PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645162

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645162

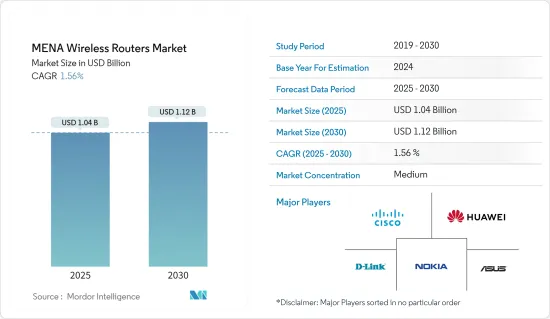

MENA Wireless Routers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The MENA Wireless Routers Market size is estimated at USD 1.04 billion in 2025, and is expected to reach USD 1.12 billion by 2030, at a CAGR of 1.56% during the forecast period (2025-2030).

The increased application of data and internet services in the region would drive the growth prospects for Wireless Routers in the Middle East and North Africa region until the forecast period.

Key Highlights

- Wireless routers include wireless access points that provide access to the internet or a private computer network. Depending on the manufacturer and model, it functions in a wired local area network, wireless-only LAN, or mixed wired and wireless networks.

- The major factor for the growth of wireless technology over the years has been the regularly changing standards set for improving the features of the routers.

- Wireless router technology has evolved steadily over the past decade, keeping pace with advances in standards set by the Institute of Electrical and Electronics Engineers (IEEE). These standards are updated regularly to improve network throughput in terms of maximum speeds and transmission capabilities.

- These upgrades have given the companies in the market the means to strive for innovation and have successfully satisfied the customers' demand for higher bandwidth and faster internet. The key market drivers are increasing consumer demand for web-enabled devices and growth in IP traffic.

- Moreover, the increasing demand for faster internet connectivity among consumers has deteriorated due to the high rise in the number of effective devices being connected, and this is spurring the demand for wireless routers with appropriate connectivity.

Middle East and North Africa Wireless Routers Market Trends

Growth in Internet Traffic and Increasing Consumer Demand for Internet-enabled Devices

- The Middle East and North Africa internet traffic is growing rapidly, driven by new internet users with increasing Wi-Fi expansion and high demand for video services.

- With the rise in high internet traffic and devices, average fixed broadband speed, and average internet users, the Middle East and North Africa Wireless Routers Market are expected to grow exponentially during the forecast period.

- Further, with the advent of IoT and changing consumer preferences toward purchasing various gadgets and wearables capable of operating and performing a plethora of functions with internet connectivity, it is also set to propel the growth of the wireless router market over the forecast period.

- In the residential sector, the wireless traffic jam will only worsen as an expanding array of smart devices increases demand for home Wi-Fi networks, from garage door openers to bathroom scales.

- According to Cisco, The number of devices connected to IP networks will likely be more than three times the global population by 2023. There will likely be 3.6 networked devices per capita by 2023, up from 2.4 networked devices per capita in 2018.

Increase In the Bandwidth Requirements Across Enterprises Owing to Digitization

- With the work-from-home (WFH) that became the new trend during the COVID-19 pandemic, players and individual consumers were occupied with securing their various IT products for their employees.

- As a result, supplies of IT peripherals, including wireless routers, led to a sharp spike in demand as everyone navigated through the unprecedented COVID-19 situation.

- With IoT and Industry 4.0 norms gaining popularity, industrial users are expected to replace cabled networks with wireless connections, up to and including closed-loop, real-time control.

- For businesses, priorities differ from most consumer users: security, support, remote access, business-grade VPN, WAN redundancy, connectivity options, and scalability rank higher than absolute raw speed, value for money, or quality of service.

- Moreover, companies are introducing new products and strategizing for expansion to leverage the growing demand in the market.

- The Nighthawk RAX20 provides consistent and powerful signal strength to multiple devices simultaneously so that users can experience smooth gaming and 4K UHD video streaming, faster file transfers, and backups, and boosts overall work productivity.

Middle East and North Africa Wireless Routers Industry Overview

The Middle East and North Africa Wireless Routers Markets are quite competitive, with diverse firms of different sizes. This market is anticipated to encounter several partnerships, mergers, and acquisitions as organizations continue to invest strategically in offsetting the present slowdowns they are experiencing. The market comprises key solutions and service providers, Cisco, Nokia, D-Link, Huawei, and ASUS.

- September 2023 - Nokia expands its industry-leading IP router portfolio with the introduction of the new 7730 Service Interconnect Router (SXR) product family. The new platforms bring the service router performance, security, assurance, and sustainability customers rely on from Nokia at the IP edge and core into advanced IP access and aggregation networks. The scale and capabilities of the new platforms also make them ideal for smaller/distributed IP edge locations, addressing the increased capacity and capability demands driven by broadband investments and evolving cloud network architectures.

- June 2023 - Nokia announced that Du, from Emirates Integrated Telecommunication Company, is deploying Nokia's Multi-Access Gateway to provide broadband services to residential and business users over 4G/5G fixed-wireless access (FWA) in addition to mobile services. Du is leveraging the Nokia FastMile 5G gateways, MAG, and Nokia professional services. The Nokia MAG leverages its 7750 Service Routers (SR) to deliver broadband services over fiber and fixed-wireless access technologies efficiently.

- April 2023 - Vehicle tracking and telematics company Netstar announced its partnership with Vodacom Business to offer Wi-Fi to commuters on thousands of minibus taxis around South Africa. The company's telematics devices installed in Toyota minibuses can double as Wi-Fi routers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Value proposition of broadband and Wi-Fi in the MENA countries

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing internet and broadband penetration

- 5.1.2 Supportive Government initiatives and roll out of Wi-Fi 6

- 5.2 Market Restraints

- 5.2.1 Lack of advanced infrastructure in North Africa

6 Market segmentation

- 6.1 By Component Type

- 6.1.1 Product

- 6.1.2 Services

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Enterprise

- 6.3 By Country

- 6.3.1 Saudi Arabia

- 6.3.2 United Arab Emirates

- 6.3.3 Qatar

- 6.3.4 Bahrain

- 6.3.5 Oman

- 6.3.6 Libya

- 6.3.7 Israel

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nokia Corporation

- 7.1.2 D-Link Systems

- 7.1.3 Huawei Technologies Co., Ltd.

- 7.1.4 Hewlett Packard Enterprise (HPE)

- 7.1.5 ASUSTeK Computer Inc.

- 7.1.6 Linksys Holdings, Inc.

- 7.1.7 TP-Link Technologies Co., Ltd.

- 7.1.8 Ubiquiti Inc.

- 7.1.9 Cisco Systems, Inc.

- 7.1.10 Saudi Telecommunication Company