PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430993

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430993

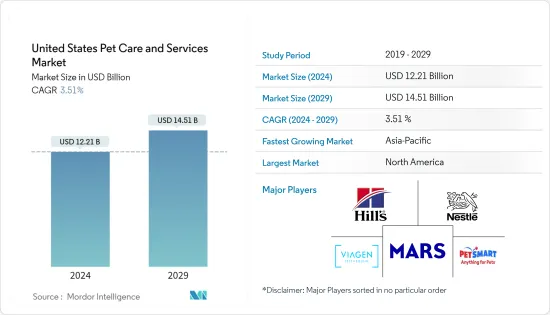

United States Pet Care and Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The United States Pet Care and Services Market size is estimated at USD 12.21 billion in 2024, and is expected to reach USD 14.51 billion by 2029, growing at a CAGR of 3.51% during the forecast period (2024-2029).

The COVID-19 pandemic has disrupted the pet health care since with the lockdown, the accessibility to the clinics got affected which impacted the treatment of animals and thus hinders the growth of the market over the forecast period. Pet adoption has increased in United States too. For instance, in May 2021, The American Society for the Prevention of Cruelty to Animals (ASPCA) released new data which reported that nearly one in five households acquired a cat or dog since the beginning of the COVID-19 crisis. Such adoptions amid the pandemic and increased the focus on pet health and thus expected to lead positive impact on the growth of the United States pet care and services market over the forecast period.

The factors propelling the studied market growth are growing adoption of pets in the country, rising pet insurance rising investments, increasing product and service launches, and adoption of key strategies by major market players.

According to the 2021-2022 National Pet Owners Survey, conducted by the American Pet Products Association (APPA), around 70% of United States households own a pet, which equates to 90.5 millions homes, including 45.3 million cats and 69 million dogs. The same source also reports that the annual expenditure on routine visit for dogs accounts for USD 242, whereas it is 178 for cats in the country.

With increased ownership of pets and livestock, the United States citizens have also become more considerate toward the health of these animals. According to the American Pet Products Association, the expenditure on pets in the United States is also rising, which may propel the market growth.

The launch of new pet care products focused at improving health and well being of pets will boost the market in the country. For instance, in March 2022, OUTWARD HOUND, a portfolio company of Prospect Hill Growth Partners launched new products at Global Pet Expo at the Orlando Orange County Convention Center. The products include Stainless Steel Slow Feeder, Soothe & Snooze Lounge Shag Pet Bed, Calming Cat Donut Beds, and others focused at enriching the lives of pets and their families.

In May 2022, ORIJEN pet food launched ORIJEN AMAZING GRAINS premium dog food which delivers a special blend of grains, including oats, quinoa and chia sourced from non-GMO crops. These whole grains are a source of essential vitamins, minerals, b-glucans, and fiber.

Furthermore, in December 2021, Grove Collaborative launched pet care brand, Good Fur, a new line of cruelty-free pet grooming products offering shampoos, conditioners, accessories and more, bringing its sustainable innovation to consumers' furry family. Thus, introduction of new products for improving the lives of pets will boost the market.

Therefore, owing to aforementioned factors, the studied market is expected to grow significantly during the study period. However, high cost of products and services is expected to hinder the market growth during study period.

US Pet Care and Service Market Trends

Dog Segment is Expected to Account for the Large Market Share Over the Forecast Period

Dogs are one of the most adopted companion animals. The factors such as increasing dog ownerships, growing burden of the diseases in them, and increasing expenditure on pet health are generating the demand for diagnostics and thus driving the growth of the market segment over the forecast period.

Factors such as the increasing adoption of dogs, the launch of pet care services, and strategies adopted by key market players will drive the studied market growth.

According to the data published by American Society for the Prevention of Cruelty to Animals, 2019, approximately 4.1 million shelter animals are adopted each year (2 million dogs and 2.1 million cats). The increasing pet ownership in the country will drive the demand for telehealth veterinary services thus boosting the market.

The trend of adoption of a dog is increasing largely around the world. Due to this, there is an increasing demand for products and services for dogs such as dog cloning, dog insurance, dog walking, dog relocation, dog foods, shampoos and conditions, and many others. The introduction of new such services and the emergence of new players offering services for dogs will drive the market.

Furthermore, with the increasing dog ownership, expenditure on their health and visits to the veterinary doctors have also increased over the time. For Instance, The American Pet Products Association survey 2021-2022, reports that in the United States the routine veterinary visits cost for dog owners USD 242 as yearly average and for surgical veterinary visit cost about USD 458. Such spending on dogs' health boost the growth of market.

The launch of new products and services for dogs is expected to boost the market growth. For instance, in May 2022, Bubbly Paws opened a franchise in Charlotte, North Carolina which will offer the innovative state of the art dog grooming and support outreach opportunities in the community.

Moreover, the adoption of key strategies such as acquisitions, partnerships, expansion, investments and others is expected to further propel the market growth. For instance, in May 2022, Dogtopia signed a franchise agreement to expand its presence in 60 new locations to cities across the country over the next several years. Dogtopia offers an experience focused on wellness, quality of care, safety and transparency in the market focused at improving the physical and mental well-being of dogs and pet parents. Thus, the accessibility of dog care services in different cities in the country will also contribute to the market growth significantly.

Thus, due to the above-mentioned factors, the studied segment is expected to contribute to the significant growth of the market.

US Pet Care and Service Industry Overview

The studied market is fragmented and moderately competitive. Key strategies such as mergers and collaborations, investments ad others is expected to boost the studied market during study period. Major players in the market are PetSmart LLC, Mars, Incorporated, ViaGen LC, Nestle S.A, and Hill's Pet Nutrition, Inc. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Pet Ownership and Pet Insurance

- 4.2.2 Increased Adoption of Technology for Pet Care

- 4.3 Market Restraints

- 4.3.1 High Cost of Products and Services

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Value by Size - in USD Million)

- 5.1 By Pet Type

- 5.1.1 Cat

- 5.1.2 Dog

- 5.1.3 Horse

- 5.1.4 Other Animals

- 5.2 By Product Type

- 5.2.1 Pet Food

- 5.2.2 Grooming Products

- 5.2.3 Pet Care

- 5.2.3.1 Oral Care

- 5.2.3.2 Dietary Supplements

- 5.2.3.3 Veterinary Diets

- 5.3 By Service Type

- 5.3.1 Grooming

- 5.3.2 Pet Transportation

- 5.3.3 Pet Boarding

- 5.3.4 Pet Sitting

- 5.3.5 Pet Walking

- 5.3.6 Other Services

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 PetSmart LLC

- 6.1.2 Mars Incorporated

- 6.1.3 ViaGen LC

- 6.1.4 Nestle S.A

- 6.1.5 Hill's Pet Nutrition, Inc.

- 6.1.6 Rover, Inc.

- 6.1.7 We Lov Pets

- 6.1.8 Tail Blazers

- 6.1.9 Petmate

- 6.1.10 PetBacker

7 MARKET OPPORTUNITIES AND FUTURE TRENDS