Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403081

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403081

Brazil Wind Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

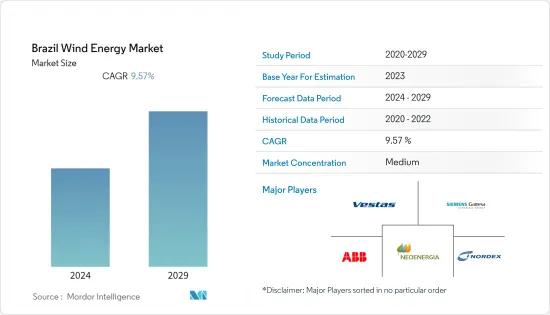

The Brazil Wind Energy Market size is expected to grow from 31.36 gigawatt in 2024 to 49.53 gigawatt by 2029, registering a CAGR of 9.57% during the forecast period.

Key Highlights

- Over the medium term, factors such as rising electricity demand and renewable capacity installation targets set by the government, are expected to drive the wind energy market in the country.

- On the other hand, the rising adoption of alternative clean energy sources, such as solar photovoltaics (PV), is anticipated to restrain the market's growth.

- Nevertheless, the growing regulation and incentive schemes by the government of Brazil are likely to create lucrative growth opportunities for the market during the forecast period.

Brazil Wind Energy Market Trends

Onshore Wind Energy Segment to Dominate the Market

- The onshore segment is likely to dominate the market during the forecast period. As of 2023, Brazil had 890 wind power plants located in 12 Brazilian states. The country has more onshore wind farms due to the inexpensive nature and flexibility of the projects, as the offshore projects have infrastructural and locational issues.

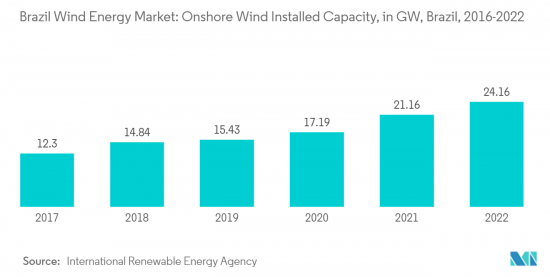

- In 2022, around 24.16 GW of onshore cumulative wind energy was installed in Brazil, while in 2021, the capacity was around 21.16 GW. The upscaled growth was due to government initiatives and investments by private companies.

- For instance, as of January 2023, Brazil's power sector regulator, ANEEL, announced its objective for installing more than 10 GW of new power generation capacity in 2023, of which more than 90% would come from wind and solar capacity.

- Furthermore, the growing size of wind turbines assisted in lowering the cost of wind energy, indicating that it is economically competitive with fossil fuel alternatives. For instance, according to Brazilian Wind Energy Association (ABEEolica), in mid-2022, the wind segment accounts for 12% of the country's electricity matrix, including 812 farms spanning 12 states. There are around 9,294 wind turbines in operation.

- In July 2022, Brazil's wind energy installation reached 22 GW of capacity, enough to supply energy to more than 28 million homes monthly. Brazil's increasing wind energy capacity is expected to directly boost the onshore market as the onshore capacity lead in the total installation.

- Onshore accounts for most installations in the wind sector across the country, and the installation is increasing significantly during the forecast period. These factors are estimated to drive growth in the onshore segment.

Rising Deployment of Solar PV is Likely to Restrain the Market Growth

- Brazil is expanding its renewable capacity significantly as the electricity demand is rising significantly across the country. The country also pledged to retire its fossil fuel-based power-generating facilities to reduce carbon emissions.

- Solar electricity generation in Brazil increased in recent years in line with global trends. According to the IRENA Statistics 2023, solar energy capacity in Brazil was around 24.079GW in 2022, an upscaled trend in the last five years, around 1.207GW in 2017. The trend is expected to be the same in the future too.

- According to the Brazilian Association of Photovoltaic Solar Energy statistics, solar photovoltaic electricity generation has continuously attained space in Brazil. As of February 2022, the installed generation capacity in Brazil surpassed 14GW, a more than 1,000-fold increase compared to 2013.

- Brazil is the largest solar energy market in the South American region. According to the Brazilian Association of Photovoltaic Solar Energy (ABSOLAR), as of October 2022, solar energy reached 13.48 GW of installed capacity. It became the third-largest source of the Brazilian electricity matrix.

- Under the latest plan, Plano Decenal de Expansao de Energia (PDEE) 2027, Brazil is expected to increase its non-hydro renewable energy to 28% of its electricity generation mix by 2027. Utility-scale solar and wind generation projects are expected to be rolled out under various auctions. The demand for renewable energy equipment is expected to remain high during the forecast period.

- The country witnessed large investments in the solar manufacturing sector, with significant investments in solar PV module manufacturing facilities, such as BYD's new solar PV module factory in Brazil, announced in September 2022. It drives the country's solar sector by securing the solar supply chain.

- Therefore, these factors impacted Brazil's wind energy market growth during the forecast period.

Brazil Wind Energy Industry Overview

The Brazilian wind energy market is moderately fragmanted. Some of the key players in the market (in no particular order) include Vestas Wind Systems AS, Nordex SE, Siemens Gamesa Renewable Energy SA, ABB Ltd, and Neoenergia SA., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 48480

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Wind Power Installed Capacity and Forecast in GW, until 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Electricity Demand

- 4.5.1.2 Renewable Capacity Installation Targets Set by the Government

- 4.5.2 Restraints

- 4.5.2.1 Rising Adoption of Alternative Clean Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vestas Wind Systems AS

- 6.3.2 Siemens Gamesa Renewable Energy SA

- 6.3.3 ABB Ltd

- 6.3.4 Nordex SE

- 6.3.5 Neoenergia SA

- 6.3.6 Xinjiang Goldwind Science & Technology Co. Ltd (Goldwind)

- 6.3.7 Acciona Energia SA

- 6.3.8 EDF SA

- 6.3.9 General Electric Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Regulation and Incentive Schemes by the Government of Brazil

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.