Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430916

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430916

South America Automotive Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2021 - 2026)

PUBLISHED:

PAGES: 80 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

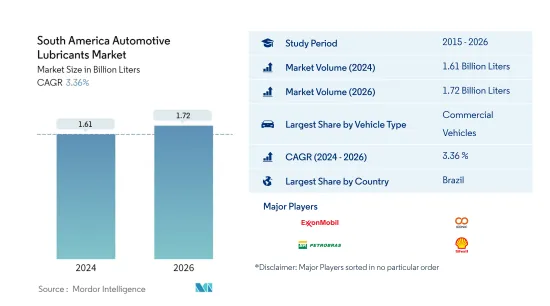

The South America Automotive Lubricants Market size is estimated at 1.61 Billion Liters in 2024, and is expected to reach 1.72 Billion Liters by 2026, growing at a CAGR of 3.36% during the forecast period (2024-2026).

Key Highlights

- Largest Segment by Vehicle Type - Commercial Vehicles : South America has a large number of pick-up trucks used for freight transportation. The region's aging CV fleet has been driving the need for lubricants during service.

- Fastest Segment by Vehicle Type - Motorcycles : Post-COVID-19, there has been an increase in demand for used and high-end motorcycles in countries such as Brazil, which is likely to augment the motorcycle lubricant demand.

- Largest Country Market - Brazil : Brazil has the highest proportion of PV, CV, and motorcycle fleets among all South American countries, making it the leading regional consumer of automotive lubricants.

- Fastest Growing Country Market - Colombia : The growing age of the motor vehicle fleet in Colombia, which requires more automotive lubricants than new vehicles, is propelling the Colombian market at a quicker rate.

South America Automotive Lubricants Market Trends

Largest Segment By Vehicle Type : Commercial Vehicles

- In South America, passenger vehicles (PV) accounted for the largest share of 52.42% in the total number of on-road vehicles in 2020, followed by motorcycles (MC) and commercial vehicles (CV), with shares of 24.2% and 31.53%, respectively.

- In the South American region, the commercial vehicle (CV) segment accounted for almost 45.9% share in the total number of on-road vehicles during 2020, followed by passenger vehicles (PV) and motorcycles (MC) with 42.6% and 11.4% shares, respectively. During the same year, travel restrictions to curb the COVID-19 outbreak significantly affected the usage of these vehicles and their lubricant consumption.

- During 2021-2026, the motorcycle segment is expected to witness the highest CAGR of 5.52%. The recovery of motorcycle sales combined with the easing down of COVID-19-related travel restrictions are likely to be the key factors driving this trend.

Largest Country : Brazil

- In the South American region, automotive lubricant consumption is the highest in Brazil, followed by Argentina and Colombia. In 2020, Brazil accounted for about 60% of the total automotive lubricant consumption in the region, whereas Argentina and Colombia accounted for shares of around 11.14% and 6.97%, respectively.

- The COVID-19 outbreak in 2020 significantly affected automotive lubricant consumption in many countries in the region. Argentina was the most affected with a 9.6% drop during 2019-2020, whereas Brazil was the least affected with a 7.73% drop in its automotive lubricant consumption.

- During 2021-2026, Colombia is likely to be the fastest-growing lubricant market as the consumption is likely to witness a CAGR of 4.82%, followed by Argentina and Brazil, which are expected to witness a CAGR of 3.82% and 3.53%, respectively.

South America Automotive Lubricants Industry Overview

The South America Automotive Lubricants Market is moderately consolidated, with the top five companies occupying 59.15%. The major players in this market are ExxonMobil Corporation, Iconic Lubrificantes, Petrobras, Royal Dutch Shell Plc and Terpel (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90264

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 Key Industry Trends

- 3.1 Automotive Industry Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 Market Segmentation

- 4.1 By Vehicle Type

- 4.1.1 Commercial Vehicles

- 4.1.2 Motorcycles

- 4.1.3 Passenger Vehicles

- 4.2 By Product Type

- 4.2.1 Engine Oils

- 4.2.2 Greases

- 4.2.3 Hydraulic Fluids

- 4.2.4 Transmission & Gear Oils

- 4.3 By Country

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.3.3 Colombia

- 4.3.4 Rest of South America

5 Competitive Landscape

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Profiles

- 5.3.1 BP Plc (Castrol)

- 5.3.2 Chevron Corporation

- 5.3.3 ExxonMobil Corporation

- 5.3.4 Iconic Lubrificantes

- 5.3.5 Petrobras

- 5.3.6 PETRONAS Lubricants International

- 5.3.7 Royal Dutch Shell Plc

- 5.3.8 Terpel

- 5.3.9 TotalEnergies

- 5.3.10 YPF

6 Appendix

- 6.1 Appendix-1 References

- 6.2 Appendix-2 List of Tables & Figures

7 Key Strategic Questions for Lubricants CEOs

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.