PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851335

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851335

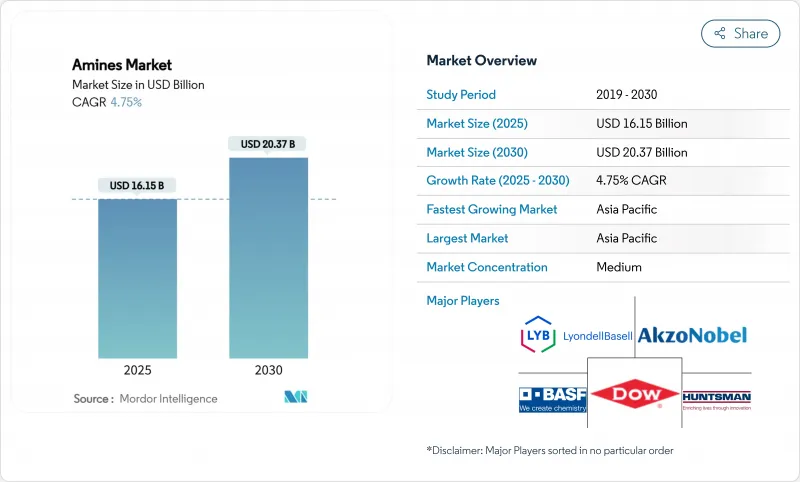

Amines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Amines Market size is estimated at USD 16.15 billion in 2025, and is expected to reach USD 20.37 billion by 2030, at a CAGR of 4.75% during the forecast period (2025-2030).

This sustained expansion is supported by resilient industrial demand, stricter environmental regulations that favor cleaner chemistries and a growing pipeline of high-value applications such as carbon-capture solvents. Rising investments in semiconductor fabrication, large-scale agricultural modernization and widespread adoption of bio-based personal-care surfactants are expanding both volume and value opportunities in the amines market. Producers are improving energy efficiency and integrating renewable feedstocks to manage volatile ammonia and ethylene prices while complying with emerging volatile organic compound limits across major economies. Leading suppliers are also channeling capital toward ultra-pure electronics-grade capacities to meet the stringent metal specifications required by next-generation chips, highlighting a visible shift from commodity production toward specialized solutions that offer superior margin potential.

Global Amines Market Trends and Insights

Surging Demand from Asian Personal-Care Formulators

Amino acid-based surfactants have outpaced traditional sulfate systems, recording 18% average annual growth since 2010. Asian formulators are mainstreaming glutamate and alaninate derivatives that offer low irritation and high biodegradability, forcing amine suppliers to expand bio-based lines with International Sustainability and Carbon Certification (ISCC-PLUS) credentials. Nouryon's certified production of green ethylene oxide and ethanolamines illustrates how plant operators are realigning portfolios toward clean-label formulations. In tandem, multifunctional amine oxides are gaining ground in shampoo, body-wash and household categories as manufacturers pursue high-foaming yet mild profiles. With middle-class consumers gravitating toward products boasting a natural-origin index approaching 100%, the amines market is set to deepen its role as a pivotal enabler of Asia's fast-growing clean-beauty ecosystem.

Rapid Pesticide Adoption in Emerging Agriculture Hubs

Modern farming practices in Asia Pacific and South America require precision chemical inputs, lifting demand for amine-based pesticide salts and emulsifiers. Novel decentralized ammonia plants powered by renewable electricity are lowering logistics costs and improving regional supply security, notably in Brazil and India. CF Industries and POET's pilot of low-carbon ammonia fertilizer demonstrates the agronomic and sustainability pay-off of integrating green hydrogen pathways. Such developments bolster long-term offtake for ethanolamines, alkylamines and fatty amines used in herbicides, insecticides and seed-treatment agents.

Shift to Wood-Free Paper & Digital Documentation

Declining office-paper consumption in developed economies is dampening demand for amine-based pulp bleaching agents and paper coatings. Companies are reallocating volumes toward faster-growing personal-care and construction segments to cushion the long-term drag. BASF's decision to reconfigure legacy amine assets toward specialty chemicals highlights the industry's proactive adjustment to this structural shift.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure Boom Spurring Construction Chemicals

- Electronics-Grade Amines for Advanced Semiconductor Fabs

- Volatile Ammonia & Ethylene Feedstock Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ethanolamines captured 42.55% of the overall amines market in 2024, owing to their indispensable role in gas sweetening, personal-care surfactants and corrosion inhibitors. Steady demand from natural-gas treatment and triethanolamine-based cement additives underpins a robust baseline, even as newer uses in carbon-capture solvents emerge. The segment's scale gives leading suppliers cost leverage and operational synergies across derivative chains ranging from ethoxylates to morpholine. In contrast, specialty amines are projected to post the fastest 5.01% CAGR through 2030, propelled by niche applications in electronics, pharmaceuticals and advanced composites.

Producers are installing multipurpose reactors capable of quick changeovers between high-purity morpholines, diamines and chiral amine intermediates. Evonik's expansion in Nanjing exemplifies this pivot toward higher value-added molecules. Concurrently, academic breakthroughs such as ruthenium/triphos catalysts achieving 90% yields on renewable feedstocks promise to widen the sustainable feedstock pool for specialty grades. The interplay of scale in ethanolamines and growth in specialty amines underpins the balanced long-term trajectory of the amines market.

The Amines Market Report is Segmented by Type (Ethyleneamines, Alkylamines, Fatty Amines, Specialty Amines, Ethanolamines), End-Use Industry (Rubber, Personal Care Products, Cleaning Products, Adhesives/Paints/Resins, Agro-Chemicals, Oil/Petrochemicals, Other End-Uses), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific retained its dual leadership position, generating 38.91% of global revenue in 2024 and expanding at a 5.88% CAGR through 2030. China's 45.52 million t ammonia capacity anchors the region's raw-material advantage. India's specialty chemicals champions, including Alkyl Amines and Balaji Amines, operate more than 20 plants and export to over 100 countries, leveraging cost-competitive manufacturing. Semiconductor expansions across Taiwan, South Korea and mainland China are pushing demand for electronics-grade amines, while ASEAN nations add incremental growth through pharmaceuticals, agro chemicals and household products. BASF's planned USD 10 billion Zhanjiang Verbund project, powered entirely by renewable electricity, illustrates how multinationals intend to capture enduring regional upside.

North America represents a mature yet strategically vital cluster, with rising investments in blue ammonia facilities integrated with carbon-capture systems. The United States is expected to quadruple ammonia capacity by 2030. This expansion safeguards domestic fertilizer supply and provides a local feedstock base for ethanolamine and urea derivatives. Meanwhile, Canada's abundant hydropower positions it as a contender for low-carbon amine production targeting both domestic and export markets.

Europe continues to pursue circular-economy objectives, driving innovations in bio-based intermediates and energy-efficient reactors. Nouryon's ISCC-PLUS certification for green ethylene oxide supports regional demand for eco-labeled surfactants. The European Commission's stricter VOC targets are encouraging formulators to substitute conventional volatile amines with higher-flashpoint derivatives that meet performance criteria. The Middle East and Africa benefit from natural-gas feedstock availability, enabling competitively priced ammonia and downstream amine chains, especially in Saudi Arabia and Oman. South America's focus on soybean and corn cultivation assures steady consumption of herbicidal amine salts, with Brazil and Argentina leading uptake.

- Air Products and Chemicals, Inc.

- Akzo Nobel N.V.

- Alkyl Amines Chemicals Limited

- Arkema

- BASF SE

- Celanese Corporation

- Clariant

- Daicel Corporation

- Dow

- Eastman Chemical Company

- Huntsman International LLC

- INEOS

- Invista

- Kemipex

- LyondellBasell Industries Holdings B.V.

- MITSUBISHI GAS CHEMICAL COMPANY, INC

- NIPPON SHOKUBAI CO., LTD.

- SABIC

- Solvay

- Tosoh Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand from Asian personal-care formulators

- 4.2.2 Rapid pesticide adoption in emerging agriculture hubs

- 4.2.3 Infrastructure boom spurring construction chemicals

- 4.2.4 Electronics-grade amines for advanced semiconductor fabs

- 4.2.5 On-site green-hydrogen-derived amines pilots

- 4.3 Market Restraints

- 4.3.1 Shift to wood-free paper and digital documentation

- 4.3.2 Volatile ammonia and ethylene feedstock pricing

- 4.3.3 Stricter amine VOC/odor regulations

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.6.1 Current Technologies

- 4.6.1.1 Zeolite-catalyzed methylamine processes

- 4.6.1.2 Direct amination of isobutylene

- 4.6.1.3 Catalytic distillation

- 4.6.1.4 Ammonolysis of EDC

- 4.6.2 Upcoming Technologies

- 4.6.1 Current Technologies

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Price Analysis

- 4.9 Production Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Ethyleneamines

- 5.1.2 Alkylamines

- 5.1.3 Fatty Amines

- 5.1.4 Specialty Amines

- 5.1.5 Ethanolamines

- 5.2 By End-use Industry

- 5.2.1 Rubber

- 5.2.2 Personal Care Products

- 5.2.3 Cleaning Products

- 5.2.4 Adhesives, Paints and Resins

- 5.2.5 Agro-Chemicals

- 5.2.6 Oil and Petrochemicals

- 5.2.7 Other End-uses

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Air Products and Chemicals, Inc.

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Alkyl Amines Chemicals Limited

- 6.4.4 Arkema

- 6.4.5 BASF SE

- 6.4.6 Celanese Corporation

- 6.4.7 Clariant

- 6.4.8 Daicel Corporation

- 6.4.9 Dow

- 6.4.10 Eastman Chemical Company

- 6.4.11 Huntsman International LLC

- 6.4.12 INEOS

- 6.4.13 Invista

- 6.4.14 Kemipex

- 6.4.15 LyondellBasell Industries Holdings B.V.

- 6.4.16 MITSUBISHI GAS CHEMICAL COMPANY, INC

- 6.4.17 NIPPON SHOKUBAI CO., LTD.

- 6.4.18 SABIC

- 6.4.19 Solvay

- 6.4.20 Tosoh Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment