PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406963

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406963

China Pea Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

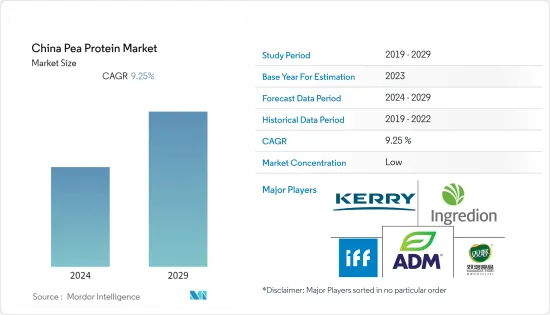

The China pea protein market size is expected to grow from USD 166.52 million in 2024 to USD 259.2 million by 2029, at a CAGR of 9.25% during the forecast period (2024-2029).

Key Highlights

- The increasing lactose-intolerant population in the country, coupled with the rise in the demand for plant-based products owing to their nutritional benefits, low cholesterol, and alternative to meat products, are driving the market's growth in the country. Lactose intolerance is 'an impaired ability to digest lactose, a sugar found in milk and other dairy products, and according to ProCon.org, in 2022, 85% of China's population is lactose intolerant.

- Additionally, due to sustainability concerns and social reasons, the majority of the population in China is vegetarian, vegan, or flexitarian, which is raising the market's demand. This has eventually raised the popularity of plant-based foods and gluten-free products and the nutritional benefits of pea-based products in the country.

- Moreover, owing to the growing number of customers who are concerned about their health, the demand for products with clean-label ingredients, without synthetic ingredients and genetically modified organisms (GMOs), is rising. In line with this, pea protein gains an advantage here, and consumers find it intriguing because it is natural and has non-GMO properties.

- Furthermore, with major players in the country offering pea protein ingredients with multiple application capabilities and functional properties, manufacturers are attracted to incorporate such ingredients into their products to gain the upper hand in the market. Eventually, consumers are also inclined toward such clean-label products.

- For instance, Cargill. Inc. offers RadipureTM, a pea protein claimed to be developed and manufactured for Asian markets, including China. Radipure™ pea protein offers the solubility and flavor profile that customers need for food application development. The company claims that Radipure pea protein has label-friendly, low-allergenic, and non-GMO features and is a highly versatile ingredient that can be used in dairy, ready-to-drink beverages, bakery, and meat alternatives. Such factors are further expected to boost the market's growth during the forecast period.

China Pea Protein Market Trends

Growing Inclination Towards Plant-Based Protein Sources

- The emergence of vegetable protein from sources like peas demonstrates a change in Chinese customer demand from animal protein to plant protein with similar functional and nutritional characteristics. This incremental shift toward a plant-based diet is primarily influenced by various factors, including ecological concerns, health consciousness, ethical or religious beliefs, and environmental and animal rights in China.

- Health concerns like the increasing diabetic population and obesity are further driving consumers toward plant-based diets and protein sources like pea protein. For instance, according to the International Diabetes Federation (IDF), in 2021, China is the country with the highest number of diabetics worldwide, with around 141 million people suffering from the disease.

- Pea proteins are suitable supplements to ensure the supply of sufficient protein when not consuming animal products, which acts as a key reason for its increased application in the sector. Its better taste and texture are the indisputable attributes attracting flexitarians toward the product. Although meat proteins provide the body with the necessary amino acid content, they are also associated with high cholesterol levels, obesity, digestion problems, and other related health issues. Thus, consumers in the country are increasingly seen preferring vegan or vegetarian protein sources such as pea protein. Thus, manufacturers in the country are concentrated on offering pea protein ingredients with high quality and organic claims to grow in the market.

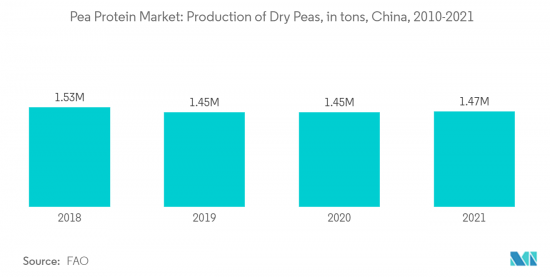

- Moreover, the increased production of peas in the country is making it easier for them to produce better ingredients with enhanced functionality, which is attracting more businesses in the country. Similarly, players are also able to reach and cater to the required demand for pea protein in the country, owing to this increased production.

- For instance, according to Food and Agirculture Oraganization (FAO), in 2021, the production of dry peas in China accounted for about 1.47 million tons, which increased from 1.45 million tons when compared to the previous year. Moreover, the rising incidences of obesity, cardiovascular diseases, and diabetes among the Chinese population prompted consumers to adopt vegan diets. For those who are allergic to milk protein, pea protein offers an alternative source of protein.

Food and Beverages Accounts the Largest Market Share

- Customers are more receptive to pea protein ingredients. They are becoming more interested in wholesome cuisine regarding food, peas, and beans, which are incredibly adaptable and a great source of important nutrients. Pea proteins have gained popularity in China majorly due to their unrivaled benefits, including their functional attributes in food applications, high nutritional quality, abundance, and availability across the country.

- According to the research article 'The Current Situation of Pea Protein and Its Application in the Food Industry,' published in the journal, 'Molecules, 'National Centre of Biological Information, pea protein has excellent functional properties, including solubility, water and oil-holding capacity, emulsion ability, gelation, and viscosity among other functional properties. Therefore, such functional properties are making pea protein a promising ingredient in the food industry, thus driving its demand from the food and beverage industries.

- Moreover, as powdered pea protein can also be utilized in snacks, baby foods, cereals, dry food mixtures, milk replacements, and pet feeds, various food manufacturers are keen on utilizing pea protein in their products, thus driving its demand. Similarly, pea protein concentrate is currently used more for its functional impacts than for its nutritional qualities in various products like meat products, cereal and bakery products, extruded snacks, and beverages, among others.

- For instance, many manufacturers find it crucial to utilize extra emulsifiers and binders as protection against poor product quality. The non-meat proteins must carry out the functions of the salt-soluble meat proteins. Many peas protein-based emulsified meat formulations offer significant texture, no off flavors, excellent visual appeal, and substantial cost savings (lower cooking losses and higher yields) without sacrificing nutritional value.

- Similarly, pea proteins find their functional applications in many other food industries, thus growing their demand in this segment. Owing to these increased food and beverage applications, the demand for pea protein is rising at higher rates in the country, and that can be depicted by the rising imports of peas into the country. According to UN Comtrade, in 2022, imports of dries, shelled peas into China accounted for about USD 855 591 thousand, which increased from USD 779,095 thousand when compared to the previous year.

China Pea Protein Industry Overview

The China pea protein market is fragmented, with various national and international players participating in the market share. The major players in this market are Archer Daniels Midland Company, International Flavours & Fragrances Inc., Ingredion Incorporated, Kerry Group PLC, and Yantai Shuangta Food Co. Ltd. The demand for plant-based ingredients is growing in the region due to consumers' increasing demand for vegan and plant-based foods and market players are engaged in mergers and acquisitions to strengthen their portfolios and innovate new products in partnership with other market players. They are keen on investing in research and developmental activities to innovate with pea protein ingredients and emerge as a top player in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Inclination Towards Plant-Based Protein Sources

- 4.1.2 Rising Application Capabilities of Pea Protein

- 4.2 Market Restraints

- 4.2.1 Rising Popularity and Availability of Other Plant-based Proteins

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Intensity of Competitive Rivalry

5 Market Segmentation

- 5.1 Form

- 5.1.1 Concentrates

- 5.1.2 Isolates

- 5.1.3 Textured/Hydrolyzed

- 5.2 End-User

- 5.2.1 Animal Feed

- 5.2.2 Personal Care and Cosmetics

- 5.2.3 Food and Beverages

- 5.2.3.1 Bakery

- 5.2.3.2 Beverages

- 5.2.3.3 Breakfast Cereals

- 5.2.3.4 Condiments/Sauces

- 5.2.3.5 Confectionery

- 5.2.3.6 Dairy and Dairy Alternative Products

- 5.2.3.7 Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.3.8 RTE/RTC Food Products

- 5.2.3.9 Snacks

- 5.2.4 Supplements

- 5.2.4.1 Baby Food and Infant Formula

- 5.2.4.2 Elderly Nutrition and Medical Nutrition

- 5.2.4.3 Sport/Performance Nutrition

6 Competitive Landscape

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Archer Daniels Midland Company

- 6.3.2 Cargill, Incorporated

- 6.3.3 International Flavours & Fragrances Inc.

- 6.3.4 ETChem

- 6.3.5 Foodchem International Corporation

- 6.3.6 Ingredion Incorporated

- 6.3.7 Kerry Group PLC

- 6.3.8 Shandong Jianyuan Bioengineering Co. Ltd

- 6.3.9 Yantai Shuangta Food Co. Ltd

- 6.3.10 Anhui Keynovo Biotech Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS