Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430956

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430956

Germany Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2021 - 2026)

PUBLISHED:

PAGES: 80 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

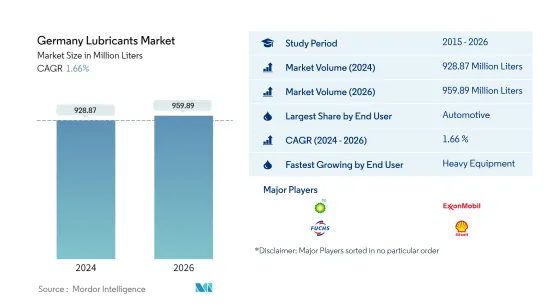

The Germany Lubricants Market size is estimated at 928.87 Million Liters in 2024, and is expected to reach 959.89 Million Liters by 2026, growing at a CAGR of 1.66% during the forecast period (2024-2026).

Key Highlights

- Largest Segment by End-user Industry - Automotive : Automotive was the largest end user among all segments, owing to the high amount of engine and gear oils used in motor vehicles compared to any other industrial application.

- Fastest Segment by End-user Industry - Heavy Equipment : Heavy equipment is likely to be the fastest-growing end user of lubricants in Germany, owing to the rising usage of different equipment used in construction segments.

- Largest Segment by Product Type - Engine Oils : Engine oil is the largest consumed product category in Germany, owing to the enormous engine size of cars, motorcycles, and trucks and their high oil changing frequencies.

- Fastest Segment by Product Type - Transmission & Gear Oils : Transmission and gear oils are expected to grow at a faster rate than any other product segment due to an expected rise in the use of automatic cars and electric vehicles.

Germany Lubricants Market Trends

Largest Segment By End User : Automotive

- In 2020, the German lubricants market was dominated by the automotive industry, which accouted for around 43.26% of the total lubricant conusmption in the country. During 2015-2019, the lubricant consumption in the automotive industry declined by a CAGR of 0.39%.

- In 2020, COVID-19 related restrictions led to declined maintenance requirments from several industries. The major impact was observed in the automotive industry, which recorded a dip of 16.82%, followed by heavy equipment (11.35%), during the year.

- Heavy equipment is likely to be the fastest-growing end-user industry of the market studied, and it is expected to register a CAGR of 2.1% during 2021-2026, followed by automotive (1.88%). The expected recovery in the sales of and usage of construction equipment is likely to drive the consumption of lubricants during the next five years.

Germany Lubricants Industry Overview

The Germany Lubricants Market is moderately consolidated, with the top five companies occupying 56.10%. The major players in this market are BP Plc (Castrol), ExxonMobil Corporation, FUCHS, Royal Dutch Shell Plc and TotalEnergies (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90304

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 Key Industry Trends

- 3.1 Automotive Industry Trends

- 3.2 Manufacturing Industry Trends

- 3.3 Power Generation Industry Trends

- 3.4 Regulatory Framework

- 3.5 Value Chain & Distribution Channel Analysis

4 Market Segmentation

- 4.1 By End User

- 4.1.1 Automotive

- 4.1.2 Heavy Equipment

- 4.1.3 Metallurgy & Metalworking

- 4.1.4 Power Generation

- 4.1.5 Other End-user Industries

- 4.2 By Product Type

- 4.2.1 Engine Oils

- 4.2.2 Greases

- 4.2.3 Hydraulic Fluids

- 4.2.4 Metalworking Fluids

- 4.2.5 Transmission & Gear Oils

- 4.2.6 Other Product Types

5 Competitive Landscape

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Profiles

- 5.3.1 Addinol

- 5.3.2 BP Plc (Castrol)

- 5.3.3 Carl Bechem GmbH

- 5.3.4 ExxonMobil Corporation

- 5.3.5 FUCHS

- 5.3.6 Liqui Moly

- 5.3.7 Rowe Mineralolwerk GmbH

- 5.3.8 Royal Dutch Shell Plc

- 5.3.9 SCT Lubricants

- 5.3.10 TotalEnergies

6 Appendix

- 6.1 Appendix-1 References

- 6.2 Appendix-2 List of Tables & Figures

7 Key Strategic Questions for Lubricants CEOs

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.