Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690139

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690139

India Rooftop Solar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

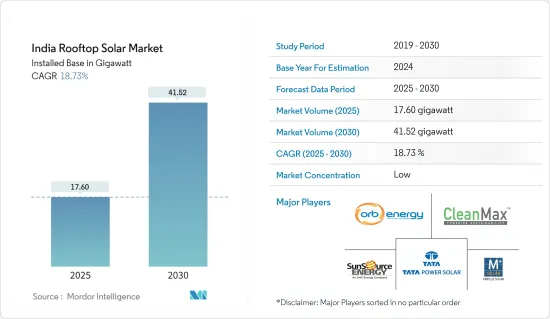

The India Rooftop Solar Market size in terms of installed base is expected to grow from 17.60 gigawatt in 2025 to 41.52 gigawatt by 2030, at a CAGR of 18.73% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as increasing demand in the commercial and industrial sectors and government emphasis on renewable energy integration are expected to be significant drivers for the market's growth.

- On the other hand, slow-paced installation of rooftop projects may likely restrain the growth of the Indian rooftop solar market over the coming years.

- Nevertheless, the untapped solar potential and focus on increasing decentralization would enable residential and industrial customers to rely less on central grids, which is expected to be a growth opportunity during the forecast period.

India Rooftop Solar Market Trends

The On-grid Segment is Expected to Dominate the Market

- In the on-grid rooftop system, photovoltaic panels or arrays are connected to the utility grid through a power inverter unit, allowing them to operate in parallel with the electric utility grid. The electricity generated by consumers is fed into the central power grid through a net-metering scheme. Such kind of connection is commonly used by commercial, industrial, and residential consumers to reduce electricity bills.

- In India, on-grid or grid-connected solar PV systems have witnessed significant growth in recent years owing to the various government policies and initiatives. This is likely to support the country in achieving its 2030 national renewable energy target.

- The country introduced the Grid Connected Solar Rooftop Scheme to promote solar rooftop installation by the state and central government. India aims to achieve a cumulative installed capacity of about 40,000 MW from Grid Connected Rooftop solar projects by the end of March 2026.

- For instance, the Ministry of New and Renewable Energy launched the Rooftop Solar Programme Phase-II scheme in March 2019 to reach the set targets. Under the scheme, the ministry is expected to provide consumers with Central Financial Assistance (CFA) for installing Rooftop Solar (RTS) in individual households or Resident Welfare Associations/Group Housing Societies.

- In September 2023, the National Portal was launched to ease the online process for consumers to install RTS. Residential consumers from any part of the country are eligible to apply for the installation of rooftop solar panels and receive a subsidy directly in their bank accounts.

- According to the Ministry of New and Renewable Energy (MNRE), during the 2023-2024 period, the cumulative solar rooftop installed capacity connected to the grid reached 11.8 GW, representing an increase of 33.86% from 8.9 GW in the 2022-2023 period. Several large-scale solar energy projects were operational and connected to the grid during 2023, which was majorly responsible for the sharp increase in the installed capacity.

- Gujarat, Maharashtra, and Karnataka are the states with the highest on-grid rooftop solar PV installed capacity. Until March 2024, Gujarat generated 3.45 GW, while Karnataka and Rajasthan generated around 7.9 GW and 1.15 GW, respectively.

- Overall, factors including the increasing adoption of rooftop solar energy for power generation, government support in the form of supportive policies, schemes, and ambitious renewable targets are expected to witness significant growth of the on-grid segment in the Indian solar rooftop market during the forecast period.

Government Emphasis on Renewable Energy Integration is Expected to Drive the Market

- According to the Ministry of New and Renewable Energy (MNRE), India secured the fifth position globally in the deployment of solar power. As of June 30, 2023, the country commissioned solar projects with a total capacity of 70.10 GW. This capacity comprised 57.22 GW from ground-mounted solar projects, 10.37 GW from rooftop solar projects, and 2.51 GW from off-grid solar projects.

- As of March 2023, the rooftop solar capacity increased to 8,877 MW, compared to 7,520 MW as of September 30, 2022. The primary factors attributed to this growth included heightened awareness among residential consumers and government subsidies targeted toward the residential segment.

- The government has formulated comprehensive policies and regulations to support rooftop solar deployment. The government took several net metering initiatives, which allow rooftop solar users to sell excess electricity generated back to the grid, providing financial benefits and promoting grid stability.

- For instance, in March 2024, the Rajasthan Electricity Regulatory Commission (RERC) raised the limit for net metering from 500 kW to 1 MW for rooftop solar installations. The Commission's decision, made through a suo motu order, aims to promote the adoption of rooftop solar installations by expanding the net metering capacity.

- Further, in November 2023, the Tamil Nadu Electricity Regulatory Commission (TNERC) issued a new order endorsing the state government's directive to exempt 50% of network charges for rooftop solar consumers in the MSME sector.

- As of March 2023, the MNRE quoted that about 404 MW of rooftop solar capacity was installed against the target of 357.9 MW up to January 2023, a decline from 678 MW since the previous financial year.

- In August 2023, the Maharashtra Electricity Regulatory Commission proposed amendments in regulations to increase the capping of net metering to 1 MW for solar rooftop projects. The net-metering applicability stood around 500 kW for rooftop solar plants in most Indian states as mandated by MNRE. The approval of proposed amendments might lead to an increase in the adoption of rooftop solar projects by large consumers. This might benefit the development of the solar rooftop market in India.

- These government incentives usually include subsidies, tax credits, grants and loan programs, and additional green credits. The Indian government is rolling out new fiscally attractive incentive schemes for residential, commercial, and industrial (C&I) solar PV systems. This will likely drive the market during the forecast period.

India Rooftop Solar Industry Overview

The Indian rooftop solar market is fragmented. Some key players in this market include Clean Max Enviro Energy Solutions Pvt. Ltd, Tata Power Solar Systems Limited, Orb Energy Pvt. Ltd, Amplus Solar Power Private Limited, and Sunsource Energy Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 70202

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Emphasis Towards Renewable Energy Integration

- 4.5.1.2 Increasing Demand in the Commercial and Industrial Sector

- 4.5.2 Restraints

- 4.5.2.1 Slow-Paced Installation of Rooftop Projects

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 End-user

- 5.1.1 Industrial

- 5.1.2 Commercial (Including Public Sector)

- 5.1.3 Residential

- 5.2 Grid Type (Qualitative Analysis Only)

- 5.2.1 On-grid

- 5.2.2 Off-grid

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Cleantech Energy Corporation Pte Ltd

- 6.3.2 Fourth Partner Energy Pvt. Ltd

- 6.3.3 Amplus Solar Power Pvt. Ltd

- 6.3.4 Clean Max Enviro Energy Solutions Pvt. Ltd

- 6.3.5 Sunsource Energy Pvt. Ltd

- 6.3.6 Orb Energy Pvt. Ltd.

- 6.3.7 Tata Power Solar Systems Limited

- 6.3.8 Mahindra Susten Pvt. Ltd

- 6.3.9 Growatt New Energy Technology Co. Ltd

- 6.3.10 Roofsol Energy Pvt. Ltd

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Untapped Solar Potential and Focus to Increase Decentralization

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.