Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408818

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408818

US Geospatial Imagery Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

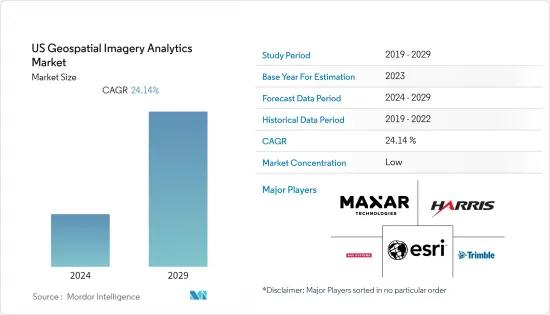

The US Geospatial imagery analytics market is valued at USD 4.33 Billion in the current year and is expected to register a CAGR of 24.14% during the forecast period to reach USD 12.77 Billion by the next five years.

Key Highlights

- Geospatial Imagery Analytics has indeed been experiencing a growing demand in recent years, and the United States has been at the forefront of this industry. Geospatial Imagery Analytics aid in resource management, environmental monitoring and protection, humanitarian aid, and long-term development. Satellites used for environmental monitoring, meteorology, mapping, and other non-military functions are also included. These sensors assess air quality, agricultural health, ice thickness, salinity, and other elements.

- With the growing concern about climate change and its impact on the planet, there is a need for accurate and up-to-date data on various environmental parameters. Satellites provide a valuable tool for monitoring changes in the Earth's climate, including temperature patterns, ice cover, sea level rise, deforestation, and more.

- The growth of satellite-based data in agriculture will significantly drive the market. Satellite imagery can assist in monitoring agricultural activities, crop health, soil moisture, and vegetation indices. This information is valuable for farmers, policymakers, and researchers in optimizing crop yields, managing water resources, and ensuring food security. For instance, in March 2023, NASA announced the introduction of NASA Acres, a program focused on applying Earth observation data to the most critical agricultural and food security concerns confronting American farmers, ranchers, and agrifood systems. It collaborates with agricultural stakeholders across the spectrum to provide Earth observatory-based data and tools that help improve productivity while safeguarding and repairing land, water, the environment, and human health.

- Despite the significant advances in AI and satellite image analysis, challenges remain to overcome. One of the main obstacles is the availability of high-quality, labeled datasets for training machine learning models. Making these datasets is often time-consuming and labor-intensive, which can limit the growth of new AI algorithms. Additionally, there are problems about the ethical use of satellite imagery and AI, particularly regarding privacy and surveillance.

US Geospatial Imagery Analytics Market Trends

Small Satellities will Boost Market Growth

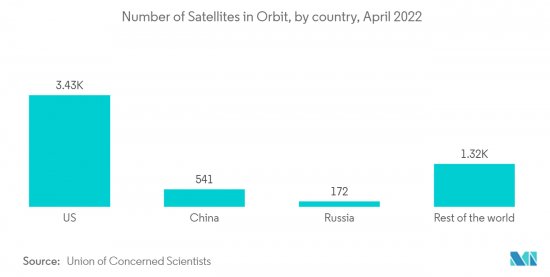

- The increasing demand for small satellites is anticipated to drive the expansion of the geospatial imagery analytics market. The small satellites are usually smaller and weigh less than 100 kg, or the size of a carry-on. These satellites are used in imagery analytics for examining small pieces of data globally with lower cost and more dependable and precise results in minute operations.

- A recent study has shown that the small satellite industry has since 2012 become a rapidly growing industry. Companies such as Terran Orbital are not only developing tens of satellites that can provide geospatial and imagery data, but a growing market is Internet of Things (IoT) satellites. Another recent company is Hiber, which also focuses on IoT satellites. While larger companies had traditionally ruled the market, smaller companies are now being invested in by the larger markets to develop new, innovative satellites that can be quickly launched and sent into different orbit levels.

- Another area of growth is firms purchasing small satellites so they can be used for geospatial consulting that increasingly uses artificial intelligence and machine learning. For instance, companies that monitor the number of cars in parking lots, mining companies interested in forecasting metal resources, or real estate investors and realty firms evaluating the quality of properties are some of the purchasers of these small satellite systems.

- In addition, OneWeb, a UK-based communications company, and Starlink, a US-based satellite internet company, are liable for nearly all of the 1,743 small satellites launched in 2021, accounting for about 95 percent of the entire upmass. Thus, the proliferation in demand for small satellites pushes the growth of the geospatial imagery analytics market.

- Small-scale satellites are changing how people can acquire data as geospatial analysts. In many cases, satellite data quality is improving, and costs are likely to drop as creating high-quality imagery at a more affordable price becomes easier. Outside of only imagery, small satellites are transforming IoT by enabling us to better connect with systems worldwide that allow easier monitoring and more data capture and transfer of information, facilitating geospatial research and even investments for firms.

Imagery Analysis and surge in use of AI will drive the market

- Satellite image analysis has been vital for various industries, governments, and researchers worldwide. It provides valuable insights into the Earth's surface urban planning, allowing for better agricultural and disaster management decision-making. With the advent of artificial intelligence (AI) and machine learning, the potential for satellite image analysis has grown exponentially, opening up new opportunities for harnessing this technology.

- One of the most significant advances in satellite image analysis has resulted from AI algorithms adeptly processing vast amounts of data quickly and accurately. These algorithms can analyze images at a much higher resolution than traditional methods, enabling the detection of subtle changes in the Earth's surface that may have formerly gone unnoticed. This increased accuracy is beneficial in applications such as monitoring deforestation, tracking the spread of wildfires, and assessing the impact of natural disasters.

- For instance, in August 2023, IBM and NASA released Prithvi, an open-source foundation AI model that may help scientists and other folks analyze satellite imagery. The vision transformer model, released under an Apache 2 license, is relatively small at 100 million parameters and was trained on a year's worth of images collected by the US space boffins' Harmonized Landsat Sentinel-2 (HLS) program. As well as the primary model, three variants of Prithvi are available, fine-tuned for identifying flooding, wildfire burn scars, crops, and other land use.

- Further, in January 2022, Planet, a leading provider of daily data and insights about Earth, and Google Cloud, Google's suite of cloud computing services, have announced an increase in their partnership and a new agreement under which the two companies will develop joint solutions that combine Planet's high-frequency Earth observation data with Google Cloud's cloud-based infrastructure to help better data-driven decision-making.

- In conclusion, integrating AI in satellite image analysis has opened new possibilities for this technology, allowing more precise and efficient Earth surface analysis. As AI algos become more accessible, satellite image analysis will be increasingly essential in addressing global challenges and informing decision-making across various sectors. By overpowering the remaining challenges and fostering collaboration between stakeholders, the full potential of AI in satellite image analysis can be harnessed for the benefit of society.

US Geospatial Imagery Analytics Industry Overview

The United states geospatial imagery analytics market is moderately consolidated with the presence of several players like Harris Corporation, Google LLC, Inc., BAE Systems, Maxar Technologies etc. The companies continuously invest in strategic partnerships and product developments to gain substantial market share. Some of the recent developments in the market are:

- In November 2022, The National Geospatial-Intelligence Agency plans to double contract spending to monitor global economic activity from space. NGA will increase the contract ceiling for its Economic Indicator Monitoring (EIM) program from $29.9 million to $60 million over five years. The program seeks to use commercial geospatial data and analytics services to improve the U.S. government's insights on economic activity and trends worldwide, such as the flow of raw materials, agricultural products, fuels, and vehicles.

- In July 2023, Maxar Technologies, a provider of complete space solutions and secure, precise geospatial intelligence, announced the initial release of its new Maxar Geospatial Platform (MGP), enabling fast and easy access to the world's most advanced Earth intelligence. MGP will simplify geospatial data and analytics discovery, purchasing, and integration. MGP users will have access to Maxar's industry-leading geospatial content, including high-resolution satellite imagery, stunning imagery base maps, 3D models, analysis-ready data, and image-based change detection and analytic outputs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001409

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing demand for Location based services

- 5.1.2 Technological innovations in geospatial imagery services

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness about benefits of Geospatial Imagery Services

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Imagery Analytics

- 6.1.2 Video Analytics

- 6.2 By Deployment Mode

- 6.2.1 On Premise

- 6.2.2 Cloud

- 6.3 By Organization Size

- 6.3.1 SMEs

- 6.3.2 Large Enterprises

- 6.4 By Vericals

- 6.4.1 Insurance

- 6.4.2 Agriculture

- 6.4.3 Defense and Security

- 6.4.4 Environmental Monitoring

- 6.4.5 Engineeting & Construction

- 6.4.6 Government

- 6.4.7 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Harris Corporation

- 7.1.2 Trimble Inc

- 7.1.3 Google LLC

- 7.1.4 Maxar Technologies

- 7.1.5 ESRI Inc

- 7.1.6 BAE Systems

- 7.1.7 Eos Data Analytics

- 7.1.8 Satellite Imaging Corporation

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.