PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408153

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408153

Canada HVAC Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

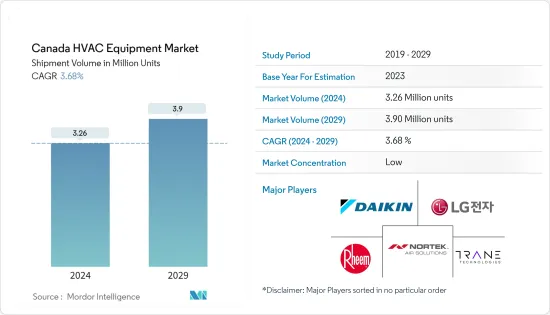

The Canada HVAC Equipment Market size in terms of shipment volume is expected to grow from 3.26 Million units in 2024 to 3.9 Million units by 2029, at a CAGR of 3.68% during the forecast period (2024-2029).

Key Highlights

- Heating, ventilation, and air conditioning (HVAC) equipment are the systems for circulating air between indoor and outdoor areas and heating and cooling in residential and commercial buildings. These techniques also filter and clean indoor air and maintain humidity at optimal levels.

- The market sizing encompasses the number of units sold for the different types of heating, air conditioning, and ventilation systems across the residential and commercial sectors in Canada. The study also tracks the key market parameters, underlying growth influencers, and major vendors operating in the industry, which supports the market estimations and growth rates over the forecast period.

- The growth in construction activities, along with the rise in disposable income, increased the availability of HVAC equipment for a broader consumer base in the country. According to Statistics Canada, the total value of building permits in the country increased by 11.9 percent in August 2022 on a monthly basis, reaching USD 12.5 billion. Both the residential sector (+12.0 percent) and the non-residential sector (+11.8 percent) witnessed an increase in the value of building permits, with Ontario gaining the most permits. Particularly in the residential sector, the value of building permits in the multi-family component experienced a sharp increase of 22.2 percent.

- Further, in terms of heating equipment, though most Canadian households use forced-air heating systems to warm their homes, the demand for heat pumps, which are more energy-efficient than air furnaces, is expected to rise significantly in the coming years. This is driven by favorable government initiatives promoting heat pump adoption. Additionally, ventilation equipment, such as air handling units, is becoming popular as air pollution levels grow and people become more conscious of maintaining a healthy and safe atmosphere.

- Various companies have also been upgrading to new heating equipment in the market. For instance, in July 2022, the Canada Games Complex underwent a USD 3 million upgrade, which would include the replacement of the facility's original boilers, along with improvements to energy efficiency and better accessibility for all. In line with the upgrade, the Federal Government covered approximately USD 2.3 million of the expected cost through its Green and Inclusive Community Building Program. Such initiatives by the companies in the market are expected to further fuel the demand for Heating Equipment during the forecast period.

- Manufacturers are facing many efficiency requirements and changes to refrigerants that are primarily driven by the U.S. Dept. of Energy (DOE), which in turn has a significant impact on the market in Canada. New DOE energy efficiency standards for 2023 are expected to significantly impact all rooftop units sold in Canada.

- The filters, coils, fins, etc., of an HVAC system, such as an air conditioner, require regular maintenance for the equipment to work efficiently and effectively throughout its operating life. Neglecting necessary maintenance will definitely reduce air conditioning performance and a significant increase in energy consumption.

- Additionally, the ongoing conflict between Russia and Ukraine is expected to impact the electronics industry significantly. The conflict might cause extra disruptions and affect the supply chains of semiconductors, leading to further increases in the prices of electronics. Overall, the impact of the conflict on the electronics industry is expected to be significant. This would hamper the production of HVAC equipment.

Canada HVAC Equipment Market Trends

Surge in Construction Activities Driving the Market

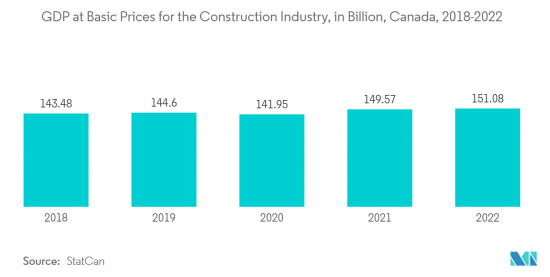

- The construction sector is vital in driving Canada's demand for HVAC systems. With the expansion in the construction of commercial and residential buildings, the need for HVAC equipment and services has been growing consistently in the country. According to StatCan, the size of Canada's construction industry increased in 2022, recording CAD 151.08 billion (USD 112.49 billion), a significant increase from the previous year.

- The construction of some large commercial buildings has recently started in the country. According to Statistics Canada, investment in building construction stood up 0.2 percent to USD 20.9 billion in October 2022, with Ontario accounting for nearly all the gains. The residential sector edged down 0.1 percent to USD 15.4 billion, while the non-residential sector increased 0.9 percent to USD 5.5 billion. Further, commercial construction investment increased by 0.1 percent to USD 3.1 billion in November 2022 and was up 13.5 percent year over year.

- With the rise in climate change awareness, builders and regulators alike in the region are seeking to decrease the carbon footprint of commercial and industrial construction. Construction guidelines such as Net Zero have established a standard for sustainable building practices. Heavy government subsidies also make it more affordable to meet the higher upfront costs sometimes associated with green construction.

- In September 2022, Johnson Controls reduced the cost of and expanded the accessibility to residential energy efficiency for homeowners through generous financing options and rebates created to maximize recently announced savings made possible by the Inflation Reduction Act. Compared to low-efficiency systems, homeowners can decrease their heating and cooling costs by up to 50 percent using higher-efficiency HVAC equipment from Johnson Controls.

Residential Segment Holds Significant Market Share

- Given the variable climate and harsh winters, HVAC systems have emerged as a necessity in most Canadian homes. Many places in Canada face extreme heat events or heat waves involving high temperatures and high humidity. As per the preliminary figures released by the BC Coroners Service, 619 people died from severe heat in British Columbia during the summer of 2022's most extended heat wave.

- Central air conditioning is Canadians' most common way to cool residences. In recent years, as per a survey conducted by Statistics Canada, sales of electrical, plumbing, heating, and air-conditioning equipment and supplies to wholesalers amounted to approximately CAD 38.86 billion (USD 29.12 billion) recently, and it stated that around three in five Canadian households own an air conditioner; among these households, 42 percent reported holding a central air conditioner, 17 percent a stand-alone, and 3 percent another type of air conditioner.

- Also, according to A-Plus Air, around 65 percent of Canadian homes are warmed by forced-air furnaces, most of which are powered by natural gas, and others use propane or oil. Furnace-based heating systems are popular because they can heat a room quickly. With some modifications, a forced-air furnace can even be roped into function as an air filter, fresh-air ventilator, or humidifier. Another benefit is that the same duct systems can be deployed for air-conditioning during warmer summer months.

- Similarly, the Canadian government encourages consumers to buy air conditioners with Energy Star as an ENERGY STAR-certified central air conditioner uses 8 percent less energy on average than a standard model. Owing to such regulations attributed to the industry, the HVAC vendors are also offering the equipment according to government standards. Due to the RTUs rule, more vendors are concentrating on commercial buildings and sustainable skyscrapers.

- Green building standards are continually evolving. Sustainable buildings are becoming increasingly cheaper to maintain. HVAC systems are expected to gain a considerable boost in the adoption rate with the massive growth in the adoption of green buildings in the near future. According to CMHC, the number of dwelling units under construction in Canada in December of 2022 was approximately 334,100.

- For instance, in May 2022, FortisBC Energy Inc. installed high-efficiency gas heat pumps in 20 homes in the Lower Mainland and Southern Interior. This is the first unit installed in British Columbia as part of the FortisBC pilot program. With the potential to cut the power needed for space and water heating by up to 50 percent, lower greenhouse gas (GHG) emissions, operate in colder winter conditions and exceed 100 percent efficiency, this technology is expected to have the potential to help customers reduce their monthly bills and contribute to achieving the province's climate action goals.

- Moreover, in November 2022, the Minister of Immigration, Refugees and Citizenship announced a USD 250 million asset in the Oil to Heat Pump Affordability (OHPA) Grant, a renewed stream to add to the existing Canada Greener Homes Initiative. The program is expected to help more households switch to affordable and reliable electric heat pumps instead of expensive heating oil. The OHPA Grant builds on the USD 250 million announced in September 2022 to make home heating more affordable and reduce pollution by helping households move to electric heat pumps.

Canada HVAC Equipment Industry Overview

The Canadian heating, ventilation, and air conditioning equipment market is highly fragmented, with key players like Daikin Industries Ltd, LG Electronics Inc., Nortek Air Solutions Llc, Rheem Manufacturing Company Inc., and Trane Technologies PLC, among others. Players in the market are adopting techniques such as collaborations and acquisitions to improve their product offerings and gain sustainable competitive advantage.

In September 2022, Trane Technologies, one of the global climate innovators, announced innovations to expand its electrified heating and cooling portfolio and upgrade two well-known rooftop units to enhance energy efficiency, building connectivity, and control. Trane introduced the latest Thermafit Air-to-Water Modular Heat Pump, Model AXM, that delivers flexible, all-electric heating and cooling. It also presented updates to its Voyager 3 and IntelliPak 2 rooftop units to improve indoor comfort and air quality in warehouses and comprehensive facilities.

In June 2022, Carrier Corporation introduced the redesigned Performance Series 17 two-stage air conditioner and the Performance Series 17 two-stage heat pump. These comply with the upcoming 2023 Department of Energy (DOE) minimum efficiency requirements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Surge in Construction Activity

- 5.2 Market Challenges

- 5.2.1 High Maintenance and Repair Costs

6 TECHNOLOGICAL SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Type of Equipment

- 7.1.1 Air Conditioning

- 7.1.1.1 Ducted Split Systems

- 7.1.1.2 Ductless Split Systems

- 7.1.1.3 Packaged Units and Rooftops

- 7.1.1.4 Chillers

- 7.1.1.5 Unit Heaters

- 7.1.2 Heating

- 7.1.2.1 Warm Air Furnaces (Gas, Electric, Oil, and Combination)

- 7.1.2.2 Heat Pumps

- 7.1.3 Ventilation

- 7.1.3.1 Air Handling Units

- 7.1.1 Air Conditioning

- 7.2 By End User

- 7.2.1 Residential

- 7.2.2 Commercial

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Daikin Industries Ltd

- 8.1.2 LG Electronics Inc.

- 8.1.3 Nortek Air Solutions LLC

- 8.1.4 Rheem Manufacturing Company Inc.

- 8.1.5 Trane Technologies PLC

- 8.1.6 Johnson controls International PLC

- 8.1.7 Carrier Corporation

- 8.1.8 Engineered Air

- 8.1.9 Gree Canada

- 8.1.10 Mitsubishi Electric Corporation

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET