PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408739

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408739

Africa Data Center Networking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030

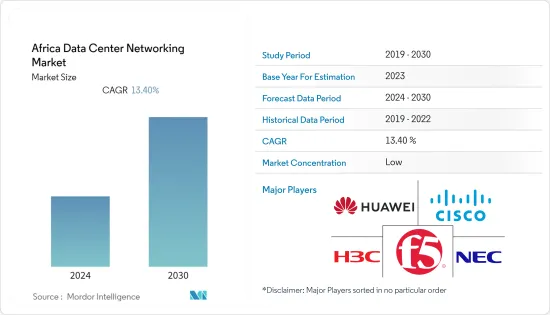

The African data center networking market reached a value of USD 302.7 million in the previous year, and it is further projected to register a CAGR of 13.4% during the forecast period.

Key Highlights

- Africa's commercial hosting capacity has surged and is now doubling every three years. Internet and public cloud adoption has been growing all over the world, and major cloud providers have a growing presence in Africa. Clients in Africa mostly use content delivery network (CDN) nodes located outside the continent, resulting in higher latencies. It has also been observed some clients are making use of longer routes to cloud destinations within Africa.

- The upcoming IT load capacity of the Africa data center construction market is expected to reach 1226 MW by 2029. The region's construction of raised floor area is expected to increase 5.2 million sq. ft by 2029. The region's total number of racks to be installed is expected to reach 260K units by 2029. South Africa is expected to house the maximum number of racks by 2029.

- There are close to 70 submarine cable systems connecting Africa, and many are under construction. One such submarine cable that is estimated to start service in 2024 is Africa-1, which stretches over 10,000 Kilometers with a landing point in Port Said and Ras Ghareb, Egypt.

Africa Data Center Networking Market Trends

IT and Telecom to Hold Significant Share

- Telecom providers are primarily responsible for driving content delivery and facilitating mobile and cloud services, and that's why telecom data centers require very high connectivity. This specific type of data center is connected to other data centers, cloud providers, and telecom operators through outside plant (OSP) cables, with cross-connects greatly deployed to ensure efficient operations through networking.

- By centralizing network control and management, SDN offers a number of benefits over traditional network architectures in Africa. The most significant of these is the ability to more easily manage and configure network traffic. Cisco ACI is a popular software-defined networking (SDN) solution that allows administrators to centrally manage network policies and automate network infrastructure. It enables network administrators to design, deploy, and manage their networks with ease.

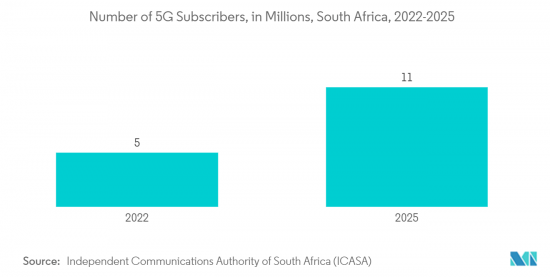

- The rapid growth of 4G adoption and the impending arrival of 5G technology are compelling telecommunications providers to invest in data centers in Africa. In October 2022, South African telecom company Telkom successfully launched a high-speed 5G internet network in collaboration with China's Huawei Technologies. Huawei remains committed to supporting South Africa in expanding its 5G infrastructure. The prominent 5G network, the largest on the African continent, currently boasts more than 2,800 deployed base stations.

- The deployment of 5G would play a key role in pushing the expansion plans and executing them as planned. For 5G networks and ubiquitous broadband, the country requires 167,000 km of fiber infrastructure. In Nigeria, data center facilities will be in demand as fiber connectivity increases so that advanced technologies can be used remotely. Such a factor will lead to major data center networking adoption.

South Africa to Hold Significant Growth

- South Africa is considered to be the most developed cloud market in sub-Saharan Africa. The increase in demand for data storage is also leading to an increase in the demand for ethernet switches. In 2022, South Africa witnessed a surge in data center investment from global data center operators, as well as the expansion of local data center facilities. To serve the growing demand for cloud services, global cloud providers, Amazon Web Services, Google Cloud Platform, IBM, Microsoft, Oracle, SAP, VMware, and others have targeted South Africa.

- AFR-IX offers international high-quality and personalized Internet and data services to corporates and telecommunications in the African continent. Their extensive Pan-African network covered with terrestrial and submarine cables makes AFR-IX one of the leading Telecom operating service providers in Africa, including in South Africa, and the most reliable and largest metro-Ethernet network with multiprotocol label switching (MPLS).

- In South Africa, Carrier Ethernet, which is also known as the Metro Ethernet in SA, has experienced growing levels of adoption and is projected to increase even further in the coming years. Carrier Ethernet is facilitating increased partnering of regional service providers with large numbers of wireless access providers, as standardization and service definitions allow for much quicker integration of external network-to-network interfaces, in turn enabling faster time-to-market of services, as well as monitoring of end-to-end service performance.

- Virtualization enables the hardware resources of a single computer to be divided into multiple virtual computers. Virtualization backup and management software vendor Veeam has grown its South African revenue by 88% in the year since it set up a local presence. Representing an increase of over 150% in its customer and partnership base, this sets the stage for further expansion.

Africa Data Center Networking Industry Overview

The Africa Data Center Networking market exhibits a degree of fragmentation among its key players, having recently intensified its competitive dynamics. Leading the sector are significant players such as Huawei Technologies Co. Ltd., Cisco Systems Inc., and F5 Networks Inc., among others. These major industry players, holding a substantial market share, are primarily focused on expanding their customer base across the region. To achieve this, they actively employ strategic collaborative efforts aimed at enhancing their market presence and driving profitability.

In January 2022, TP Link Corporation Ltd. introduced the Archer AXE75, an AXE5400 Tri-Band Gigabit Wi-Fi 6E router. This router is designed to offer a broad coverage area and high-performance capabilities, augmented by the inclusion of the HomeShield security system and a potent chipset.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Need of Cloud Storage

- 4.2.2 Increasing Cyberattacks Among Enterprises

- 4.3 Market Restraints

- 4.3.1 Increasing Network Complexity

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 By Product

- 5.1.1.1 Ethernet Switches

- 5.1.1.2 Router

- 5.1.1.3 Storage Area Network (SAN)

- 5.1.1.4 Application Delivery Controller (ADC)

- 5.1.1.5 Other Networking Equipment

- 5.1.2 By Services

- 5.1.2.1 Installation & Integration

- 5.1.2.2 Training & Consulting

- 5.1.2.3 Support & Maintenance

- 5.1.1 By Product

- 5.2 End-User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Huawei Technologies Co. Ltd.

- 6.1.2 Cisco Systems Inc.

- 6.1.3 F5 Networks Inc.

- 6.1.4 H3C Holding Limited

- 6.1.5 NEC Corporation

- 6.1.6 Juniper Networks Inc.

- 6.1.7 VMware Inc

- 6.1.8 A10 Networks Inc.

- 6.1.9 Extreme Networks Inc.

- 6.1.10 Dell EMC

- 6.1.11 Array Networks Inc.

- 6.1.12 Radware Corporation

- 6.1.13 TP-Link Corporation Limited

- 6.1.14 Moxa Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS