Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692018

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692018

Asia-Pacific Milk Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 228 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

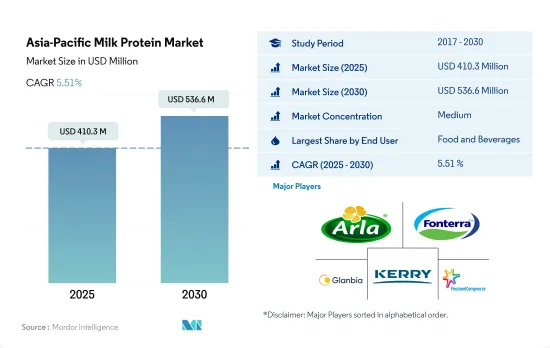

The Asia-Pacific Milk Protein Market size is estimated at 410.3 million USD in 2025, and is expected to reach 536.6 million USD by 2030, growing at a CAGR of 5.51% during the forecast period (2025-2030).

Food and beverages leads the market with 84% market share, supported by the varied usage of milk protein in snacks, beverages, and bakery industries

- The higher functionality of milk proteins drives their application in the F&B segment in combination with other protein sources. To cater to more health-conscious consumers, manufacturers have produced a variety of beverages, reduced-fat snacks, and more in bakeries as egg replacements. Nutritionally fortified foods offer a significant opportunity for the business in the milk protein segment. The trend in protein across food and beverages makes protein fortification a top choice, and consumers are looking for protein and fiber claims while purchasing. The milk protein market is majorly dominated by the F&B sector in 2023, where 84% by value of its application is shared by the snacks, beverages, and bakery industries.

- Milk proteins account for a large portion of the supplements market, primarily rising in baby formula at a CAGR of 5.08% by value over the forecast period. Packaged baby foods are common in cities because they provide appropriate nutrients for infants. In 2021, the female labor force participation rate in India was 19.23%. An increase in the number of working mothers has encouraged infant food firms to create nutrient-rich products like milk protein supplements to meet the region's growing demand for easy nourishment.

- Milk protein's high efficacy in egg replacement is boosting its demand in the bakery industry. It had an application share of 53% by volume in 2022. For countries like China, where Avian flu is a budding concern, milk protein is expected to surge further amid egg replacement trends. Milk protein ingredients help formulators meet growing consumer demand for more nutritious and delicious bakery offerings across a wide range of applications such as bread, cakes, pastries, cookies, and crackers, as well as icings, fillings, and glazes.

With country's experiencing a shift in population's acceptance of healthy and protein-fortified drinks. India ranked 3rd behind China and Rest of Asia-Pacific countries

- In 2022, China maintained its top position. Milk protein's increased appeal in specialist product categories such as newborn nutrition, clinical diets, sports, and weight training was ascribed to this. High-protein goods have recently received significant public attention in China, identifying protein as one of the most desired elements before food purchase. In 2020, over 36% of Chinese citizens were interested in purchasing high-protein food products. The country is expected to have the biggest development potential throughout the forecast period, with a CAGR of 5.01% in terms of value.

- Next to China, India has been witnessing a constant rise in health-conscious consumers. The steady rise in obesity rates among Indians has shifted the population's acceptance of healthy and protein-fortified drinks. In 2021, the percentage of overweight women rose from 20.6% to 24%, while in men, the number increased from 18.9% to 22.9%. Milk proteins help reduce overall calorie intake and decrease the desire for sweet and high-calorie foods. When combined with a regular exercise routine, MPI or MPC can help people lose weight healthily and sustainably. Hence, the country is projected to have the second-fastest growth in the forecast period, with a CAGR of 4.62% by value.

- The supplement segment of the milk protein market is projected to register a CAGR of 2.90% by value in the forecasted period in Australia. The substantial growth of key application sectors like medicinal and sports nutrition supplements is anticipated to drive the milk protein market for dietary supplements in the coming years. In 2021, nearly half of Australians of all ages (46.6%) had one or more chronic conditions, and almost one in five (18.6%) had two or more chronic conditions.

Asia-Pacific Milk Protein Market Trends

Increasing number of health and fitness centers is driving the market

- The industry is driven by increased health-related concerns and expanding membership at health clubs. The increasing number of fitness clubs/health clubs further fosters the availability of consumers and their involvement rate. For instance, in 2020, China had the most health and fitness clubs in the region, with 27,000 clubs. South Korea and Japan had 6,590 and 4,950 fitness clubs, respectively.

- The increase in the number of health and fitness clubs majorly impacts the market as they are the major marketplace for sports nutrition products in the region. According to the International Health, Racquet, and Sportsclub Association (IHRSA), there is an increase in fitness franchises in the region, driving sales of the sports nutrition segment. The IHRSA launched national and state-level grassroots campaigns, ranging from reopening health clubs to urging lawmakers to include the health and fitness industry in any COVID-19 relief package, as more than 79,000 fitness professionals and consumers took action on IHRSA campaigns relating to the pandemic.

- The importance of leading a healthy lifestyle fuels the sports nutrition marketplace. The accelerated growth of the Indian sports nutrition market in the last few years has been spurred primarily by the huge growth in the Indian sports industry, strong demand for various health supplements and energy drinks among athletes and bodybuilders, and increasing youth participation in sports and activities that require a high level of fitness and nutrition. Protein supplements lead the market, accounting for a share of 70% of the overall consumption in this segment. The Indian sports nutrition market currently lies in the unorganized sector, with a market size of over INR 1,300 crore and a Y-o-Y growth of about 25%.

Government initiatives are supporting the milk production in developing countries such as India

- The graph given depicts the total production of cow milk and goat milk, as these are commonly used raw materials for milk proteins. In the region, India and China are the highest milk-producing countries, accounting for nearly 80% of production. The strongest gains over the past decade have been registered in Southeast Asia, where a lack of traditional consumption of fresh milk, combined with low tariffs, has led to imported milk products accounting for nearly one-quarter of domestic requirements in the subregion. Milk production in Asia is likely to be the primary driver of global output, which continues to be driven by rising dairy cattle numbers and increasing milk collection efficiency in India and Pakistan, with rising output in large-scale farms in China.

- China's milk production in the region increased by 4.5% to more than 34.5 MMT in 2021. This is due to improved productivity, which caused China's production and consumption of milk to grow rapidly. Imports are also showing positive growth due to consumer demand and requirements for the manufacturing industries in China. Skim milk powder, which is majorly used for milk protein production, has increased due to the Chinese food industry's dependence on imported skim milk powder.

- In countries like India, milk production is highly supported by government authorities implementing specific regulations in different states. To boost milk output in India, the Uttar Pradesh state government is establishing milk conservation centers and greenfield dairies. According to production data from the Food and Agriculture Organization Corporate Statistical Database (FAOSTAT), India is the highest milk producer and ranks first position in the world, contributing 24% of global milk production in the year 2021-22.

Asia-Pacific Milk Protein Industry Overview

The Asia-Pacific Milk Protein Market is moderately consolidated, with the top five companies occupying 49.32%. The major players in this market are Arla Foods amba, Fonterra Co-operative Group Limited, Glanbia PLC, Kerry Group PLC and Koninklijke FrieslandCampina N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90177

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 End User Market Volume

- 3.1.1 Baby Food and Infant Formula

- 3.1.2 Bakery

- 3.1.3 Beverages

- 3.1.4 Breakfast Cereals

- 3.1.5 Condiments/Sauces

- 3.1.6 Confectionery

- 3.1.7 Dairy and Dairy Alternative Products

- 3.1.8 Elderly Nutrition and Medical Nutrition

- 3.1.9 Meat/Poultry/Seafood and Meat Alternative Products

- 3.1.10 RTE/RTC Food Products

- 3.1.11 Snacks

- 3.1.12 Sport/Performance Nutrition

- 3.1.13 Animal Feed

- 3.1.14 Personal Care and Cosmetics

- 3.2 Protein Consumption Trends

- 3.2.1 Animal

- 3.3 Production Trends

- 3.3.1 Animal

- 3.4 Regulatory Framework

- 3.4.1 Australia

- 3.4.2 China

- 3.4.3 India

- 3.5 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Form

- 4.1.1 Concentrates

- 4.1.2 Isolates

- 4.2 End User

- 4.2.1 Animal Feed

- 4.2.2 Food and Beverages

- 4.2.2.1 By Sub End User

- 4.2.2.1.1 Bakery

- 4.2.2.1.2 Beverages

- 4.2.2.1.3 Breakfast Cereals

- 4.2.2.1.4 Condiments/Sauces

- 4.2.2.1.5 Dairy and Dairy Alternative Products

- 4.2.2.1.6 RTE/RTC Food Products

- 4.2.2.1.7 Snacks

- 4.2.3 Personal Care and Cosmetics

- 4.2.4 Supplements

- 4.2.4.1 By Sub End User

- 4.2.4.1.1 Baby Food and Infant Formula

- 4.2.4.1.2 Elderly Nutrition and Medical Nutrition

- 4.2.4.1.3 Sport/Performance Nutrition

- 4.3 Country

- 4.3.1 Australia

- 4.3.2 China

- 4.3.3 India

- 4.3.4 Indonesia

- 4.3.5 Japan

- 4.3.6 Malaysia

- 4.3.7 New Zealand

- 4.3.8 South Korea

- 4.3.9 Thailand

- 4.3.10 Vietnam

- 4.3.11 Rest of Asia-Pacific

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 5.4.1 Arla Foods amba

- 5.4.2 Fonterra Co-operative Group Limited

- 5.4.3 Glanbia PLC

- 5.4.4 Groupe LACTALIS

- 5.4.5 Kerry Group PLC

- 5.4.6 Koninklijke FrieslandCampina N.V.

- 5.4.7 Milligans Food Group Limited

- 5.4.8 Morinaga Milk Industry Co. Ltd

- 5.4.9 Olam International Limited

6 KEY STRATEGIC QUESTIONS FOR PROTEIN INGREDIENTS INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.