PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1331248

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1331248

Glucagon-Like Peptide-1 (GLP-1) Agonists Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028)

The Glucagon-like Peptide-1 (GLP-1) Agonists Market size is estimated at USD 11.87 billion in 2023, and is expected to reach USD 12.55 billion by 2028, growing at a CAGR of 1.12% during the forecast period (2023-2028).

The market is estimated to reach a value of about USD 13 billion by 2027.

The COVID-19 pandemic positively impacted the Glucagon-like Peptide-1 (GLP-1) Agonists Market. Diabetes and uncontrolled hyperglycemia are risk factors for poor outcomes in patients with COVID-19 including an increased risk of severe illness or death. People with diabetes have a weaker immune system, the COVID-19 complication aggravates the condition, and the immune system gets weaker very fast. People with diabetes have more chances to get into serious complications rather than normal people.

Glucagon-like peptide-1 receptor agonists (GLP-1RAs) are a class of medications used for the treatment of type 2 diabetes and some drugs are also approved for obesity. One of the benefits of this class of drugs over older insulin secretagogues, such as sulfonylureas or meglitinides, is that they have a lower risk of causing hypoglycemia. Besides being important glucose-lowering agents, GLP-1RAs have significant anti-inflammatory and pulmonary protective effects and an advantageous impact on gut microbes' composition. Therefore, GLP-1RAs have been potential candidates for treating patients affected by COVID-19 infection, with or even without type 2 diabetes, as well as excellent antidiabetic (glucose-lowering) agents during COVID-19 pandemic times.

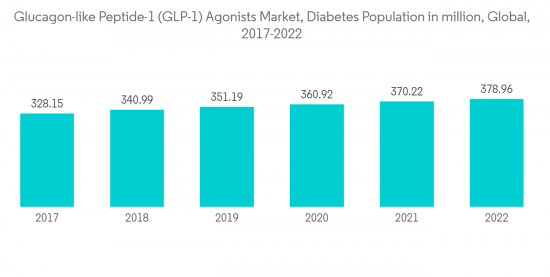

According to International Diabetes Federation (IDF), the adult diabetes population in 2021 is approximately 537 million, and this number is going to increase by 643 million in 2030. Technological advancements have increased over the period leading to several modifications either in the GLP-1RA drug or the formulations being developed.

Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

Glucagon-like Peptide-1 (GLP-1) Agonists Market Trends

Dulaglutide Segment Occupied the Highest Market Share in the Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year

Dulaglutide drug held the highest share of about 45.8% in the Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year.

According to International Diabetes Federation (IDF), the adult diabetes population in 2021 was approximately 537 million, which will increase by 643 million in 2030. Technological advancements increased over the period leading to several modifications in the GLP-1RA drug or the formulations being developed.

GLP1RAs are available internationally and are recommended for use when treatment escalation for type 2 diabetes is required after metformin and lifestyle management. They can be safely used with all other glucose-lowering therapies except vildagliptin. Dulaglutide (Trulicity) is a weekly subcutaneous GLP1RA that reduces HbA1c with additional weight loss and cardiorenal protection benefits. Therapy with dulaglutide allows many patients to reach and maintain target HbA1c without insulin and/or sulfonylureas, eliminating the associated hypoglycemia risk. GLP1RAs elicit greater weight reduction and are recommended over SLGT2 inhibitors when cerebrovascular disease other than heart failure or renal disease predominates.

Dulaglutide is fully funded for patients meeting special authority criteria in some countries. For instance, New Zealand guidelines recommend offering GLP1RAs to all patients with HbA1c levels above target, especially when GLP1RA use would provide additional reductions in cardiovascular risk and/or permit reduction or cessation of other therapies that contribute to weight gain or hypoglycemia.

Owing to the rising rate of obesity, growing genetic factors for type-2 diabetes, and the increasing prevalence and government support initiatives, the market will likely continue to grow.

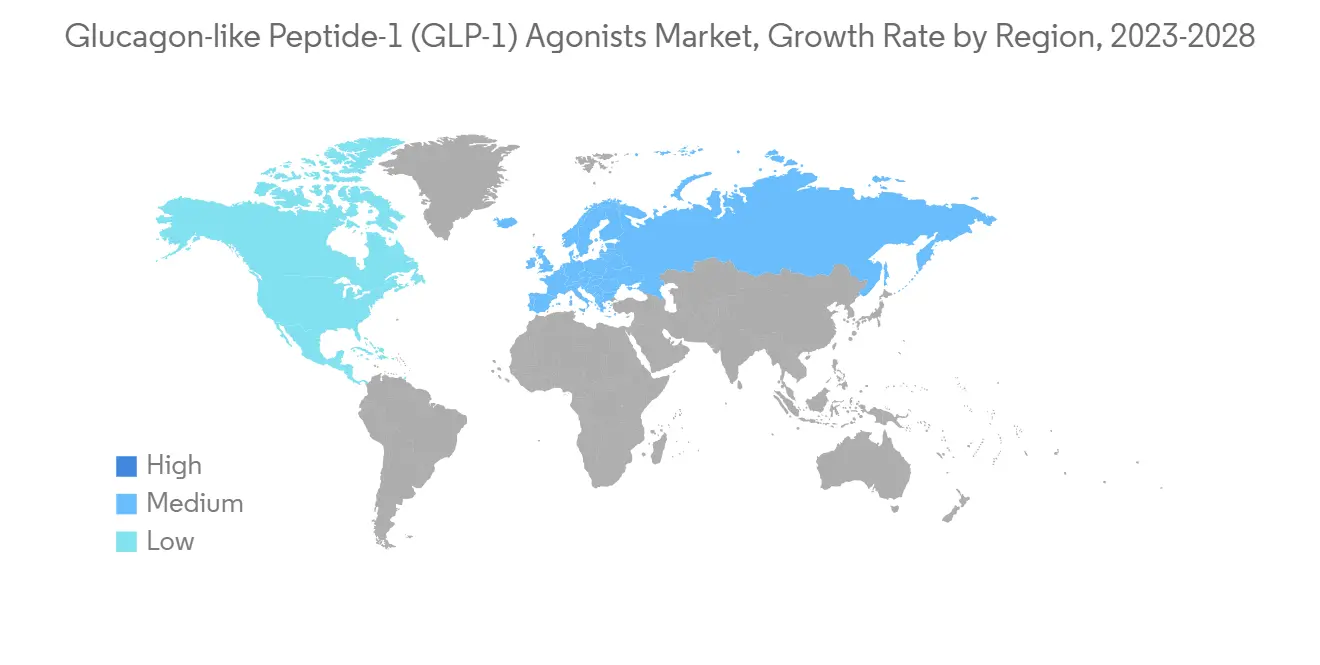

North American region held the highest market share in the Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year

North America held the highest market share of about 62.6% in the Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year.

The Centers for Disease Control and Prevention (CDC) National Diabetes Statistics Report 2022 estimated that more than 130 million adults are living with diabetes or prediabetes in the United States. Type 2 diabetes is more common, and diabetes is more consequential among communities of color, those who live in rural areas, and those with less education, lower incomes, and lower health literacy.

Health Canada is the third regulatory agency to provide more options for people interested in GLP-1 agonists. It approved the first and only GLP-1 agonist pill (Rybelsus by Novo Nordisk) for people with type 2 diabetes recently after approval by the European Medicines Agency and the US. GLP-1 RAs can be taken alone or in combination with other treatments for type 2 diabetes to improve blood glucose management, i.e., time in range. In addition to lowering blood glucose, they benefit heart health by reducing the risk of heart attack, stroke, and heart-related death. It is important because people with type 2 diabetes are at substantially higher risk of heart disease than those without diabetes.

Owing to the high prevalence of diabetes due to a sedentary lifestyle and the factors above market is expected to grow over the forecast period.

Glucagon-like Peptide-1 (GLP-1) Agonists Industry Overview

The GLP-1 market is consolidated, with major manufacturers, namely Eli Lilly, Sanofi, Novo Nordisk, AstraZeneca, etc., holding a presence in all regions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Drugs

- 5.1.1 Dulaglutide

- 5.1.1.1 Trulicity

- 5.1.2 Exenatide

- 5.1.2.1 Byetta

- 5.1.2.2 Bydureon

- 5.1.3 Liraglutide

- 5.1.3.1 Victoza

- 5.1.4 Lixisenatide

- 5.1.4.1 Lyxumia

- 5.1.5 Semaglutide

- 5.1.5.1 Ozempic

- 5.1.1 Dulaglutide

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 Spain

- 5.2.2.3 Italy

- 5.2.2.4 France

- 5.2.2.5 United Kingdom

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 Japan

- 5.2.3.2 China

- 5.2.3.3 Australia

- 5.2.3.4 India

- 5.2.3.5 South Korea

- 5.2.3.6 Malaysia

- 5.2.3.7 Indonesia

- 5.2.3.8 Thailand

- 5.2.3.9 Philippines

- 5.2.3.10 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Oman

- 5.2.5.4 Egypt

- 5.2.5.5 Iran

- 5.2.5.6 Rest of Middle East and Africa

- 5.2.1 North America

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 COMPANY PROFILES

- 7.1.1 Novo Nordisk

- 7.1.2 Sanofi

- 7.1.3 Eli Lilly

- 7.1.4 AstraZeneca

- 7.1.5 Boehringer Ingelheim

- 7.1.6 Pfizer

- 7.2 MARKET SHARE ANALYSIS

- 7.2.1 NovoNordisk

- 7.2.2 Sanofi

- 7.2.3 AstraZeneca

- 7.2.4 Others

8 MARKET OPPORTUNITIES AND FUTURE TRENDS