PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406050

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406050

Hospitality Industry in Mexico - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

The Hospitality Industry in Mexico Market is expected to register a CAGR of greater than 5.5% during the forecast period(2024-2029).

Mexico is renowned for its remarkable natural beauty, lush tropical climate, delectable traditional cuisine, and centuries-old culture, making it the most sought-after destination in Latin America. Tourism is a key component of the Mexican economy and has played a significant role in its development and growth. In recent years, Mexico has been at the forefront of the tourism industry, leading Latin America in the development of tourism-related trades and the provision of tourism-related services to visitors.

According to Mexican government estimates, there will be more than 6.5% more hotel rooms in summer 2023 than in 2022, and similar numbers as in 2019. The hospitality sector in Mexico accounts for a significant portion of the country's GDP, amounting to 3% and 30%, respectively. Over the past 20 years, Mexico has seen an increase in the number of domestic and international tourists, as well as in the number of services offered.

The adoption of digitalization across the tourism ecosystem undoubtedly contributed to the business's capacity to become more resilient in the aftermath of the COVID-19 pandemic. This is why it is essential to provide TAs with the necessary knowledge and insight into how technology providers, like HyperGuest can help them to improve their productivity and economic development in a highly interconnected tourism industry. Digitalization has significantly increased its value and reach, and HyperGuest is no different, as it eliminates obstacles and assists TAs to streamline, manage, and minimize transactions.

Mexico Hospitality Market Trends

Rising Number of Tourists to Mexico are Driving the Market

The Mexican government and the tourism industry have invested heavily in the development of the top destinations to make them more appealing to tourists. Additionally, numerous tourist excursions have been implemented to increase awareness of the top destinations. According to a report by Mexico News Daily, INEGI, the National Institute of Statistics and Geography, the number of foreign tourist arrivals rose by more than 9% in May 2023, reaching around 3.5 million, an increase of 276,000 from the previous year. Cancun is Mexico's largest airport by air arrivals. In the first half of 2023, the airport welcomed 1.6 million foreign visitors. The Mexican transport system plays a fundamental role in facilitating tourism, as it facilitates the transportation of domestic and international travelers from their local area to their final destination and vice versa.

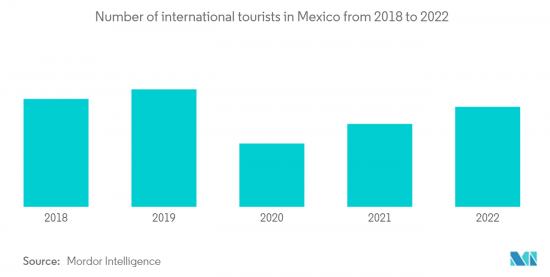

The Mexican tourism sector experienced a period of decline during the peak of COVID-19 but has seen a resurgence in recent months, with the Mexican government estimating that over 35 million international tourists visited the country during the period from January to July 2022.

Increased hotel occupancy in Mexico

Mexico's hotel occupancy rate for the month of August 2022 is 55.9%, which is 18.7% higher than the same time last year in 70 tourist spots, according to DataTur's Hotel Monitoring Results. The Mexican Caribbean tourism destinations experienced their highest hotel occupancy rates in the preceding three years in the first three months of 2022.

According to Statista, The average hotel occupancy rate in Mexico City in 2022 was around 58 percent, which is a whopping 72 percent higher than the same time last year. Hotels in Mexico City had been steadily increasing their occupancy rates from 2010 to 2018, with the peak being in '20, when it was 70.5%. In 2022, Cancun had the highest occupancy rate in Mexico, with almost 76 percent of hotel rooms booked. Riviera Maya came in second, with a similar percentage. Both places are in Quintana Roa.

Mexico Hospitality Industry Overview

The hospitality market in Mexico is highly fragmented. Even though Mexico has a high number of international chains present in the country, the hospitality industry is dominated by local players. There are around 180 international and domestic brands across Mexico. Grupo Posadas is the leader in the segment, with more than 140 hotels that are present across the country. The major players dominating the market are Grupo Posadas, InterContinental Hotels Group, Marriott International, Cityexpress Hoteles, and Grupo Real Turismo.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growth in the tourist attractions is also driving the market

- 4.1.2 Increased investments in hotels, restaurants and cafes

- 4.2 Market Restraints

- 4.2.1 Changing consumer preferences and demands

- 4.3 Market Opportunities

- 4.3.1 Rise in consumer preferences for luxury hotels and stays

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact of COVID-19 on the market

- 4.6 Insights on Revenue Flows from Accommodation and Food and Beverage Sectors

- 4.7 Insights on leading Cities in the Mexico with respect to number of visitors

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Chain Hotels

- 5.1.2 Independent Hotels

- 5.2 By Segment

- 5.2.1 Service Apartments

- 5.2.2 Budget and Economy Hotels

- 5.2.3 Mid and Upper mid scale Hotels

- 5.2.4 Luxury Hotels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Grupo Posadas

- 6.2.2 InterContinental Hotels Group

- 6.2.3 Marriott International

- 6.2.4 Cityexpress Hoteles

- 6.2.5 Grupo Real Turismo

- 6.2.6 AIM Resorts

- 6.2.7 RIU Hotels & Resorts

- 6.2.8 Grupo Real Turismo

- 6.2.9 Palace Resorts

- 6.2.10 Hoteles Mision*

7 MARKET FUTURE TRENDS

8 DISCLAIMER