PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406255

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406255

South Africa Refined Petroleum Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

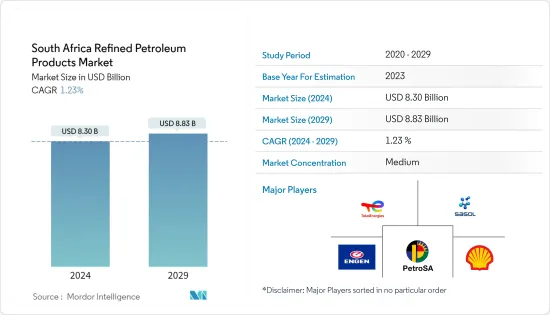

The South Africa Refined Petroleum Products Market size is estimated at USD 8.30 billion in 2024, and is expected to reach USD 8.83 billion by 2029, growing at a CAGR of 1.23% during the forecast period (2024-2029).

The South Africa refined petroleum products market is estimated to be at USD 8.20 billion by the end of this year and is projected to reach USD 8.72 billion in the next five years, registering a CAGR of over 1.23% during the forecast period.

Key Highlights

- Over the medium term, the increasing infrastructure development activities in the country and the growing population are expected to drive the market during the forecasted period.

- On the other hand, an increasing fluctuation in crude oil prices is expected to hinder the market's growth during the forecasted period.

- Nevertheless, the increasing investments in the petrochemical market are expected to create huge opportunities for the refined petroleum products market.

South Africa Petroleum Market Trends

Automotive Gas Oil (AGO) to Dominate the Market

- Automotive Gas Oil (AGO), commonly known as diesel fuel, is expected to dominate the South African refined petroleum products market.

- Automotive Gas Oil is widely used in various sectors, including transportation, mining, agriculture, and construction. South Africa's industrial and transportation sectors heavily rely on diesel-powered vehicles and equipment, making Automotive Gas Oil a crucial fuel for these industries.

- Moreover, South Africa has a significant demand for heavy-duty vehicles such as trucks, buses, and mining equipment. These vehicles require diesel fuel due to their higher energy density and better torque characteristics, making AGO the fuel of choice for such applications.

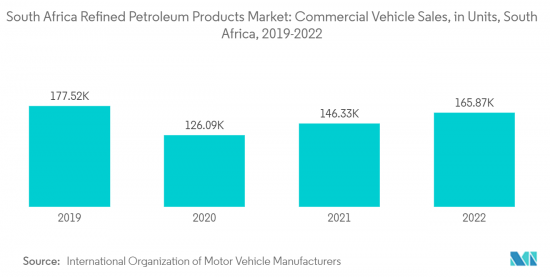

- For instance, according to the International Organization of Motor Vehicle Manufacturers, the sales of commercial vehicles in South Africa grew by more than 13% between 2021 and 2022. Signifying increased purchases of commercial vehicles, consequently increasing the demand for Automotive Gas Oil.

- Furthermore, in May 2023, according to the announcement made by the Department of Energy, there was an expected decrease of approximately 80 cents per liter in petrol prices for the upcoming time. Similarly, diesel prices are anticipated to decrease by around 90 cents per liter. The primary factor behind this price relief is the decrease in the cost of oil, which has led to a reduction in international product prices. As a result, there is an excess recovery of between USD 0.069 and USD 0.075 per liter.

- Therefore as per the above-mentioned points, the Automotive Gas Oil segment is expected to dominate the market during the forecasted period.

Increasing Demand for Petroleum Products to Drive the Market

- As the economy of the country is growing, there is a rise in industrial activities, construction projects, and transportation needs. These sectors heavily rely on refined petroleum products like gasoline, diesel, and jet fuel, driving the demand for such products.

- South Africa's population steadily increases, increasing energy consumption and transportation requirements. Urbanization further contributes to the demand for refined petroleum products as cities expand and transportation infrastructure develops.

- Moreover, the transportation sector, including private vehicles, commercial fleets, and public transportation, is a major consumer of refined petroleum products. As the number of vehicles on the road increases, so does the demand for gasoline and diesel.

- Furthermore, refined petroleum products are essential for various industries, including manufacturing, mining, agriculture, and construction. These sectors rely on petroleum products for fueling machinery and equipment, creating a consistent demand for such products.

- According to Statistical Review of World Energy 2023, primary energy consumption in South Africa amounted to 4.82 exajoules in 2022, down from five exajoules in the previous year.

- Various manufacturing sites are also inaugurated in the country; for instance, in October 2022, ALPLA Group inaugurated a cutting-edge manufacturing facility in Lanseria, located near Johannesburg. This new headquarters for Sub-Saharan Africa consolidates five former South African sites into a single location, bringing together all ALPLA technologies, processes, and materials. The Lanseria plant serves as a hub for the company's regional operations. Also, ALPLA will launch its first apprenticeship program in Africa in 2023.

- Therefore, as per the above points, the increasing demand for Refined Petroleum Products is expected to drive the market during the forecasted period.

South Africa Petroleum Industry Overview

South Africa's refined petroleum products market is semi fragmented. Some of the major players in the market (in no particular order) include TotalEnergies SE, ENGEN PETROLEUM LTD, PetroSA, Shell PLC, and Sasol Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Refined Petroleum Products Market in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Economic Growth

- 4.5.1.2 Infrastructure Development

- 4.5.2 Restraints

- 4.5.2.1 Fluctuating Crude Oil Prices

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Refined Products

- 5.1.1 Illuminating Paraffin

- 5.1.2 Fuel Oil

- 5.1.3 Automotive Gas Oil (AGO)/Diesel

- 5.1.4 Premium Motor Spirit (PMS)

- 5.1.5 Liquefied Petroleum Gas (LPG)

- 5.1.6 Other Refined Products

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 TotalEnergies SE

- 6.3.2 ENGEN PETROLEUM LTD.

- 6.3.3 PetroSA

- 6.3.4 Shell PLC

- 6.3.5 Sasol Limited

- 6.3.6 Astron Energy (Pty) Ltd.

- 6.3.7 BP Southern Africa (Pty) Ltd.

- 6.3.8 Chevron Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Petrochemical Industry Development