PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406934

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406934

Germany Milk Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

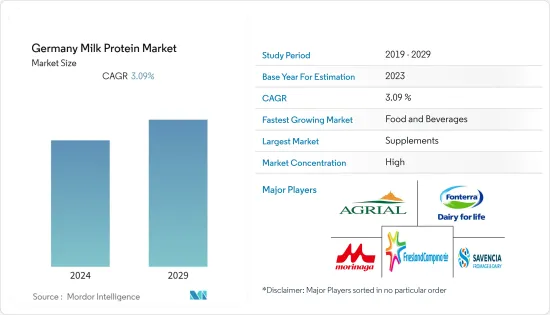

The Germany milk protein market was valued at USD 33.9 million and is expected to register a CAGR of 3.09% over the next five years.

Key Highlights

- The superior qualities and functionalities of milk protein isolate, such as high protein content with lower carbs and lower lactose content, make them the leading protein ingredient. Additionally, its functionalities, along with increasing diversified scope innovations in the market, are escalating its demand in the food and beverage sector, especially in the bakery industry. Its increased demand in the personal care sector and rising research confirming its benefits, such as reducing allergic infections, are projected to drive the segment. In addition, Germans are consuming more functional food overall, including more protein-rich items like milk protein, as a result of expanding disposable income and population growth.

- Moreover, as the majority of food manufacturing companies shift towards producing healthy snack options, there is an increasing need for milk proteins in processed foods that are high in protein. Along with the increased demand for nutrition-based products in clinical nutrition, infant formula, and sports, rising knowledge about functional foods and dietary supplements like milk proteins is anticipated to fuel market expansion. The rising awareness regarding its functionalities that make the infant formula easier to digest and help athletes build lean bodies makes it the fastest-growing segment. Further, customers are becoming more aware of the advantages of including enough protein in their diets as health and well-being are prioritized, which is driving up demand for milk protein products.

Germany Milk Protein Market Trends

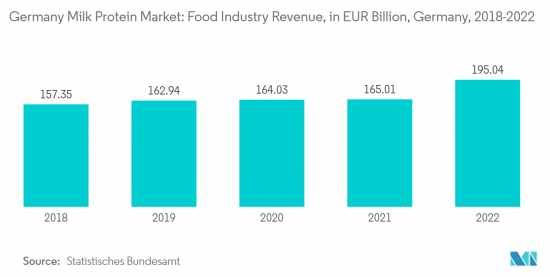

Increasing Demand for Milk Protein in Food and Beverages Industry

- The food and beverage industry holds a significant market share in milk protein application. Milk's protein concentration makes it a useful ingredient in functional foods intended for weight control or as meal replacements because it can increase feelings of satiety and fullness. Milk proteins have stabilizing and emulsifying qualities that are useful for preventing component separation and achieving smooth textures in a variety of food and beverage formulations. For instance, Fonterra launched SureProteinTM SoftBar 1000, a milk protein that is exceptionally soft with a relatively short chew-to-bar formulation.

- The ingredient was developed to address the high protein, low sugar formulation needs of consumers. The demand for milk proteins in protein-rich processed foods is growing as the majority of food manufacturing companies are moving toward health-snacking options. Also, the increasing awareness about functional foods and dietary supplements, such as milk proteins, along with the rising demand for nutrition-based products in clinical nutrition, infant formulas, and sports, is expected to drive the growth of the market.

Milk Protein Concentrates holds the Largest Market Share

- Casein and whey are major proteins present in milk. Hence, the high production of milk in the country also drives the milk protein market. To improve the nutritional value of a variety of food products, including yogurt, cheese, ice cream, and bakery goods, milk protein concentrates are used to boost the protein level.

- In addition, meal replacement solutions that use milk protein concentrates provide a convenient and well-balanced source of important nutrients. For instance, Epi Ingredients launched Epiprot 60 UL milk protein concentrate containing 60% native proteins, which is also available in Germany.

- Moreover, milk protein concentrates are a type of protein that is used in infant formulae to imitate the protein structure of human breast milk, which supplies vital nutrients for a baby's growth and development. Furthermore, the growing health consciousness among Germans also drives the market. In order to provide additional health benefits and enhance the texture and mouthfeel of the drink, milk protein concentrates are used in the preparation of protein-enriched beverages, smoothies, and nutritional drinks. Thus, all the above-mentioned factors drive the milk protein market in the country.

Germany Milk Protein Industry Overview

The Germany milk protein market is consolidated. The major players in this market are Agrial Group, Fonterra Co-operative Group Limited, Morinaga Milk Industry Co., Ltd., Royal FrieslandCampina N.V., and Savencia Fromage & Dairy (sorted alphabetically). Major companies are focusing on offering milk proteins for various application industries. Further, the companies have been introducing new and innovative ingredients using milk proteins so as to make their product unique from the existing products. Owing to the rapidly developing nature of the market, new product innovation has become the most commonly used strategy among all, as it helps in understanding the changing needs of the various application industries in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Functional Food and Beverages

- 4.1.2 Growing Milk Protein Concentrates Application in Processed Food Products

- 4.2 Market Restraints

- 4.2.1 Competition from Vegan/Plant-based Protein Powders

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 Market Segmentation

- 5.1 Form

- 5.1.1 Concentrates

- 5.1.2 Isolates

- 5.2 End-User

- 5.2.1 Animal Feed

- 5.2.2 Food and Beverages

- 5.2.2.1 Bakery

- 5.2.2.2 Beverages

- 5.2.2.3 Breakfast Cereals

- 5.2.2.4 Condiments/Sauces

- 5.2.2.5 Dairy and Dairy Alternative Products

- 5.2.2.6 RTE/RTC Food Products

- 5.2.2.7 Snacks

- 5.2.3 Supplements

- 5.2.3.1 Baby Food and Infant Formula

- 5.2.3.2 Elderly Nutrition and Medical Nutrition

- 5.2.3.3 Sport/Performance Nutrition

6 Competitive Landscape

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Agrial Group

- 6.3.2 Fonterra Co-operative Group Limited

- 6.3.3 Hoogwegt Group

- 6.3.4 Lactoprot Deutschland GmbH

- 6.3.5 LAITA

- 6.3.6 MEGGLE GmbH & Co.KG

- 6.3.7 Morinaga Milk Industry Co., Ltd.

- 6.3.8 Royal FrieslandCampina N.V

- 6.3.9 Savencia Fromage & Dairy

- 6.3.10 GNC Holdings, LLC

- 6.3.11 GEA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS