PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408589

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408589

Scrap Metal Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

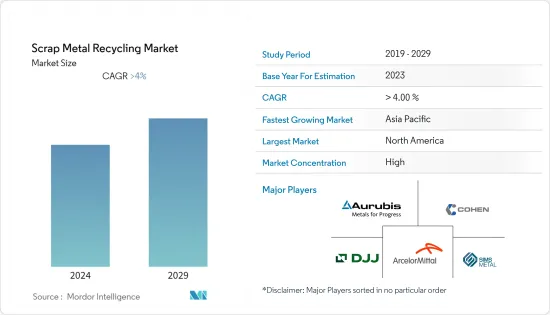

The scrap metal recycling market is estimated to reach 947.39 million tons by the end of this year and is projected to reach 1,164.33 million tons in the next five years, registering a CAGR of 4% during the forecast period.

Covid-19 negatively impacted the demand for metals. The disruption in supply chains and decline in industrial production such as automotive, construction, and manufacturing experienced a significant decline in production, leading to reduced scrap metal generation. However, since restrictions were removed, the industry has been recovering. A rise in demand for automobiles is restoring the market's growth trajectory.

Key Highlights

- A major factor driving the market studied is the growing demand for metals from various industries such as automotive, construction, and packaging. Additionally, environmental awareness and sustainability will likely favor the market's growth.

- On the flip side, the lack of infrastructure and collection systems in many developing countries will negatively affect the growth of the scrap metal recycling market during the forecast period.

- The growing focus on E-waste recycling, increasing demand for sustainable materials, and focus on circular economy will likely provide new growth opportunities for the market.

- North American region is expected to dominate the market during the forecast period. Stringent environmental regulations, strong infrastructure development, and a well-established recycling ecosystem drive this growth.

Scrap Metal Recycling Market Trends

Automotive Industry to Dominate the Market

- Recycled metals play a significant role in the automotive industry contributing to sustainability efforts and reducing environmental impacts.

- One of the primary uses of recycled steel in the automotive industry is in the production of vehicle bodies ad frames. These are also used to manufacture various sheet metal components used in vehicles, such as doors, hoods, fenders, and trunk lids. Moreover, chassis and undercarriage components are often made from recycled steel. Many of the suspension parts and safety components, such as seat frames and safety beams, are often made of recycled steel.

- Aluminum is another essential material in the automotive industry due to its lightweight and strength properties. Recycled aluminum is used to produce parts like engine blocks, wheels, and body panels. Recycling aluminum requires significantly less energy than producing it from raw bauxite ore, making it a more environmentally friendly option. Recycled copper can also be used in automotive wiring and electrical components.

- Moreover, recycled lead can be remelted to create new car batteries, starting the cycle from the beginning.

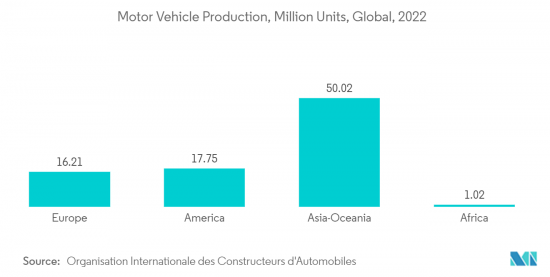

- The global automotive industry experienced a significant increase in vehicle production in 2022, with more than 85 million motor vehicles manufactured worldwide. This 6% growth compared to the previous year indicates a rising demand for automotive, influencing the scrap metal recycling market.

- The growth in America's automotive production is particularly notable, with a 10% year-on-year increase in 2022. Canada, Mexico, and the United States all witnessed production expansions, reaching production figures of 1.22 million units, 3.50 million units, and 10.06 million units, respectively.

- Furthermore, the investment in domestic electric vehicle (EV) manufacturing in the United States indicates a growing focus on EV production and associated components. With auto manufacturing companies announcing a combined investment of USD 13 billion in EV manufacturing in 2022, there is a clear push toward developing and adopting electric vehicles.

- In 2022, Europe experienced a slight decline of 1% in motor vehicle production, with a total of 16,216,888 vehicles manufactured. This decrease can be attributed to several factors, such as the energy crisis in Europe and ongoing supply chain disruptions. These challenges have had a negative impact on the European automotive sector, making it more vulnerable in 2023.

- Asia's economies and sectors, driven by the region's growing population, continuously evolve. The automotive industry is one of the sectors benefiting from this growth, as the increasing population creates a higher demand for efficient mobility solutions. Asia has gained a reputation for being home to some of the world's most valuable vehicle manufacturers.

- Similarly, South Korea has experienced positive growth in automotive production. According to the Korea Automobile Manufacturers Association (KAMA), the country produced 3.75 million vehicles in 2022, representing a notable 9% increase compared to the previous year's production of 3.62 million units.

- In South America, there have been notable developments in the automotive industry, with different countries experiencing varying production trends. Colombia witnessed a significant increase in year-on-year production, with a 26% jump, reaching 51,455 units. Argentina also experienced substantial growth, with a 24% increase and production reaching 536,893 units.

- Considering these factors, the scrap metal recycling market is expected to benefit from the increased demand for automobiles driven by the growing global vehicle production, the surge in North American and Asian automotive manufacturing, and the expanding EV market.

North America to Dominate the Market

- Recycled metals, such as steel and aluminum, are commonly used in construction projects. They are utilized to create structural elements, reinforcing bars, roofing materials, and facade panels. The recycled metals in construction reduce the demand for raw materials, conserves energy, and lowers carbon emissions.

- Many electronic devices contain metals, especially precious metals like gold, silver, platinum, and palladium. These metals are used in circuit boards, connectors, wiring, and various components. Recycling electronic waste is crucial for recovering valuable metals and preventing hazardous materials from ending up in landfills.

- The aerospace sector utilizes recycled metals, such as aluminum and titanium, in the manufacturing of aircraft components, including wings, fuselages, and engine parts. These can also be used in various consumer goods. Metal furniture pieces, such as chairs and bed frames, often contain recycled contents. In household appliances, these are used in components like metal casings, frames, and internal parts.

- The United States has the largest aviation market in North America and one of the world's largest fleet sizes. Strong exports of aerospace components to countries, such as France, China, and Germany, along with robust consumer spending in the United States, have been driving the manufacturing activities in the aerospace industry, which is expected to induce a positive momentum for the aerospace material market in the country.

- Additionally, in the United States, according to the Federal Aviation Administration (FAA), the commercial fleet is forecast to increase to 8,756 in 2041, with an average annual growth rate of 2% per year.

- This growth in the aerospace industry is expected to positively impact the demand for aerospace materials, thereby influencing the scrap metal recycling market in the country.

- In the 2022 defense budget, the United States government allowed USD 768.2 billion for national defense programs, which is about a 2% increase from the Biden administration's original budget request.

- According to the United States Census Bureau, housing starts have shown a notable increase in the United States, indicating a thriving residential construction sector. Privately-owned housing starts in May 2023 reached a seasonally adjusted annual rate of 1,631,000, a significant rise of 21.7% compared to the revised April 2023 estimate. Single-family housing starts also experienced a substantial growth rate of 18.5% in May 2023. These figures indicate a strong demand for housing and a potential market for the studied market in residential construction.

- In 2022, there were over 27 million eCommerce users in Canada, accounting for 75% of the Canadian population. This number is expected to grow to 77.6% in 2025. According to the International Trade Administration, in March 2022, e-commerce sales amounted to approximately USD 2.34 billion. Retail eCommerce sales are estimated to total USD 40.3 billion by 2025. As e-commerce continues to expand, there will be a corresponding need for efficient recycling and disposal of electronics.

- All the above-mentioned factors are likely to fuel the growth of North America's scrap metal recycling market over the forecast time frame.

Scrap Metal Recycling Industry Overview

The scrap metal recycling market is consolidated. Some of the major companies (in no particular order) are Aurubis AG, COHEN, The David J. Joseph Company, LLC, Sims Limited, and ArcelorMittal.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions And Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Environmental Awareness and Sustainability

- 4.1.2 Metal Recycling Leading to Energy Saving

- 4.1.3 Growing Demand from Various End-user Industries

- 4.2 Restraints

- 4.2.1 Lack of Infrastructure and Collection Systems in Many Countries

- 4.2.2 Quality and Contamination Issues

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Metal Type

- 5.1.1 Ferrous

- 5.1.1.1 Iron

- 5.1.1.2 Steel

- 5.1.2 Non-ferrous

- 5.1.2.1 Copper

- 5.1.2.2 Aluminum

- 5.1.2.3 Lead

- 5.1.2.4 Others

- 5.1.1 Ferrous

- 5.2 Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Manufacturing and Industrial Sectors

- 5.2.6 Consumer Appliances

- 5.2.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AIM Recycling

- 6.4.2 ArcelorMittal

- 6.4.3 Aurubis AG

- 6.4.4 CMR Green Technologies Ltd

- 6.4.5 COHEN

- 6.4.6 Greenwave Technology Solutions, Inc.

- 6.4.7 OmniSource, LLC

- 6.4.8 Sims Limited

- 6.4.9 SL Recycling

- 6.4.10 The David J. Joseph Company (Nucor Corporation)

- 6.4.11 TKC Metal Recycling Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing E-waste Recycling Market

- 7.2 Increasing Demand for Sustainable Materials and Focus on Circular Economy