PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408384

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408384

Africa Data Center Rack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030

The African Data Center Rack Market value was USD 1.1 million in the previous year, and it is further projected to grow and register a CAGR of 15.41%.

Under Construction IT Load Capacity: The upcoming IT load capacity of the Africa data center market is expected to reach over 1,200 MW by 2029.

Under Construction Raised Floor Space: The region's construction of raised floor area is expected to increase by 5.2 million sq. ft by 2029.

Planned Racks: The region's total number of racks to be installed is expected to touch over 250,000 units by 2029. South Africa is expected to house the maximum number of racks by 2029.

Planned Submarine Cables: There are close to 60 submarine cable systems connecting Africa, and many are under construction. One such submarine cable, estimated to be built by the end of 2023, is 2Africa, which stretches over 45000 Kilometers with landing points in Lagos, Nigeria.

Africa Data Center Rack Market Trends

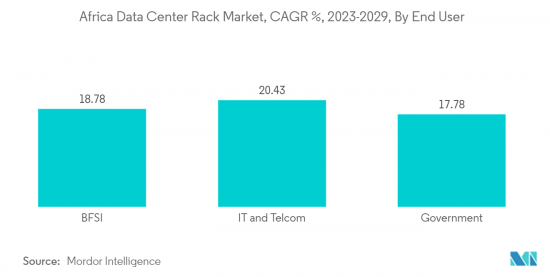

IT and Telecom to have significant market share

- The major end-users expected to increase IT load capacity during the forecast period include cloud, BFSI, e-commerce, telecommunications, media and entertainment, and others. Since cloud aggregation and remote service provision have become the new norm in Africa, more companies leverage colocation services to enhance service provision and customer experience with new online platforms.

- With the rollout of initiatives like AfCFTA (Africa Continental Free Trade Area) by trade associations and governments, the ease of doing business across Africa has increased, allowing more e-commerce platforms to surface. This has also encouraged users to access services and commodities, contributing to sector growth.

- The need for data localization has encouraged global cloud aggregators to introduce cloud data centers in the country in the recent past. This highlights the growing demand and favorability of investment in the region, helping sectors like the cloud grow. Further, the World Bank data highlighted how Africa would require significant investments for better internet connectivity, with new 4G base stations and other infrastructure for long-term network evolution. As the network evolves in the region, it would directly impact the need for more data centers to cater to the increase in data traffic, which is expected to reach about 7 gigabytes per month per subscriber by 2025 through about 30 million 5G subscribers.

- Also, this would lead to the manufacturing sector deploying new technologies to offer real-time insights to managers, helping them avoid machinery failure and plan maintenance. The end users are expected to grow owing to the above-mentioned factors during the forecast period.

South Africa is the largest Country

- South Africa is the most prominent country for data centers in Africa since the country comprises about 42 million internet users. It also has internet penetration rates closer to 70%, and its adaptation to e-commerce and other demand-generating aspects is growing. This, in turn, has led data center operators to set up their data center facilities in the region to leverage the increasing demand for the facilities.

- South Africa held a market share of around 63.1%, followed by the Rest of African countries at 24.4%, and Nigeria accounted for 12.4% in 2021. The company that has strengthened its market share in South Africa is Teraco Data Environments (acquired by Digital Realty), which currently has a market share of 36.72% and operates at an IT load capacity of 150 MW. Through its subsidiaries, Medallion Communication Ltd and Teraco Data Environments, companies such as Digital Realty have announced plans to develop mega and massive data centers with IT load capacities of 160 MW and 110 MW during the forecast period.

- Cape Town has been ranked among the top smart cities worldwide for its IoT and real-time data analysis through sensor implementation. Smart cities create huge amounts of data owing to the varying smart services imparted to the citizens.

- The country is expected to witness more such smart cities as operators plan to extend the deployment of IoT-based devices. The Rest of Africa segment also comprises smart cities like Kigali, Rwanda, which have sensors to measure air quality, monitor the power grid's safety, and detect water leakages. Due to all the above factors, the South African data center market is expected to grow and register a CAGR of 15.68% over the forecast period.

Africa Data Center Rack Industry Overview

The African Data Center Rack Market is fairly consolidated with significant players such as Rittal GMBH & Co.KG, Schneider Electric SE, Legrand SA, Dell Inc., and Hewlett Packard Enterprise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Deployment of Data Center Facilities

- 4.2.2 Growing Cloud Computing Adoption Leading to Investment in Hyperscale Data Centers

- 4.2.3 BFSI Sector Expected to Hold a Significant Share

- 4.3 Market Restraints

- 4.3.1 Increasing Utilization of Blade Servers

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 By Rack Size

- 5.1.1 Quarter Rack

- 5.1.2 Half Rack

- 5.1.3 Full Rack

- 5.2 By End User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End Users

- 5.3 By Country

- 5.3.1 Nigeria

- 5.3.2 South Africa

- 5.3.3 Rest of South Africa

6 COMPETITIVE LANDSCAPE

7 Company Profiles

- 7.1 Eaton Corporation

- 7.2 Black Box Corporation

- 7.3 Rittal GMBH & Co.KG

- 7.4 Schneider Electric SE

- 7.5 Vertic Group Corp.

- 7.6 Dell Inc.

- 7.7 nVent Electric PLC

- 7.8 Hewlett Packard Enterprise

- 7.9 Legrand SA

- 7.10 Fujitsu Corporation

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS