PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408776

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408776

Brazil Location Based Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

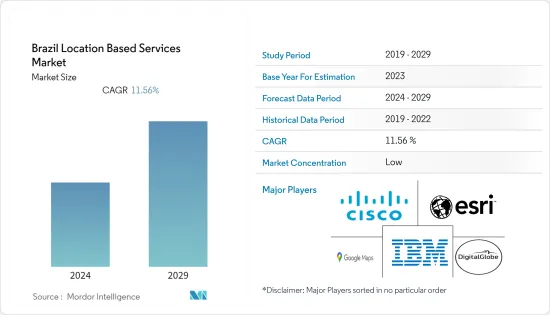

The Brazil location-based services market size is valued at USD 0.63 billion in the current year. It is expected to register a CAGR of 11.56% during the forecast period to reach USD 1.08 billion by the next five years.

Key Highlights

- The growing demand and the need for accurate and real-time geospatial data are driving location-based services (LBS). Retail, logistics, and tourism industries are leveraging LBS to locate the nearest restaurant or advertise deals to shoppers nearby to optimize operations, improve customer experiences, and gain competitive advantages.

- The need for accurate updates and critical location-based information has risen in almost every industry. Most consumers have also adopted access to this data, and in turn, these consumers are also delivering real-time data through diverse platforms such as social media. The availability of real-time data developments in an abundance of critical location-based intelligence. Use cases of this include marketing to consumers nearby, the alert of potential local threats, and much more.

- The fastest-developing positioning methods are based on mobile positioning and satellite-based GPS. With more widespread methods, like global cell identity (CGICTA) and enhanced observed time difference (E-OTD), the practical precision falls in the range of 50-1000 m. These technologies provide end-users with opportunities based on the accuracy required for specific application location identification.

- The COVID-19 pandemic increased global demand for real-time and accurate location-based information. Countries worldwide relied heavily on daily COVID-19 updates that informed users of infections, hospitalization rates, and other pertinent information to keep the masses safe. The management of COVID-19 data and additional disaster-related information evolved with the assistance of geographic information systems (GIS) and location-based intelligence.

- Location-based services currently face tremendous risks from government policies and regulations on consumer privacy. Most software developers are becoming aware of the growing international privacy laws and industry self-regulation codes that govern their use. In November this year, Google agreed to pay around $392 million in a settlement with 40 states over allegations that the company tracked people through their devices after location tracking had been turned off.

Brazil Location Based Services Market Trends

FMCG and E-Commerce Sector Expected to Witness Significant Growth

- There has been an increasing trend in e-commerce establishments in the past decade. Mobile apps have enjoyed tremendous success due to their personalization features. They are easier to use and form a direct link between the brands and customers, thus enabling high levels of consumer engagement.

- Mobile apps help e-commerce stores analyze the market and consumer behavior, resulting in better marketing strategies. E-commerce services based on user location have emerged as a significant segment of modern information services. In these user-intensive applications, quality of service is essential, and design methods increasingly rely on software standards to achieve quality.

- E-commerce applications provide tailored offers to customers that reside in specific locations. These offers are delivered to customers through personalized notifications, which are more effective than general-purpose push notifications.

- In other words, marketplaces rely on artificial intelligence to identify locations and products that are popular there. Once the data is set up, sellers can pay a one-time cost to ship their stock to the final location.

- Consumer goods marketers can target customers effectively due to active engagement on social media channels such as mobile, personal computers, and tablets. Location-based marketing allows big brands to focus on smaller shops and may focus on in-store marketing while attempting to comprehend client behavior.

- RTLS includes various location technologies, from Bluetooth beacons and passive radio frequency identification (RFID) to large-scale systems that constantly communicate assets and back-end processes. Many warehouse owners use a mix of location-based technologies to meet their needs most cost-effectively.

location based advertising will drive the market

- Over two-thirds of the worldwide population is now connected via GPS-enabled mobile phones. Location data is one of the most critical data sources. According to the GSMA, currently, there are approximately 5,160 million global mobile subscribers and 4,570 million internet users. The percentage of GPS penetration in mobile phones has grown and is now almost 100% in smartphones. The improved satellite technology has made commercial GPS receivers more sensitive than ever since 1998.

- Geo-targeted campaigns are being used by businesses and institutions, such as shops, financial institutions, auto dealers, restaurants, educational institutions, hotels, and healthcare institutions, to retain and attract their audiences. Healthcare units and banks are also improving mobile apps with an integrated geolocation facility. This allows them to provide more customized services and promote market growth.

- Advertisers have a compelling opportunity to place advertising and marketing content on social media platforms due to the shift in consumer behavior towards using mobile apps for shopping and engaging socially. LBS will enable brands to develop mobile apps that are easier for customers. This will increase the market growth. The LBA industry offers apps to lure advertisers to use their core platforms. Service providers will demand extra for any additional features or content. To improve their services, it is becoming more common for location-based platform suppliers to work with analytics solution providers.

- Other developments in communication technology, such as Assisted GPS, Cell ID positioning, and increasing IoT device penetration, are expected to help the growth of location-based services and the LBA market. Marketers, regulators, network providers, and marketers will have great opportunities to tap into the market for location-based advertising.

Brazil Location Based Services Industry Overview

The location-based services market is in need of greater coherence. Ongoing research and technological advancements are expected to be the primary trends driving the market forward. Companies are implementing various strategies to expand their customer base and establish a strong presence in the market, with a focus on long-term partnerships, mergers, and acquisitions.

In October 2023, the Brazilian Army placed an order with the country's state-owned shipyard, Arsenal de Marinha do Rio de Janeiro (AMRJ), to construct four LOpRib (Lancha de Operacoes Ribeirinhas) multimission riverine fast armored attack crafts. This procurement is intended to enhance the mobility and firepower of combat groups deployed in smaller regions of Brazil. Notably, this agreement will double the number of LOpRib boats in operation within the Brazilian Armed Forces. The LOpRib design is based on the Excalibur craft type produced by the Ladario Fluvial Base.

In May 2023, Cesium announced a strategic partnership with Google Maps Platform. This collaboration involves the launch of Photorealistic 3D Tiles via the Map Tiles API. Photorealistic 3D Tiles utilize the widely accepted Open Geospatial Consortium's 3D Tiles standard, which Cesium developed. This data is publicly available for over 2,500 cities and 49 countries, and it is accessible within an open ecosystem of 3D Tiles-enabled runtimes, including CesiumJS, Unity, Unreal, and NVIDIA Omniverse. Developers now can use Cesium ion to seamlessly integrate their 3D geospatial data, allowing them to create immersive metaverse experiences with Photorealistic 3D Tiles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emerging Use-cases for LBS due to High Penetration of Social Media and Location-based App Adoption

- 5.1.2 easy availability of GPS, and emergence of location-based technology is boosting the growth of the location-based services market

- 5.2 Market Restraints

- 5.2.1 Challenges Related to Data Quality, Consistency, and Accessibility

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Location

- 6.2.1 Indoor

- 6.2.2 Outdoor

- 6.3 By Application

- 6.3.1 Mapping and Navigation

- 6.3.2 Business Intelligence and Analytics

- 6.3.3 Location-based Advertising

- 6.3.4 Social Networking and Entertainment

- 6.3.5 Others

- 6.4 By End User

- 6.4.1 Transportation and Logistics

- 6.4.2 IT and Telecom

- 6.4.3 Healthcare

- 6.4.4 Government

- 6.4.5 BFSI

- 6.4.6 Hospitality

- 6.4.7 Manufacturing

- 6.4.8 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Cisco Systems Inc.

- 7.1.3 DigitalGlobe Inc.(Maxar Technologies )

- 7.1.4 Esri Technologies Ltd

- 7.1.5 Google LLC

- 7.1.6 Ericsson Inc.

- 7.1.7 GL Communications Inc.

- 7.2 *List Not Exhaustive

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS