

- Furthermore, India is experiencing tremendous growth in this area. Massive investments in industrial expansion would boost cooling tower growth in the country's area industry. Furthermore, the increased need for energy-efficient systems in the food and beverage industry will likely boost the market growth in the country and increase the worldwide cooling towers market share throughout the forecast period.

- Additionally, the electricity demand in the region is constantly increasing; the electricity generation increased by almost 8.4% in 2021 compared to 2020. In 2021 total electricity generated was 13994.4 TWh, and in 2020 total electricity generated was 12949.3 TWh. Although countries in the region are working on renewable energy sources to meet current electricity demands, many countries, such as Thailand, India, and China, are working on generating electricity through thermal power plants.

- For instance, According to the Ministry of Energy India, the country is preparing to add as much as 56 GW of coal-fired generation capacity by 2030 to meet the growing electricity demand. The increase in coal-fired capacity would represent about a 25% jump above the country's current 204 GW of coal-fueled generation from 285 coal thermal power plants.

- Thus due to the abovementioned points, the Asia-Pacific region is expected to dominate the market segment during the forecasted period.

Cooling Tower Industry Overview

The Global Cooling Tower Market is moderately fragmented. Some key players in this market (in no particular order) include Baltimore Aircoil Company Inc, Hamon, CIE, SPX Cooling Tech LLC, Johnson Control, and Thermax Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93646

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Oil Industry

- 5.1.2 HVACR

- 5.1.3 Chemical Industry

- 5.1.4 Power Generation

- 5.1.5 Others

- 5.2 Flow Type

- 5.2.1 Cross Flow

- 5.2.2 Counter Flow

- 5.3 Type

- 5.3.1 Evaporative Cooling Tower

- 5.3.2 Dry Cooling Tower

- 5.3.3 Hybrid Cooling Tower

- 5.4 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Russia

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Australia

- 5.4.3.4 Malaysia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 United Arab Emirates

- 5.4.4.3 Nigeria

- 5.4.4.4 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Columbia

- 5.4.5.4 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baltimore Aircoil Company Inc

- 6.3.2 Hamon and CIE

- 6.3.3 SPX Cooling Tech LLC

- 6.3.4 Johnson Control

- 6.3.5 Evapco Inc

- 6.3.6 Artech Cooling Towers Pvt. Ltd

- 6.3.7 Babcock and Wilcox Enterprises Inc

- 6.3.8 Brentwood Industries Inc

- 6.3.9 Enexio Management Gmbh

- 6.3.10 Thermax Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.