PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431017

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431017

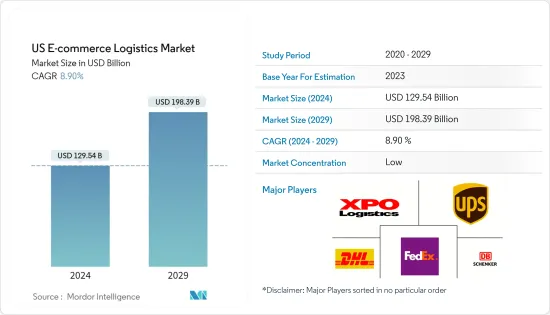

US E-commerce Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The US E-commerce Logistics Market size is estimated at USD 129.54 billion in 2024, and is expected to reach USD 198.39 billion by 2029, growing at a CAGR of 8.90% during the forecast period (2024-2029).

According to the sources, ecommerce sales in the U.S. topped USD 1 trillion in 2022, surpassing the USD 1 trillion mark for the first time. E-commerce logistics in the USA is driven by several factors, including growing e-commerce purchases, advances in technology, and changing consumer trends. However, challenges such as last-mile delivery issues, supply chain management issues, increasing costs, product recalls, and regulatory compliance issues need to be addressed.

The e-commerce logistics industry is one of the fastest-growing and fastest-growing industries in the USA. It is driven by the continuous advancement of logistics technologies brought about by automation, robots, wearables, drones, self-driving vehicles, cloud computing, the Internet of Things (IoT), etc.

These technologies cater to customers all over the country. While some regions or cities may have more e-commerce activities or infrastructure, the overall market is dynamic and diverse. Industries are investing in a regional logistics network by building new distribution centers and smart warehouses.

The pandemic hastened the shift to online shopping, boosting e-commerce logistics demand. However, the pandemic also caused supply chain disruptions, resulting in delays and shortages. As a result, companies had to rapidly adapt, find new sources of supply, and adjust their operations. As demand increased, so did capacity constraints, resulting in limited order fulfillment.

In March 2022, Maersk expanded its e-commerce presence by buying a bunch of companies to make sure they had all the tools they needed to do e-commerce. They mainly focused on e-commerce for B2C or B2B customers. They bought a company in Utah called Visible Supply Chain Management, which is one of the top e-commerce fulfillment companies in the U.S.

US E-Commerce Logistics Market Trends

Upgrade e-commerce with new supply chain technology

As digitalization continues to revolutionize industries around the world, it's only natural that supply chain technology will also need a refresh or two - not only for small and medium-sized enterprises (SMEs) looking to optimize their supply chains but also to keep up with their competition.

Artificial intelligence (AI) plays a significant role in e-commerce, as it can be used to enhance customer service in the form of intelligent product recommendation, personalization, virtual assistants, and chatbots, among others. In addition to e-commerce, supply chains can also benefit from technologies like machine learning, which helps with planning and demand forecasting, as well as data analytics, which optimizes and automates inventory management. Augmented reality (AR) can also be used to create a more immersive experience when introducing a product. For example, many cosmetics brands use AR software that allows customers to 'try on' products before making a purchase.

Growing Preference for online Shopping Post Pandemic May Impede Market Growth

Online shopping is a popular activity among consumers of all ages; however, digital shopping is most prevalent among the younger generation of internet users, with approximately 55% of Millennials purchasing goods online in 2022. Additionally, mobile commerce is becoming increasingly popular, with consumers relying more and more on their mobile devices and apps for shopping. In the Q4 of 2022, mobile commerce accounted for 38% of total online expenditure in the U.S.

According to the Census Bureau's Department of Commerce, the first-quarter e-commerce revenue for the U.S., adjusted for seasonal variations (but not price variations), was USD 272,6 billion, a 3.0% increase from the fourth quarter of 2022. The first-quarter total retail sales were USD 1.799 billion, a 0.9% increase from the first quarter of 2022 and a 7.4% increase from the second quarter of 2021. E-commerce revenue in the first quarter of 2023 represented 15.1% of total retail sales, up from 15.1% in the first quarters of 2022.

US E-Commerce Logistics Industry Overview

The e-commerce logistics industry in the United States is highly fragmented. The demand for logistics services in the region is increasing at a rapid pace, and companies are stepping up their game to take advantage of this huge opportunity. Therefore, international players are investing in a regional logistics network by opening new distribution centers and smart warehouses. Some of the leading players include Amazon, DHL, UPS Supply Chain Solutions, XPO Logistics, DB Schenker, SF Express, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends in the Industry

- 4.3 Government Initiatives and Regulations

- 4.4 Insights on the E-commerce Market

- 4.5 Insights on Reverse/Return Logistics

- 4.6 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise In Cross Border Logistics

- 5.1.2 Upgrade e-commerce with new supply chain technology

- 5.2 Market Restraints / Challenges

- 5.2.1 Supply Chain Disruptions

- 5.2.2 Warehousing and Inventory management

- 5.3 Market Opportunities

- 5.3.1 Technological Advancement

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing and Inventory management

- 6.1.3 Value-added services (Labeling, Packaging, etc)

- 6.2 By Business

- 6.2.1 B2B

- 6.2.2 B2C

- 6.3 By Destination

- 6.3.1 Domestic

- 6.3.2 International/cross-border

- 6.4 By Product

- 6.4.1 Fashion and Apparel

- 6.4.2 Consumer Electronics

- 6.4.3 Home Appliances

- 6.4.4 Furniture

- 6.4.5 Beauty and Personal Care Products

- 6.4.6 Other Products (Toys, Food Products, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 DHL Logistics

- 7.2.2 FedEx

- 7.2.3 DB Schenker

- 7.2.4 XPO Logistics

- 7.2.5 UPS Supply Chain Solutions

- 7.2.6 Geodis Logistics

- 7.2.7 Saddle Creek Logistics

- 7.2.8 Rakuten Super Logistics

- 7.2.9 Kenco Logistics Services

- 7.2.10 Kuehne and Nagel Logistics*

8 FUTURE OF THE MARKET

9 APPENDIX

10 DISCLAIMER ABOUT US