PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408101

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408101

Beverages - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

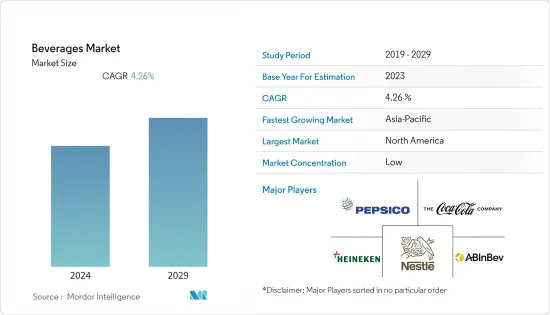

The beverages market is expected to grow from USD 3.71 trillion in 2024 to USD 4.58 trillion by 2029 at a CAGR of 4.26% during the forecast period (2024-2029).

Key Highlights

- Rising health consciousness and the growing prevalence of lifestyle diseases encouraged consumers to choose healthy drinks. Furthermore, the market is witnessing an increased demand for low-alcohol-by-volume beverages, specifically among millennials and baby boomers. For instance, according to UN Comtrade statistics, the amount of non-alcoholic drinks imported to Hungary peaked in 2022 at 174 million euros from 154 million euros in 2021. The sales of low-alcohol drinks have been rising, with the availability of a broader product portfolio with improved taste, aiding consumers to select products as per their preferences easily.

- Furthermore, the increasing participation of individuals in professional sports, recreational outdoor activities, and exercise and physical fitness is creating demand for dietary supplements, such as energy drinks. Energy drinks are functional beverages that help increase energy and enhance mental alertness and physical performance. Leading players are further focusing on developing sugar-free drinks to cater to the needs of individuals with diabetes and other chronic illnesses.

- For instance, in 2022, an Australian soft drinks company, Nexba, launched a range of caffeine- and sugar-free energy drinks with added vitamins and prebiotics. Nexba Natural Energy drinks are free from artificial ingredients and available in two flavors: Lemon yuzu and Wild Citrus. The company claims the flavors contain ginseng extract, vitamin B complex, and vitamin C to improve gut health and enhance energy levels. Therefore, the abovementioned factors will likely influence the market positively during the forecast period.

Beverage Market Trends

Consumer Inclination Toward Sugar-Free Drinks

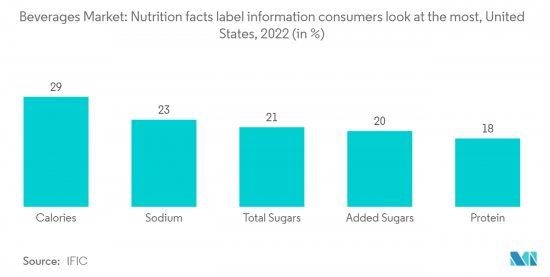

- Healthy food choices attract consumers' attention due to their vast interest in holistic well-being. Consumers are looking for products low in sugar and contain health-enhancing ingredients. Furthermore, according to the International Diabetes Federation, India was home to 77 million diabetes patients in 2019, the second-largest in the world. By 2030, the number is predicted to reach 101 million. According to the same source, around 114 million adults in China had diabetes in 2019. Due to the high prevalence of diabetes globally, consumers are becoming more aware of the importance of a healthy diet and an active lifestyle.

- Moreover, changes in consumer preferences for reduced or no-sugar products direct beverage manufacturers toward product innovation. Manufacturers in the market effectively communicate their products to live up to consumers' expectations and deliver the functionality they demand. They are developing a range of novel products to meet the consumers' demand who are actively trying to avoid consuming sugary drinks to prevent the harmful effects of excessive sugar intake.

- For instance, Shine Drink launched a new sugar-free range in October 2022. The product is called 'brain drinks' or 'smart -drinks' and contains natural functional ingredients. The product is available in blueberry lemonade and peach passion fruit flavors. Moreover, private-label companies are also entering the market to meet the demand for healthier alternatives in the beverage category, competing with the top brands.

North America Holds the Largest Market Share

- Shifting consumer preference for non-alcoholic beverages is identified as the key market driver in the beverages market in North America. In addition, the market growth can be attributed to the high consumption of sports and energy drinks owing to the widespread participation in leisure sports, physical activities, and intense gym workouts. The trend is also anticipated to continue during forecast years due to the rising government initiatives to accelerate the active participation of school and college students in various sports activities.

- Moreover, the increasing prevalence of lactose intolerance and dairy allergies led to the penetration of plant-based beverages such as fruit and vegetable juices and flavored cold drinks. In addition, increasing affinity towards organic and clean-label products is influencing key manufacturers to develop innovative variants in the ready-to-drink beverages category.

- For instance, in February 2022, Starbucks launched a new plant-based Frappuccino line with two flavors, Caramel Waffle Cookie and Dark Chocolate Brownie. Additionally, the strong consumer demand for portability and convenience has accelerated innovations in packaging shape, lighter packaging materials, and an increased application of flexible packaging. Thus, all these factors drive the beverage market in North America.

Beverage Industry Overview

The market is highly competitive, with key players operating, such as Nestle S.A., Anheuser-Busch InBev, Heineken N.V., PepsiCo, Inc., and The Coca-Cola Company. Various active companies in the market have adopted product innovation as a strategy due to changing consumer preferences worldwide. The primary focus of the companies is to offer products with different flavors and added functionalities, thereby catering to consumer preferences efficiently. For instance, in September 2022, Gatorade, a PepsiCo brand, launched a caffeinated energy drink, "Fast Switch," for athletes. The product is a cross between an energy drink and a sports drink. The product is non-carbonated, contains no sugar, and does not include any artificial colors or flavors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Preference for Plant-based and Clean-label RTD Products

- 4.1.2 Consumer Inclination Toward Sugar-Free Drinks

- 4.2 Market Restraints

- 4.2.1 Concerns Over Health Issues Associated With Beverages

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Alcoholic Beverages

- 5.1.1.1 Beer

- 5.1.1.2 Wine

- 5.1.1.3 Spirits

- 5.1.2 Non-Alcoholic Beverages

- 5.1.2.1 Energy & Sports Drink

- 5.1.2.2 Soft Drinks

- 5.1.2.3 Bottled Water

- 5.1.2.4 Packaged Juice

- 5.1.2.5 RTD Tea and Coffee

- 5.1.2.6 Other Non-Alcoholic Beverages

- 5.1.1 Alcoholic Beverages

- 5.2 By Distribution Channel

- 5.2.1 On-trade

- 5.2.2 Off-trade

- 5.2.2.1 Supermarkets/Hypermarkets

- 5.2.2.2 Convenience/Grocery Stores

- 5.2.2.3 Online Retail Stores

- 5.2.2.4 Other Off Trade Channels

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Nestle S.A.

- 6.3.2 PepsiCo, Inc.

- 6.3.3 The Coca-Cola Company

- 6.3.4 Anheuser-Busch InBev

- 6.3.5 Heineken N.V.

- 6.3.6 Diageo plc

- 6.3.7 Suntory Holdings Limited

- 6.3.8 Constellation Brands, Inc.

- 6.3.9 Red Bull GmbH

- 6.3.10 Keurig Dr Pepper

7 MARKET OPPORTUNITIES AND FUTURE TRENDS