Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644945

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644945

Asia-Pacific Solar Inverter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 92 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

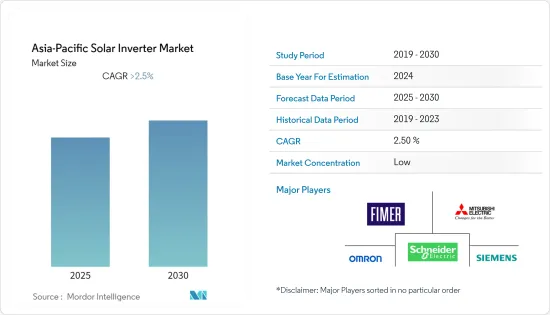

The Asia-Pacific Solar Inverter Market is expected to register a CAGR of greater than 2.5% during the forecast period.

The market did not witness any significant negative impact of COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the short term, the Asia-Pacific solar inverter market is predicted to flourish due to the ambitious solar energy targets set by the Asian countries and the interests shown by private investors.

- On the other hand, the cut-throat competition from other renewables is expected to restrain the market shortly.

- Nevertheless, product innovation and the introduction of the latest technologies in solar PV inverters are likely to create ample opportunities for the solar inverters market in the region.

- China is expected to dominate the market in the unfolding scene due to government initiatives to expand the solar energy portfolio in the country.

APAC Solar Inverter Market Trends

Central Inverters Expected to Witness Significant Growth

- A central inverter is a large grid feeder. It is often used in solar photovoltaic systems with rated outputs over 100 kWp. Typically, floor or ground-mounted inverters convert DC power collected from a solar array into AC power for grid connection. These devices range in capacity from around 50kW to 1MW and can be used indoors or outdoors.

- A central inverter has a maximum input voltage of 1,000V. However, some newer central inverters already come with 1,500V input voltage. These inverters allow PV arrays based on a maximum voltage of 1,500V, requiring fewer BOS (balance of system) components.

- In India, the government has set a highly ambitious goal of reaching a target of 350GW of renewable power generation by 2030, of which 55% is to be supported by solar energy. The current solar energy installed capacity is 40GW as of 2021 and is expected to escalate in the near future due to the upcoming solar PV projects. Solar PV projects highly demand central inverters due to their technical benefits.

- For example, in October 2022, a 1.5MW hybrid BESS system commissioned in Leh Ladakh, India, featured a PVS980 1MW central inverter and a PVS980-BC 2MW energy storage inverter, provided by FIMER, one of the leading solar PV inverter companies in India.

- Further, the technological achievements made by industry experts to introduce new models of central inverters are expected to drive the market. For example, in January 2022, Sungrow, the China-based solar energy company, launched its new '1+X' central modular inverter with an output capacity of 1.1MW. This 1+X modular inverter can be combined into eight units to reach a power of 8.8MW and features a DC/ESS interface for connecting energy storage systems (ESS).

- Owing to such developments, the central inverters are expected to grow at a faster rate in the Asia-Pacific region during the forecast period.

China Expected to Dominate the Market

- China is the largest producer of solar energy in the world. The country has made remarkable progress in solar energy generation due to its location (which is quite sun-drenched) and the declining cost of solar PV technology.

- There has been an increased emphasis on solar inverters in China, providing a Zero-voltage Ride Through (ZVRT) scheme. To meet the scheme norms, the solar PV power plants must continue to operate without breaking. This is even more significant as the country hosts a considerable amount of solar power generation globally. Its share in the renewable power generation mix was around 327TWh in 2021 and will show a greater value due to the upcoming PV projects.

- For example, in March 2022, the Chinese government announced new plans to build solar and wind power plants in the Gobi Desert. The two plants will be installed with a total power capacity of 450GW. The project is a part of the country's efforts to boost renewable energy generation in the power sector.

- Additionally, in May 2022, China's National Energy Administration predicted that the country is expected to install around 108GW of solar power this year. China Huaneng Group has revealed new plans to build a 10GW solar panel factory in Guangxi province.

- Such developments are expected to make the country the frontrunner in solar energy capacity growth in the coming years.

APAC Solar Inverter Industry Overview

The Asia-Pacific solar inverter market is fragmented. Some of the key players in the market (in no particular order) include Fimer SpA, Schneider Electric SE, Siemens AG, Mitsubishi Electric Corporation, and Omron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93275

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope Of The Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Central Inverters

- 5.1.2 String Inverters

- 5.1.3 Micro Inverters

- 5.1.4 Cellular Glass

- 5.1.5 Other Types

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial & Industrial

- 5.2.3 Utility-scale

- 5.3 By Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Fimer SpA

- 6.3.2 Schneider Electric SE

- 6.3.3 Siemens AG

- 6.3.4 Mitsubishi Electric Corporation

- 6.3.5 Omron Corporation

- 6.3.6 General Electric

- 6.3.7 Huawei Technologies Inc.

- 6.3.8 Enphase Energy Inc.

- 6.3.9 Delta Energy Systems Inc.

- 6.3.10 SMA Solar Technology AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.